The deepening plight of many small and medium-sized companies is poised to exacerbate South Korea’s economic woes as the country’s large corporations have been struggling with slumping demand both at home and abroad.

Industrial output by Asia’s fourth-largest economy fell by 2 percent from a year earlier in September, government data showed this week. A report released by the Bank of Korea on Sunday showed sales of about 574,000 local firms that close their books in the July-December period rose by a mere 0.3 percent in 2015 from the year before, slowing from a 1.3 percent on-year gain in the previous year.

According to recent data from Chaebol.com, an online business data provider, 15 of the top 30 Korean companies by sales saw their operating profits shrink in the first nine months of this year from a year earlier. The operating profits of the two largest manufacturers, Samsung Electronics and Hyundai Motor, recorded on-year declines of 1.24 percent and 13.8 percent, respectively, during the January-September period.

The combined turnover of the 30 companies fell by 2.7 percent from a year earlier to 644 trillion won ($559.4 billion) over the cited period.

This flagging performance of large companies has been coupled with the weakening vitality of small and mid-sized enterprises, which hire nearly 90 percent of the country’s waged workers.

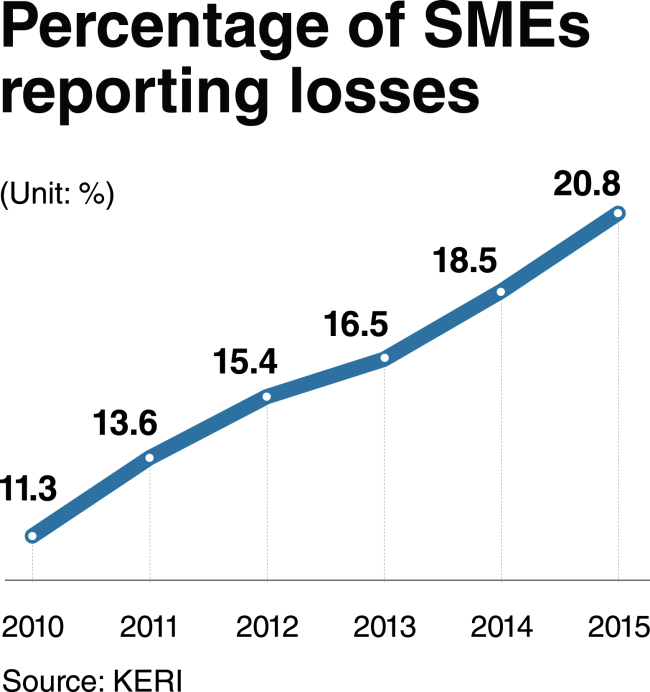

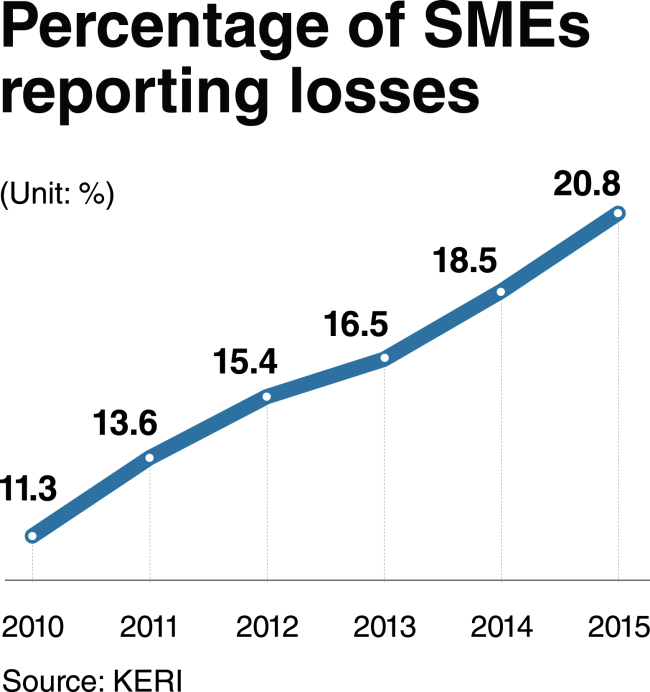

According to recent analysis by a local economic research institute, the proportion of SMEs reporting losses jumped from 11.3 percent in 2010 to 20.8 percent last year. Nearly 1 in 10 small businesses failed to earn profits enough to cover interest payments for three consecutive years in 2015.

The analysis also showed the rate of on-year increase in assets held by SMEs surveyed dropped from 12.2 percent in 2006 to 4.4 percent last year, far below the 9.4 percent tallied in 2009 in the aftermath of the global financial crisis.

The sales of small and mid-sized firms increased by a mere 1.7 percent from a year earlier in 2015, compared to 20 percent for 2010. The average annual rate of increase in SME investments, which stood at 10.5 percent during the period between 2001 and 2008, remained in a negative territory for the following years through 2015.

Business sentiment for the coming month has worsened from a month earlier among both large and small companies.

The business survey index for November, based on a survey by the Federation of Korean Industries of the country’s top 600 companies, dropped to 89.8 from 96 for October. A reading below 100 means pessimists outnumber optimists.

A similar index compiled by the Korea Federation of SMEs based on a survey of 3,150 small businesses also slid from 91.6 for October to 86.1 for November.

Economists particularly worry about implications of moribund SMEs for local labor markets.

