Shareholder-friendly policies emerge as focal point in Samsung-Elliott battle

Lessons may come from fights and conflicts rather than peace

By 서지연Published : July 2, 2015 - 16:21

A monthlong faceoff between Samsung and U.S. activist hedge fund Elliott over a proposed merger between Samsung C&T and Cheil Industries is shedding light on the importance of corporations’ shareholder-friendly policies.

This week, the two key Samsung units announced plans to boost shareholder value, including higher dividend payouts and the establishment of a corporate governance committee.

But it seems too soon to predict that these policies will help soothe disgruntled Samsung C&T investors with the merger terms enough for Samsung to push through the $8 billion deal at a crucial shareholder vote on July 17.

Regardless of the result of the vote, some analysts said, the battle will push the nation’s corporations to increase dividends, as it is expected to serve as motivation to enhance shareholder value.

Samsung C&T gained momentum in its push for the merger when it won a court battle Wednesday, with Elliott seeking to stop the shareholder vote.

But the builder still faces some challenges to its merger attempt, which Seoul analysts said aimed at consolidating the founding family’s control of Samsung Group.

Some minority individual investors are publicly complaining about the deal, siding with Elliott’s claim that Samsung C&T was significantly undervalued.

“Separate from Elliott, a growing number of Korean investors, especially those who hold Samsung C&T shares, are raising their voices against the merger terms. They also doubt the growth outlook of the merged firm,” a capital market expert with more than 20 years of experience in equity investment said.

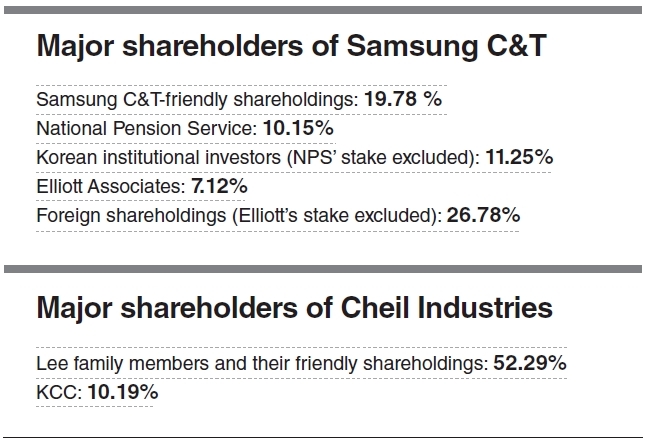

Shareholdings of foreign institutional investors, including Elliott, in Samsung C&T are said to be about 34 percent. But it is still unknown how many foreign investors will support the merger plan.

The company’s official friendly shareholdings are estimated to be only around 20 percent.

“Samsung has no choice but to be nervous about subtle change in sentiment of Samsung C&T’s Korean investors,” he said.

Industry watchers said for a safe bet, Samsung C&T needs a 47 percent friendly stake.

In particular, the support from the National Pension Service, the nation’s biggest investor, is critical as it is the largest shareholder in Samsung C&T with a 10.15 stake.

The NPS has remained undecided, just stressing the importance of boosting shareholder value. Last October, the NPS thwarted a plan to merge another two Samsung units -- Samsung Engineering and Samsung Heavy Industries.

Despite the court ruling in favor of Samsung, some opponents are continuing to take issue with the stock swap ratio.

For the merger, Cheil offered 0.35 new shares for each share of Samsung C&T, based on the stock value of each firm in May. Under this ratio, the stake of Samsung C&T investors in the combined company will be drastically reduced.

Samsung C&T is one-third the size of Samsung’s de facto holding company Cheil Industries in terms of stock value for now. The builder, however, is five times bigger than Cheil on the basis of asset value, as it has stakes in key Samsung units, including Samsung Electronics and Samsung SDS.

For instance, Samsung C&T holds a 4.1 percent stake in Samsung Electronics, whose market value amounts to around 8 trillion won (7.2 billion).

But some economists do not agree with their claims that the merger deal damaged shareholder value due to an “unfair” calculation of the merger ratio.

“It doesn’t make sense that the proposed merger damaged shareholder value as shares of Samsung C&T rose about 20 percent after the merger announcement (in May),” Shin Jang-sup, an economics professor at the National University of Singapore, said in an email exchange with The Korea Herald.

He said Samsung C&T shareholders also have to think of the damage from attacks by “vulture” funds like Elliott against the nation’s major conglomerates.

“Leaving the already realized gains in the dark, Elliott is trying to turn the attention of other shareholders and the public only to its populist target, Samsung Group’s succession plan,” he said.

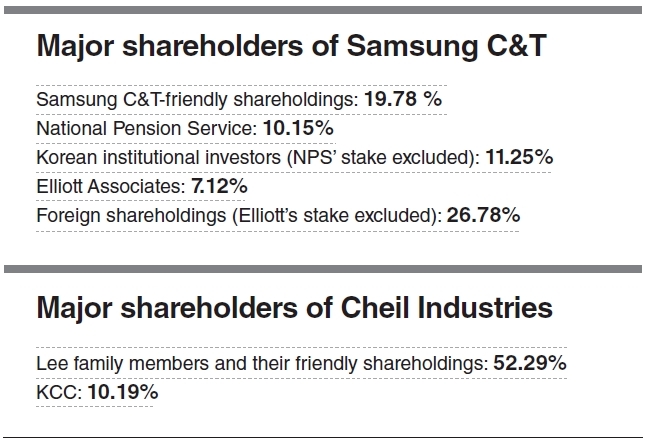

Despite the professor's allegation, the widely accepted view in the market is that the merger was designed to transfer managerial rights of Samsung Group to the next generation-Samsung Electronics vice chairman Lee Jay- yong.

