Financial holding firms aim to curb growth of household debt to 2%: sources

By YonhapPublished : Jan. 18, 2024 - 09:22

Five financial holding firms in South Korea have submitted their plan to financial authorities to curb the growth of household debt to less than 2 percent this year, informed sources said Thursday.

The financial holding firms set the voluntary goal in a recent meeting with financial authorities, according to the sources.

The government "asked the financial holding firms to help maintain household debts within the economic growth rate, and they each said they will limit their household debt increase to 1.5 percent or 2 percent," a ranking financial official said, speaking on condition of anonymity.

The country's economy is expected to grow 2.1 percent on-year in 2024, according to its central bank, while its nominal economic growth is expected to reach 4.9 percent.

"(The government) stressed the need for borrowers to limit their loans to a level they can repay but also for the financial firms to do the same," the official said.

The country's household debts gained 10.1 trillion won ($7.5 billion) from a year earlier in 2023, a turnaround from an 8.8 trillion-won decrease in the previous year.

However, its household debt to gross domestic product ratio dropped to 104.5 percent last year from 105.4 percent in 2022, the Financial Services Commission said earlier, also highlighting that the country's household debts had increased by more than 80 trillion won each year for the past eight years until 2021.

Still, its debt-to-GDP ratio remains the highest among the 34 countries surveyed by the Institute of International Finance last year, with South Korea being the only country with a ratio greater than 100 percent.

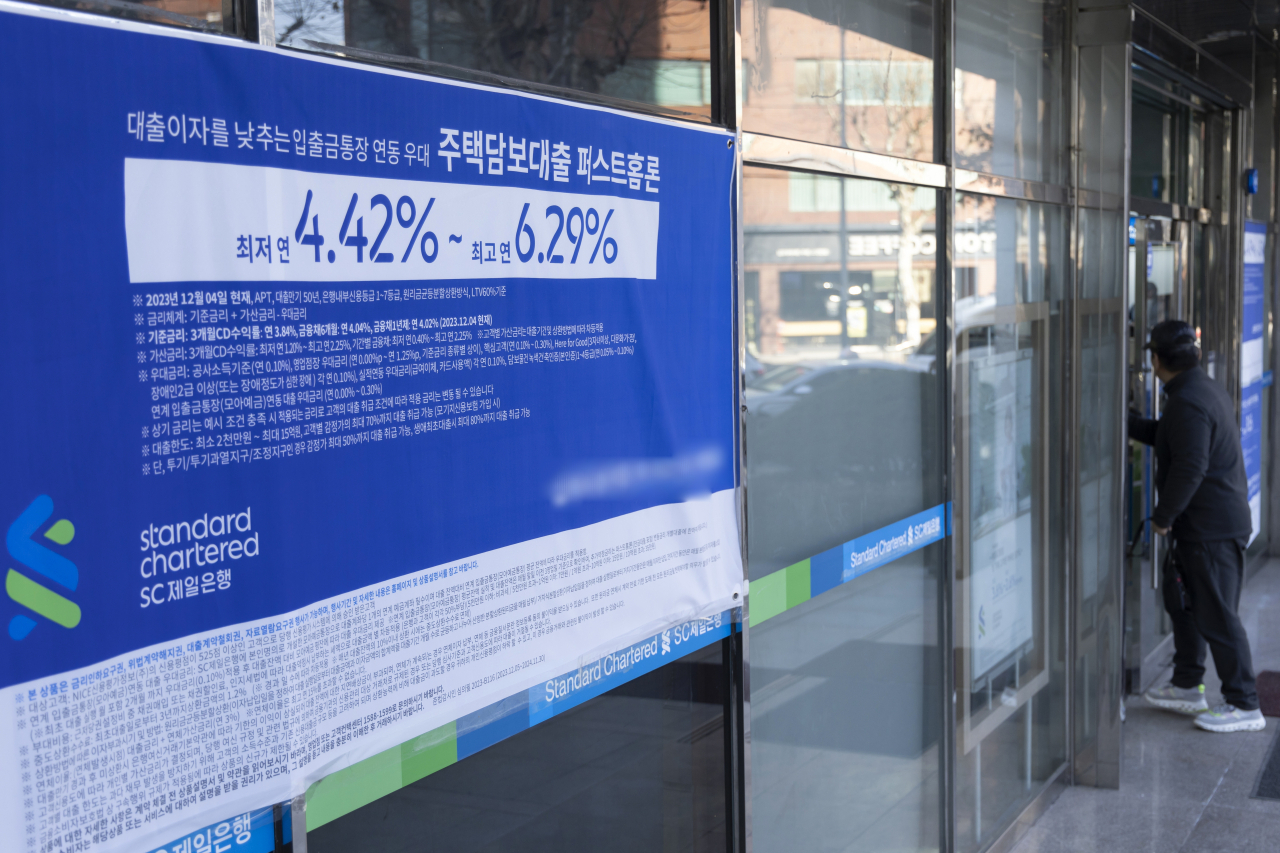

The financial regulator has estimated the ratio to dip further to 100.8 percent this year amid a prolonged slump in the real estate market and high interest rates.

"Household debts need to be reduced, but it needs to be done slowly so that it will not put any pressure on our economy," FSC Vice Chairman Kim So-young told a press briefing Tuesday. "We may, of course, reach a double-digit figure next year in the debt-to-GDP ratio since it is expected to lower to 100.8 percent by the end of this year." (Yonhap)