[News Focus] Korea’s national debt up 107 trillion won since 2016

By Kim Yon-sePublished : Feb. 6, 2020 - 15:35

SEJONG -- The Moon Jae-in administration has drawn up and approved a series of supplementary budgets in a bid to stimulate GDP growth and create jobs amid a tough employment market.

Officials say the stimulus measures, including the active use of tax money and the issuance of treasury bonds, have benefited the overall economy. But opponents question their efficacy, pointing to a sharp increase only in nonregular jobs and to disappointing GDP growth -- 2 percent in 2019, the lowest rate in 10 years.

Once again, there are rumors that the government may be planning another addition to the budget in the wake of the new coronavirus from China, to counteract the economic slowdown that many foresee.

The rumors are aggravating worries about the government’s fiscal soundness, with the national debt having already reached a critical level.

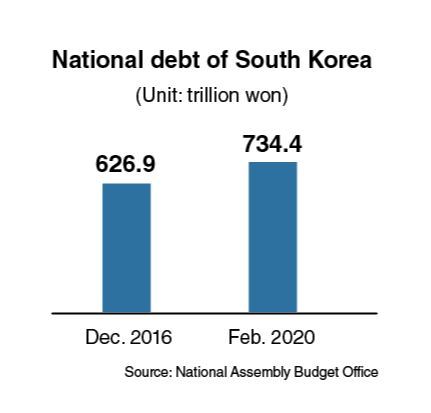

According to the National Assembly Budget Office, the national debt was estimated at 734.4 trillion won ($619.4 billion) as of Feb. 5. This marked an increase of 107.5 trillion won or (14.6 percent) in 38 months, compared with 626.9 trillion won at the end of 2016.

This represents a surge of more than 100 percent from a decade ago, at the end of 2009, when the debt stood at 359.6 trillion won.

Parliamentary estimates also suggest that per capita national debt surpassed the 14 million won mark (14.16 million won) for a population of 51.8 million. It surged by more than 1 million won in two years, after topping the 13 million won mark for the first time in February 2018.

“Per capita sovereign debt stayed at 10.52 million won at the end of 2014,” a financial analyst said. “This indicates that an ordinary citizen’s national debt burden has increased by 34.6 percent over the past five years.”

Whenever the Finance Ministry issues state bonds for the purpose of reinvigorating the economy, this inevitably causes a surge in national debt and increases the tax burden, which will ultimately be borne by ordinary households, he said.

The ratio of public debt to GDP -- an indicator of fiscal soundness, reflecting all debt held by the central and local governments -- is projected to exceed the 40 percent mark in 2020 for the first time in history, according to the Finance Ministry’s report to the National Assembly on its midterm fiscal policy.

A lawmaker from the Democratic Party of Korea was quoted by a news provider as saying that the ministry was backing away from its earlier plans to limit the national debt-to-GDP ratio to about 41.6 percent for the 2018-2022 period, and was now prepared to tolerate a ratio approaching 45 percent by 2022.

This suggests that the Moon administration might possibly continue to use taxpayers’ money too freely and to issue bonds just as freely until the president’s term expires in May 2022.

The sovereign debt-to-GDP ratio is estimated to have hovered around 38-39 percent in 2018.

A debt-to-GDP ratio of 45 percent would see South Korea’s debt reach 1.16 quadrillion won in about two years.

A real estate agent in Seoul pointed out that lackluster housing transactions have caused a sharp drop in revenue from capital gains taxes and acquisition taxes, as the tough rules on mortgage loans have frustrated home buyers.

Amid the restricted policy options, some market insiders in the real estate industry are cautiously predicting that the Moon government will have no choice but to shift its property market policy toward deregulation to vitalize apartment transactions.

A real estate agent in Gyeonggi Province said he could not rule out the possibility that the Moon administration would eventually decide to boost the economy by easing loan regulations, as the Park Geun-hye administration did between 2013 and 2015.

By Kim Yon-se (kys@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)