Samsung Group heir apparent Lee is the biggest shareholder of Cheil Industries, Samsung’s de facto holding company.

Therefore, the proposed merger, if realized, is expected to onsolidate Lee’s dominance on key Samsung units where Samsung C&T holds stakes.

“Samsung’s recent merger plan has a positive effect of stabilizing Samsung’s governance,” said a recent report from Sustinvest, a local advisory services for proxy voting.

“However, it doesn’t mean that the company has every option available to it to achieve its goal. As a company with different investors, it has to put shareholder value ahead of other goals in management decisions.”

Above is the first in four-part series featuring the battle between Samsung C&T and Elliott Associates over the Korean builder’s merger deal with Cheil Industries, and its implications. – Ed

By Seo Jee-yeon (jyseo@heraldcorp.com)

This week, the two key Samsung units announced plans to boost shareholder value, including higher dividend payouts and the establishment of a corporate governance committee.

But it seems too soon to predict that these policies will help soothe disgruntled Samsung C&T investors with the merger terms enough for Samsung to push through the $8 billion deal at a crucial shareholder vote on July 17.

Regardless of the result of the vote, some analysts said, the battle will push the nation’s corporations to increase dividends, as it is expected to serve as motivation to enhance shareholder value.

Samsung C&T gained momentum in its push for the merger when it won a court battle Wednesday, with Elliott seeking to stop the shareholder vote.

But the builder still faces some challenges to its merger attempt, which Seoul analysts said aimed at consolidating the founding family’s control of Samsung Group.

Some minority individual investors are publicly complaining about the deal, siding with Elliott’s claim that Samsung C&T was significantly undervalued.

“Separate from Elliott, a growing number of Korean investors, especially those who hold Samsung C&T shares, are raising their voices against the merger terms. They also doubt the growth outlook of the merged firm,” a capital market expert with more than 20 years of experience in equity investment said.

Shareholdings of foreign institutional investors, including Elliott, in Samsung C&T are said to be about 34 percent. But it is still unknown how many foreign investors will support the merger plan.

The company’s official friendly shareholdings are estimated to be only around 20 percent.

“Samsung has no choice but to be nervous about subtle change in sentiment of Samsung C&T’s Korean investors,” he said.

Industry watchers said for a safe bet, Samsung C&T needs a 47 percent friendly stake.

In particular, the support from the National Pension Service, the nation’s biggest investor, is critical as it is the largest shareholder in Samsung C&T with a 10.15 stake.

The NPS has remained undecided, just stressing the importance of boosting shareholder value. Last October, the NPS thwarted a plan to merge another two Samsung units -- Samsung Engineering and Samsung Heavy Industries.

Despite the court ruling in favor of Samsung, some opponents are continuing to take issue with the stock swap ratio.

For the merger, Cheil offered 0.35 new shares for each share of Samsung C&T, based on the stock value of each firm in May. Under this ratio, the stake of Samsung C&T investors in the combined company will be drastically reduced.

Samsung C&T is one-third the size of Samsung’s de facto holding company Cheil Industries in terms of stock value for now. The builder, however, is five times bigger than Cheil on the basis of asset value, as it has stakes in key Samsung units, including Samsung Electronics and Samsung SDS.

For instance, Samsung C&T holds a 4.1 percent stake in Samsung Electronics, whose market value amounts to around 8 trillion won (7.2 billion).

But some economists do not agree with their claims that the merger deal damaged shareholder value due to an “unfair” calculation of the merger ratio.

“It doesn’t make sense that the proposed merger damaged shareholder value as shares of Samsung C&T rose about 20 percent after the merger announcement (in May),” Shin Jang-sup, an economics professor at the National University of Singapore, said in an email exchange with The Korea Herald.

He said Samsung C&T shareholders also have to think of the damage from attacks by “vulture” funds like Elliott against the nation’s major conglomerates.

“Leaving the already realized gains in the dark, Elliott is trying to turn the attention of other shareholders and the public only to its populist target, Samsung Group’s succession plan,” he said.

Despite the professor's allegation, the widely accepted view in the market is that the merger was designed to transfer managerial rights of Samsung Group to the next generation-Samsung Electronics vice chairman Lee Jay- yong.

Samsung Group heir apparent Lee is the biggest shareholder of Cheil Industries, Samsung’s de facto holding company.

Therefore, the proposed merger, if realized, is expected to onsolidate Lee’s dominance on key Samsung units where Samsung C&T holds stakes.

“Samsung’s recent merger plan has a positive effect of stabilizing Samsung’s governance,” said a recent report from Sustinvest, a local advisory services for proxy voting.

“However, it doesn’t mean that the company has every option available to it to achieve its goal. As a company with different investors, it has to put shareholder value ahead of other goals in management decisions.”

Above is the first in four-part series featuring the battle between Samsung C&T and Elliott Associates over the Korean builder’s merger deal with Cheil Industries, and its implications. – Ed

By Seo Jee-yeon (jyseo@heraldcorp.com)

![[KH Explains] Why Korea's so tough on short selling](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/19/20240519050115_0.jpg&u=20240520081646)

![[News Focus] Mystery deepens after hundreds of cat deaths in S. Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/17/20240517050800_0.jpg&u=)

![[Weekender] Geeks have never been so chic in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050845_0.jpg&u=)