[News Focus] Since 2017, nearly 70 percent spike seen at some Gangnam apartments

By Kim Yon-sePublished : Aug. 20, 2020 - 12:39

SEJONG -- Some apartment complexes in Seoul were found to have renewed all-time high prices despite the measures introduced by the government on June 17 to cool the market.

The record-breaking prices are have risen particularly in the wealthy Gangnam area, which comprises Gangnam-gu and Seocho-gu, two of the 25 administrative districts in Seoul.

According to the data held by the Land Ministry, an 84-square-meter apartment in the Acro Riverpark complex in Banpo-dong, Seocho-gu, traded at 3.57 billion won ($3.1 million) on July 14.

This showed a sharp climb, given that a unit for the same size was sold for 3 billion won on June 17, when the latest real estate measures were made public.

The price growth is also noteworthy compared to May 2017, when the Moon Jae-in administration took office. As the same size unit traded at 1.9 billion won on May 17, 2017, that’s a difference of 87 percent in only 38 months.

The rise is still large when measured on the basis of average prices of all 84-square-meter units traded at the complex -- by 1.99 billion won in May 2017 vs. 3.34 billion won in July 2020 -- a 67.8 percent increase.

In May 2017, some 84-square-meter units of apartment complex Dogok Rexle in Dogok-dong, Gangnam-gu, traded 1.4 billion won or under. But a unit for the same scale was sold at 2.65 billion won on July 3, 2020.

While it marked an 89 percent surge during the Moon administration, prices right before the June 17 measures stayed under 2.5 billion won.

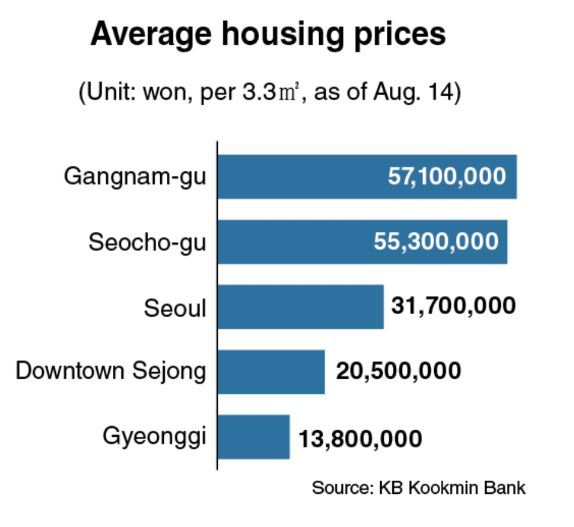

For the whole Gangnam area, Gangnam-gu and Seocho-gu saw the average price of housing (including apartment) reach a record-high of 17.3 million won and 16.7 million won per square meter, according to KB Kookmin Bank. The average for 25 districts in Seoul posted 9.6 million won.

Real Estate 114 data showed that the average apartment prices -- for overall scale units -- in Gangnam-gu and Seocho-gu came to 2.01 billion won and 1.95 billion won as of July.

For the whole Seoul, the average trading price exceeded 1 billion won for the first time in history to post 1.005 billion won last month.

The capital’s average apartment price -- which ranged between 517 million won 619 million won between 2013 and 2016 -- has continued to climb to 701 million won in 2017, 870 million won in 2018 and 952 million won in 2019.

“Though a certain period is needed to see the impact of anti-speculation measures, ordinary households cannot but cast doubts over efficacy of the government policies,” said a real estate agent in Seoul.

He said the people’s distrust has aggravated since the June 17 real estate measures were unveiled, in line with the huge assessment gains in properties owned by some political heavyweights and presidential secretaries.

The government unveiled a road map for housing supply in Seoul on Aug. 4 amid the growing fury among ordinary households. But it seems that many market observers remain skeptical about immediate stabilization of Seoul apartment prices, as supply via new construction requires about two years.

“The supply by building new apartments should have been pushed ahead from the early stage of the administration,” an agent said. “But the government has actively expanded the supply in satellite cities in Gyeonggi Province over the past three years.”

At the current stage, multiple homeowners have seemingly chosen to tolerate tough regulations involving property-owning taxes until Moon’s term expires in May 2022, he said.

Their stance could indicate that it would be better for them to pay enhanced property-owning taxes for one or two years, rather than bear the heavier burden of paying huge capital gains taxes when they sell their apartment.

By Kim Yon-se (kys@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)