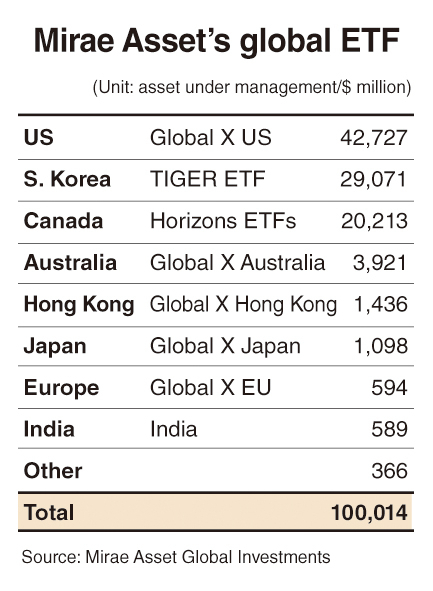

Mirae Asset Global Investments revealed Tuesday that its exchange-traded fund business has surpassed $100 billion in assets under management.

As of Tuesday, Mirae Asset manages a portfolio of 538 ETFs across various regions worldwide, spanning Korea, the US, Canada, Australia, and Japan.

The total assets under management for these ETFs reached $100 billion, positioning Mirae Asset as the 13th-largest ETF provider globally in that measure.

“Our global ETF franchise will serve as a strong foothold as we leverage our synergies across markets and offer investors unequaled exposure to disruptive themes, access to international markets, and tools that help them achieve their investment objectives,” Park Hyeon-joo, global strategic officer at Mirae Asset, said in a statement.

The asset management firm also said that Mirae Asset's ETF business has experienced remarkable growth, with assets under management surging by 350 percent over the last five years.

According to Mirae Asset, its success can be attributed to the company's consistent efforts in diversifying its product strategy and the increasing recognition of its ETF brands.

Global X in the US especially has witnessed more than fourfold growth in AUM since its acquisition in 2018. In particular, its flagship product, Global X Nasdaq 100 Covered Call, has garnered market attention with its current AUM surpassing $8.1 billion.

Also, Horizons ETFs, the fourth-largest ETF provider in Canada, continues to show a presence in the market, Mirae Asset said.

With global ETF AUM expected to grow to $15 trillion in 2027, Mirae Asset looks to continue differentiating itself in the ever-evolving ETF landscape and strengthening its innovative ETF business that is client-centric.

To achieve this goal, at the ETF Rally 2023 event held in Korea in May employees from Mirae Asset's global ETF division gathered to discuss future strategies for business synergies.

"Moving forward, we will remain dedicated to introducing competitive products that cater to the discerning needs of our valued investors,” said Kim Young, head of the global business unit at Mirae Asset.

In 2006, Mirae Asset first stepped into the market in Korea with its Tiger ETF.

The company then entered the global ETF market by listing ETFs on the Hong Kong Stock Exchange in 2011. This achievement marked Mirae Asset as the pioneering asset management company in Korea to venture into the global ETF market.

Since expanding to Hong Kong, Mirae Asset has been actively and strategically expanding its global presence through mergers and acquisitions.

The journey began with the acquisition of Canada's Horizons ETFs, and in 2018 the firm acquired Global X in the US. In 2022, Mirae Asset further solidified its position by acquiring ETF Securities in Australia, which now operates as Global X Australia.

In 2019, Mirae Asset formed the joint venture Global X Japan with Daiwa Securities in Japan, further enhancing its foothold in the region.

In the Japanese market, Global X Japan stands as the only ETF specialist firm and has captivated local investors with its distinctive product offerings. About two years since its establishment, it surpassed 100 billion yen ($723 million) AUM in March.

Mirae Asset has also expanded its influence in emerging market ETFs. In 2018, the firm introduced its first ETF product in India.

![[Weekender] How DDP emerged as an icon of Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050915_0.jpg&u=)

![[Music in drama] An ode to childhood trauma](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050929_0.jpg&u=)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)