Corporate Korea is becoming polarized between the largest, most profitable corporations and a growing number of marginal companies unable to service their debts with their operating profits.

According to market analysts here, South Korean companies listed on the country’s main bourse are estimated to have reaped more than 100 trillion won ($85.9 billion) and 143 trillion won in combined net and operating profits, respectively, last year. It is the first time annual aggregate corporate net profits have exceeded 100 trillion won.

The market consensus is that most of the top 20 listed firms in terms of market capitalization improved their earnings last year.

The rise in corporate profits was attributed mainly to cost-cutting and other belt-tightening measures, rather than robust increases in sales.

“Due to the increase in operating profits, there is growing corporate valuation charm,” said Hwang Young-key, head of the Korea Financial Investment Association.

Experts say that whatever the reasons, it is encouraging that local corporations have reaped record profits amid worsening business conditions at home and abroad.

But they note the improved performance needs to result in more corporate investment to help shore up the slugging economy, urging government policymakers to accelerate deregulation to remove barriers to business activities.

In contrast with increased corporate profits are a growing number of marginal companies saddled with overcapacity and heavy debt.

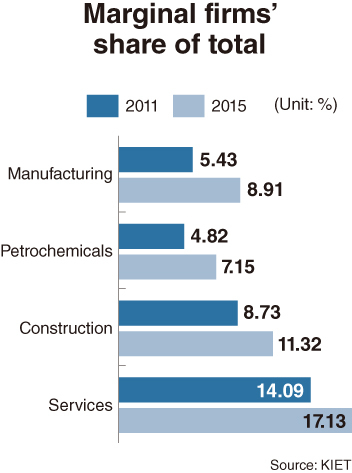

According to a report recently released by the Korea Institute for Industrial Economics and Trade, companies that failed to service debts with operating profits for three consecutive years accounted for 12.7 percent of local enterprises in 2015, up from 9.4 percent in 2011.

The proportion of marginal firms rose from 5.4 percent to 8.9 percent in manufacturing over the cited period. The corresponding figures for construction and services sectors climbed from 8.7 percent and 14.1 percent to 11.3 percent and 17.1 percent, respectively.

Data for 2016 are yet to be compiled, but the proportion was seen to continue to grow last year as the Korean economy struggled with weak domestic consumption and a prolonged slump in exports.

The KIET report analyzed that a 1 percentage point increase in the proportion of marginal firms led to a decrease in overall industrial productivity by 0.23 percent.

In step with the worsening productivity, the country’s economic growth has decelerated, with some research institutes predicting the Korean economy will grow by less than 2 percent this year.

Experts say ongoing corporate restructuring should be expedited to prevent heavily indebted and inefficient companies from further dragging down the country’s economy.

The government has designated shipbuilding, shipping, steelmaking, petrochemicals and construction as five major sectors subject to intensive restructuring.

A special law was put into practice in August last year to prompt corporations to voluntarily undertake pre-emptive restructuring by offering tax incentives, financial support and procedural conveniences.

So far, restructuring plans submitted by 15 companies, seven of which are small and medium-sized enterprises, have been approved.

Deputy Trade and Industry Minister Toh Kyung-hwan said about 40-50 more companies were expected to join the voluntary restructuring program this year.

Experts express concern about the possibility of corporate restructuring being loosened or delayed amid growing political populism in the run-up to the presidential election this year to choose a successor to impeached President Park Geun-hye.

Potential presidential candidates have mostly remained negative or lukewarm on accelerating corporate restructuring accompanied by massive lay-offs.

“Corporate restructuring should no longer be postponed out of concern over a temporary impact on the economy,” said a KIET researcher, asking not to be named.

He called for more boldness in liquidating marginal firms in accordance to market principles to enhance the efficiency of resource distribution.

The researcher also said a close coordination is needed between the government and the private sector to ensure that corporate restructuring would result in strengthening the country’s long-term competitiveness not weakening its industrial foundation.

Toh said there could be partial changes to the existing restructuring scheme under the next administration, but the basic direction should be kept regardless of change of government.

A study by the Korea Development Institute, a state-run think tank, suggested corporate restructuring would eventually help increase employment by enabling limited resources to be distributed more efficiently.

A 10 percentage point reduction in the proportion of marginal companies would lead to the corporate sector hiring about 110,000 more workers, according to the study.

Experts note it is also important to complement corporate restructuring with a set of measures to expand financial support for laid-off workers and provide them with education and retraining to help them land jobs in more productive fields.

By Kim Kyung-ho (khkim@heraldcorp.com)

-

Articles by Korea Herald

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)