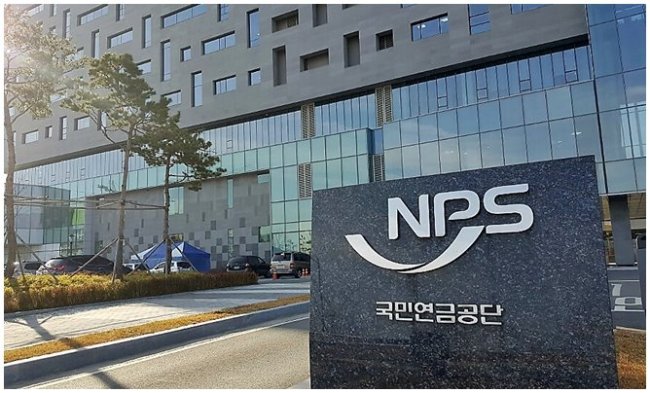

The National Pension Service, South Korea’s largest institutional investor, saw the total value of its stock holdings drop drastically this year despite a slight increase in the number of investment targets, data showed Wednesday.

The overall downturn was attributable to the stock market trend which has recently been reeling under uncertainties such as trade tensions between Washington and Beijing, as well as the prolonged slow growth of the domestic economy.

The overall downturn was attributable to the stock market trend which has recently been reeling under uncertainties such as trade tensions between Washington and Beijing, as well as the prolonged slow growth of the domestic economy.

According to local corporate tracker CEO Score, the number of companies in which the pension operator holds 5 percent or more in equity stood at 303 as of end-September, up from 287 in the beginning of the year. Of them, 108 companies saw an increase of NPS investment and 195 saw a reduction during the same period.

But the total value of stocks held by the NPS was tallied at 102.6 trillion won ($92 billion), down 19.3 trillion won, or 15.8 percent, from January.

The depreciation was entirely due to fallen stock prices, as the NPS’ equity position remained the same or even climbed slightly in most cases, CEO Score explained.

EO Technics, a laser solution provider, marked the steepest fall in stock value, with the NPS’ stock holding value dropping 54.7 percent despite its status quo in share ratio. The pension operator also saw a double-digit stock value depreciation in auto parts maker Mando (45.98 percent) and steelmaker SeAH Besteel (42.51 percent), data showed.

The three companies in which NPS saw its stock value total rise by more than 100 percent were Fila Korea (267.32 percent), Shinsegae (138.45 percent) and Hanjin (102.16 percent).

“NPS achieved 25.9 percent in domestic stock investment last year, but ever since the beginning of this year, it has been recording visible deficits,” said an industry observer.

“Though investments need to be viewed in a mid- and long-term perspective, the organization needs to tighten up its investment strategies as it is operating public funds.”

Earlier this week, the Ministry of Health and Welfare unveiled the NPS’ earnings rate for the third quarter, which came down to 2.38 percent, markedly low compared to its average last year of 7.26 percent and five-year average of 5.6 percent for the 2013-2017 period.

Investment return is considered a major fiscal issue as the pension operator is expected to run out of funds in the upcoming decades, years earlier than the previous projection.

A paper by the Korea Institute for Health and Social affairs suggested in June this year that the NPS will start running on deficit from the early 2040s, when its reserves peak at 1,576.9 trillion won in 2041, eventually reaching depletion in 2058.

In 2015, the Board of Audit and Inspection had pointed out that the pension service could delay its fund depletion timeline by a maximum of eight years should it improve its mid-term earnings by 1 percentage point.

By Bae Hyun-jung (tellme@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)