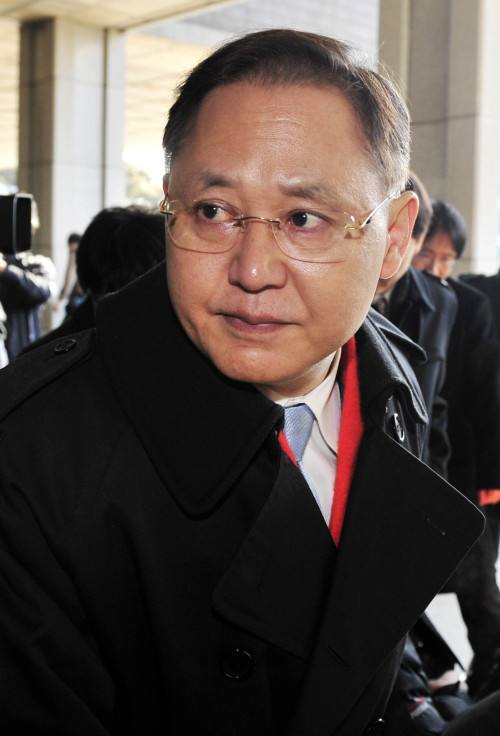

Kim Eun-seok, former ambassador for energy and resources, was grilled Friday over stock rigging and insider trading involving development of a Cameroon mine.

They want to question him over whether he had orchestrated an exaggerated Foreign Ministry report on the profitability of the development by a KOSDAQ-listed company, as well as over his suspected involvement in insider-trading.

As he entered the Seoul Central Prosecutors’ Office, Kim denied any wrongdoing.

“All I did was for the country. There is nothing for me to be disciplined over. I would never attempt insider trading, especially if it was based on a false report,” he said.

Kim insisted that he trusted the report on the mineral reserves.

“I am not a scientist and I cannot prove that on my own. But I heard that the reports were checked by many institutions and I thought all the details were based on facts,” he said.

According to the investigators, Kim will be interrogated over three primary suspicions.

First, Kim will have to explain whether he deliberately omitted the Korea Exchange’s warning that the estimate for the diamond reserves had been exaggerated.

They want to question him over whether he had orchestrated an exaggerated Foreign Ministry report on the profitability of the development by a KOSDAQ-listed company, as well as over his suspected involvement in insider-trading.

As he entered the Seoul Central Prosecutors’ Office, Kim denied any wrongdoing.

“All I did was for the country. There is nothing for me to be disciplined over. I would never attempt insider trading, especially if it was based on a false report,” he said.

Kim insisted that he trusted the report on the mineral reserves.

“I am not a scientist and I cannot prove that on my own. But I heard that the reports were checked by many institutions and I thought all the details were based on facts,” he said.

According to the investigators, Kim will be interrogated over three primary suspicions.

First, Kim will have to explain whether he deliberately omitted the Korea Exchange’s warning that the estimate for the diamond reserves had been exaggerated.

The Ministry of Foreign Affairs and Trade in 2010 publicized that CNK International had won a bid to develop Cameroonian diamond mines with reserves of 420 million carats. The amount was about 2.6 times the world’s annual diamond production.

The authorities said the estimate was based on the United Nations Development Program and Chungnam National University research but was later revealed to be a copy of CNK’s insider report. When suspicions were raised, Kim, who was in charge of the government’s support for the project, ordered release of another report saying the Cameroonian government had approved the figure.

However, the actual reserves were less than one-seventeenth of the initial assumption, the Board of Audit and Inspection revealed in January. The BOA said Kim had received the information but ignored it. The BOA advised the Foreign Ministry to fire Kim.

Kim will also be questioned on whether he leaked the information about the CNK project to his relatives in advance.

Kim, who had been acquainted with Oh Deok-kyun, the chief of CNK, since 2008 told two of his brothers about the development project ahead of the announcement.

After the Foreign Ministry’s report the price of CNK stocks soared to 18,000 won ($16.1) per share from 3,400 won in less than a month and Kim’s brothers pocketed 540 million won, prosecutors said.

But after the report was found to be inflated, the price fell to around 7,000 won. Industry insiders believe about 13,000 investors saw an average 65 percent in losses as a result of investments made based on the government report. The Securities & Future Commission earlier this month filed complaints against CNK president Oh Deok-kyun and other company management for unfair trade practices.

The third suspicion Kim faces is that he introduced high-ranking government officials to CNK heads in order to highly publicize the development.

Kim reportedly introduced Oh to former Vice Minister of Knowledge Economy Park Young-joon. Park and Kim, along with several other high-ranking officials have visited Cameroon several times and Park reportedly asked Cameroonian officials to “look after” CNK in May and October 2010.

Park denied that his deeds were participation into the stock-rigging scandal.

“Of course I support Korean companies’ advance into a foreign markets. That is patriotism,” he said in a radio show earlier this month.

The prosecution said it has already interrogated some key figures of the scandal and that questioning Kim was expected to confirm many of the claims.

Meanwhile, the Foreign Affairs Ministry said Friday that it has taken steps to nullify Oh’s passport in order to force him to come back to the country for questioning. Oh, who is reportedly in Cameroon, told prosecution that he would return when all business matters are settled.

By Bae Ji-sook (baejisook@heraldcorp.com)

-

Articles by Korea Herald

![[KH Explains] Hyundai-backed Motional’s struggles deepen as Tesla eyes August robotaxi debut](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050605_0.jpg&u=20240516155018)