“In the past, small and medium-sized firms played a role of safety net against restructuring of large companies by absorbing many laid-off workers,” said Sung Tae-yoon, a professor of economics at Yonsei University in Seoul.

“But they have lost this function, which may be a reason for a recent steep rise in the number of people who remain unemployed for a long period,” he said.

The country’s unemployment rate reached 3.6 percent in September, the highest number for the month in 11 years, according to figure.

In a report released last month, the Hyundai Research Institute, a private think tank, forecast that more than 320,000 workers would lose jobs if the ongoing and planned restructuring of five industrial sectors saddled with heavy debt and overcapacity --shipbuilding, shipping, petrochemicals, steel and construction -- led to a 10 percent reduction in their size.

Such industrial overhauling will have a severe impact on a number of subcontractors, aggravating difficulties faced by SMEs.

Industry watchers note, however, government support has been focused on large companies, with few substantive measures worked out to help smaller businesses hit equally hard or even harder by the prolonged economic downturn.

Over the past years, the government has pursued a policy to enhance the balance between large and small companies by placing an emphasis on inclusive growth. This policy, however, has resulted in loosening efforts to restructure loss-making SMEs and weakening the vitality of the overall small business sector, experts say.

Most SME owners tend to keep management information to themselves and remain negative to mergers and acquisitions.

The government needs to push for more active measures to boost the competitiveness of small businesses in the long run rather than waiting for them to undertake restructuring voluntarily, experts say.

By Kim Kyung-ho (khkim@heraldcorp.com)

Industrial output by Asia’s fourth-largest economy fell by 2 percent from a year earlier in September, government data showed this week. A report released by the Bank of Korea on Sunday showed sales of about 574,000 local firms that close their books in the July-December period rose by a mere 0.3 percent in 2015 from the year before, slowing from a 1.3 percent on-year gain in the previous year.

According to recent data from Chaebol.com, an online business data provider, 15 of the top 30 Korean companies by sales saw their operating profits shrink in the first nine months of this year from a year earlier. The operating profits of the two largest manufacturers, Samsung Electronics and Hyundai Motor, recorded on-year declines of 1.24 percent and 13.8 percent, respectively, during the January-September period.

The combined turnover of the 30 companies fell by 2.7 percent from a year earlier to 644 trillion won ($559.4 billion) over the cited period.

This flagging performance of large companies has been coupled with the weakening vitality of small and mid-sized enterprises, which hire nearly 90 percent of the country’s waged workers.

According to recent analysis by a local economic research institute, the proportion of SMEs reporting losses jumped from 11.3 percent in 2010 to 20.8 percent last year. Nearly 1 in 10 small businesses failed to earn profits enough to cover interest payments for three consecutive years in 2015.

The analysis also showed the rate of on-year increase in assets held by SMEs surveyed dropped from 12.2 percent in 2006 to 4.4 percent last year, far below the 9.4 percent tallied in 2009 in the aftermath of the global financial crisis.

The sales of small and mid-sized firms increased by a mere 1.7 percent from a year earlier in 2015, compared to 20 percent for 2010. The average annual rate of increase in SME investments, which stood at 10.5 percent during the period between 2001 and 2008, remained in a negative territory for the following years through 2015.

Business sentiment for the coming month has worsened from a month earlier among both large and small companies.

The business survey index for November, based on a survey by the Federation of Korean Industries of the country’s top 600 companies, dropped to 89.8 from 96 for October. A reading below 100 means pessimists outnumber optimists.

A similar index compiled by the Korea Federation of SMEs based on a survey of 3,150 small businesses also slid from 91.6 for October to 86.1 for November.

Economists particularly worry about implications of moribund SMEs for local labor markets.

“In the past, small and medium-sized firms played a role of safety net against restructuring of large companies by absorbing many laid-off workers,” said Sung Tae-yoon, a professor of economics at Yonsei University in Seoul.

“But they have lost this function, which may be a reason for a recent steep rise in the number of people who remain unemployed for a long period,” he said.

The country’s unemployment rate reached 3.6 percent in September, the highest number for the month in 11 years, according to figure.

In a report released last month, the Hyundai Research Institute, a private think tank, forecast that more than 320,000 workers would lose jobs if the ongoing and planned restructuring of five industrial sectors saddled with heavy debt and overcapacity --shipbuilding, shipping, petrochemicals, steel and construction -- led to a 10 percent reduction in their size.

Such industrial overhauling will have a severe impact on a number of subcontractors, aggravating difficulties faced by SMEs.

Industry watchers note, however, government support has been focused on large companies, with few substantive measures worked out to help smaller businesses hit equally hard or even harder by the prolonged economic downturn.

Over the past years, the government has pursued a policy to enhance the balance between large and small companies by placing an emphasis on inclusive growth. This policy, however, has resulted in loosening efforts to restructure loss-making SMEs and weakening the vitality of the overall small business sector, experts say.

Most SME owners tend to keep management information to themselves and remain negative to mergers and acquisitions.

The government needs to push for more active measures to boost the competitiveness of small businesses in the long run rather than waiting for them to undertake restructuring voluntarily, experts say.

By Kim Kyung-ho (khkim@heraldcorp.com)

-

Articles by Korea Herald

![[Graphic News] Number of coffee franchises in S. Korea rises 13%](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050817_0.gif&u=)