By Manpreet Gill

One of the biggest investment debates of our times is whether to own cash or government bonds. In the developed markets, one of the most rapid policy rate hiking cycles in history has meant that short-term returns from cash are now higher than what one can earn on a longer maturity bond. Unsurprisingly, this has led to a significant move into cash deposits or money market funds across major economies around the world.

Despite this, many asset allocators (ourselves included) continue to advocate the case for high quality bonds over cash. Are the yield optics sending investors a false signal?

Yield today vs. yield tomorrow

If yields were the only drivers of total investment returns, then there would be little debate on which asset to choose -- one could simply allocate to the asset class with the highest yield. In today’s market, that would be cash.

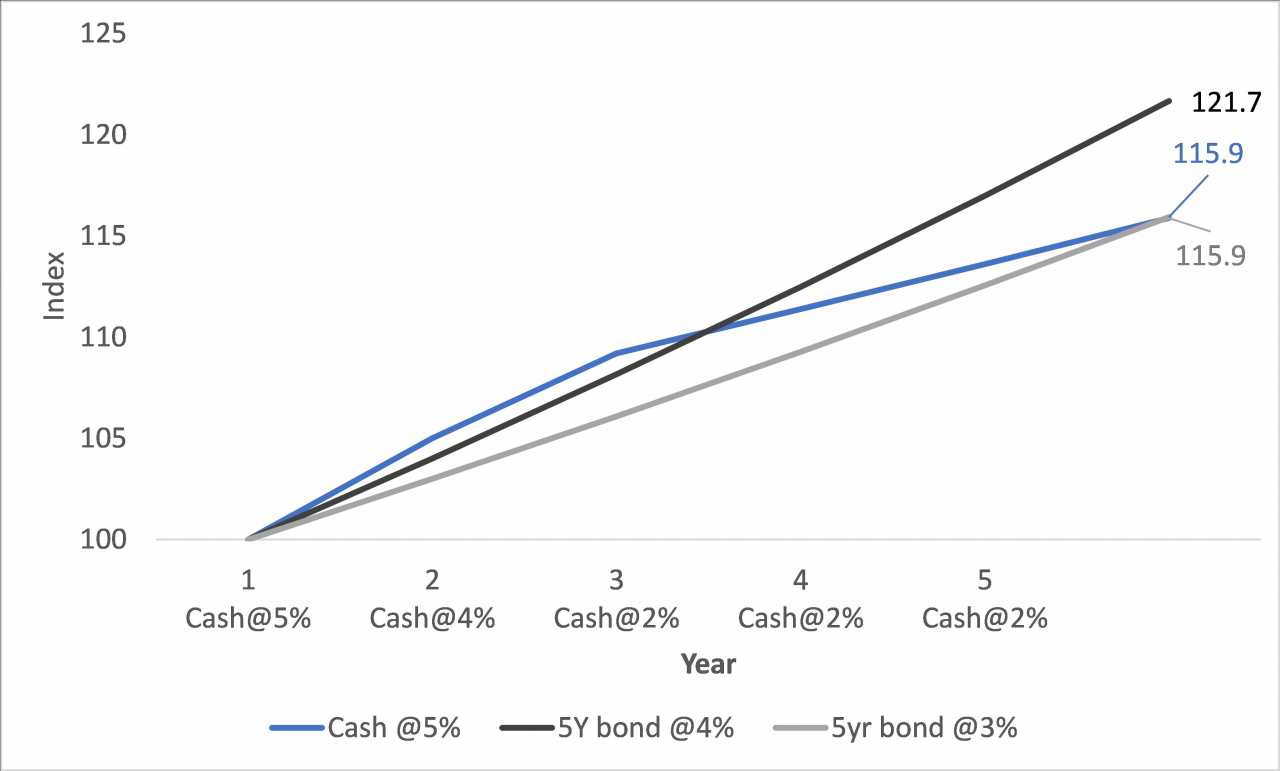

However, one needs to dig a little deeper in the investment world to figure out the real value of the two competing assets. The trade-off is best illustrated with a simple example. In the chart below, we compare three scenarios over a five-year horizon:

1. In the first scenario, an investor allocates to cash deposits, which currently yield around 5 percent over one year. We assume these yields stay relatively high at 5 percent and 4 percent in the first two years but fall to 2 percent thereafter as an economic recession unfolds and, in response, the central bank cuts short-term rates rapidly.

2. In the second scenario, an investor buys a five-year bond that yields 4 percent i.e., less than the return from cash. However, in this case, the investor can lock in the 4 percent yield for the next five years till the bond matures.

3. In the third scenario, the investor buys another five-year bond, but one that yields just 3 percent.

The chart illustrates how an investor’s returns pan out over the five-year period. In the first year, cash is clearly ahead with its higher yield.

However, as the one-year cash yield starts to drop in later years, returns fall rapidly. When the investor looks back with hindsight after five years, the five-year bond yielding 4 percent (1 full percent below the cash yield) ended up being the investment that delivered the highest returns.

Cash only ended up matching returns for a five-year bond that yielded 3 percent.

Quantifying reinvestment risk

Today’s investment environment is not that far off from our simple example -- in US dollars, three-month US treasury bills yield approximately 5.5 percent, while five-year and 10-year US government bonds yield 3.95 percent and 3.75 percent respectively.

Our stylized path of one-year deposit rates over the coming years is also plausible, in our view. While it remains debatable how long the US Federal Reserve holds rates at high levels, we continue to expect an economic recession over the next six to 12 months. History shows that a recession has always resulted in the Fed cutting interest rates rapidly in response. This means investors with cash deposits are likely to reinvest their deposits at much lower yields once their current deposits mature in the years ahead.

For investors, our example illustrates the real cost of reinvestment risk. Today’s yields optically favor cash deposits. However, we believe this is not the optimal decision for generating the highest total returns possible. Given where we are in the economic cycle, we continue to believe Developed Market government bonds offer a more attractive reward for the risk assumed relative to cash.

Some cash is prudent, but beware of losing purchasing power.

Leaving aside the need for liquidity, some cash can make sense within an investment allocation. This was not really the case for a large part of the previous cycle when cash yields largely went to zero. However, ever since central banks began to raise rates rapidly, cash has become a little more competitive.

Nevertheless, there is little reason to expect cash to do a better job of preserving wealth in real (or inflation-adjusted) terms compared with riskier asset classes. The optical yield illusion is making many investors respond to the headline yield on cash, but high-quality bonds are the hidden gems that are likely to outperform cash and better keep up with inflation over the coming years.

Manpreet Gill is chief investment officer for Africa, Middle East and Europe at Standard Chartered Bank’s Wealth Management unit. The views in this column are his own. -- Ed.