Shipbuilders tilt toward offshore plants

Hyundai, Daewoo, Samsung turn attention to high-value-added business to offset slump in shipbuilding

By Korea HeraldPublished : Dec. 13, 2012 - 20:31

The nation’s top three shipbuilders ― Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, and Samsung Heavy Industries ― are stepping up efforts to boost competitiveness in their offshore plant and engineering business, considering it a future growth engine.

The three ship manufacturers have suffered from a lack of orders in their core shipbuilding business for the past few years, affected by the prolonged global economic downturn, especially in Europe. But global demand for offshore plants has been gradually on the rise.

Growth potential and comparative advantage

Offshore plants refer to floating facilities used for exploration and drilling oil and gas buried under the sea, including drill ships and FPSO units, which are floating vessels used for oil production, storage and offloading.

Industry watchers said that orders for offshore plants will continue to increase, regardless of the global economic condition, as the oil and gas reserves on land have decreased.

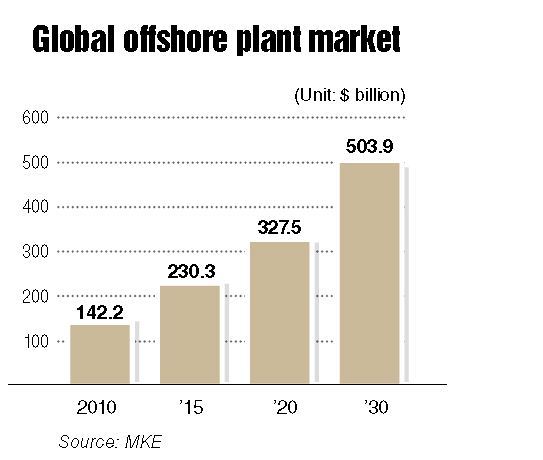

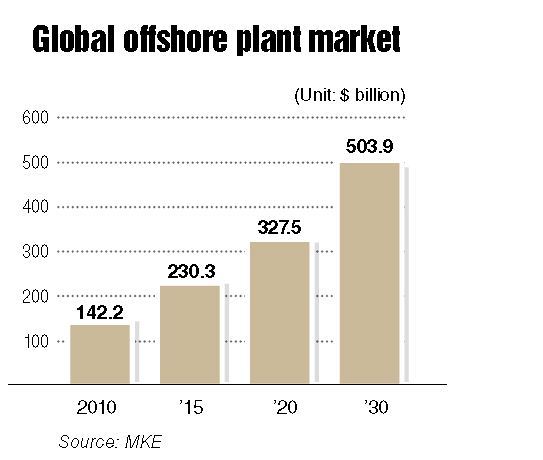

According to data from the Ministry of Knowledge Economy, the market for offshore plants has increased 5.4 percent yearly on average and is expected to expand to $230.3 billion in 2015 and $327.5 billion in 2020.

Offshore plants are high-value-added vessels as they require complicated engineering, in which the nation’s shipbuilders have comparative advantage over Chinese rivals.

Korean shipbuilders were the world’s best performers in the offshore plant business this year, winning 18 drill ship orders and two FPSO orders between January and September.

Their reliance on offshore plant orders has been increasing. In the case of Hyundai Heavy Industries, the world’s top shipbuilder, offshore plant orders reached $24.1 billion, which accounts for 77.5 percent of the company’s total orders for this year up to the end of November.

Hyundai Heavy has transformed itself into the largest offshore plant builder based on its on-ground shipbuilding construction method. Since the beginning of its involvement in the sector in the 1990s, the company said its offshore and engineering unit has completed 3 million tons of offshore facilities and 510 kilometers of subsea pipeline in 49 projects.

Samsung Heavy showed the same trend. The company won $7.8 billion worth orders in offshore plants in the same period, which is 86 percent of the $9 billion in total orders. Samsung Heavy, in particular, takes market leadership in drill-ship building. The company won 31 drill ships orders out of the total 51 demanded globally over the past 10 years.

The nation’s top three shipbuilders’ shift to offshore plants was reflected in their annual year-end executive promotion and personnel reorganization announcements.

Investments and tasks ahead

The goals that Hyundai Heavy Industries set in its annual executive promotion on Dec. 1 were to downsize the number of executives and to strengthen its offshore plant and engineering unit.

Samsung Heavy Industries named vice president Park Dae-young as the new CEO. Park has more than 20 years’ experience in the offshore plant business.

Industry watchers said DSME will follow suit in the upcoming year-end executive promotion announcement.

Shipbuilding companies have also spurred the expansion of investment in offshore plant module production, design and engineering.

In November, Hyundai Heavy established an offshore plant in Onsan, South Gyeongsang Province, to produce large-sized offshore-plant modules. Its production capacity is over 50,000 tons a year.

Samsung Heavy formed a partnership with AMEC, a U.K.-based offshore-plant engineering company, in October this year to improve its offshore plant design capacity.

There are still a few critical tasks to overcome ahead of the nation’s shipbuilders to establish their offshore businesses as cash generating.

“Despite the growth potential of offshore plants, the nation’s shipbuilders heavily depend on overseas partners in such areas as plant design and supply of materials. Offshore plants will remain as a low-margin business unless the shipbuilders improve those weak points,” an industry source said.

By Seo Jee-yeon (jyseo@heraldcorp.com)

The three ship manufacturers have suffered from a lack of orders in their core shipbuilding business for the past few years, affected by the prolonged global economic downturn, especially in Europe. But global demand for offshore plants has been gradually on the rise.

Growth potential and comparative advantage

Offshore plants refer to floating facilities used for exploration and drilling oil and gas buried under the sea, including drill ships and FPSO units, which are floating vessels used for oil production, storage and offloading.

Industry watchers said that orders for offshore plants will continue to increase, regardless of the global economic condition, as the oil and gas reserves on land have decreased.

According to data from the Ministry of Knowledge Economy, the market for offshore plants has increased 5.4 percent yearly on average and is expected to expand to $230.3 billion in 2015 and $327.5 billion in 2020.

Offshore plants are high-value-added vessels as they require complicated engineering, in which the nation’s shipbuilders have comparative advantage over Chinese rivals.

Korean shipbuilders were the world’s best performers in the offshore plant business this year, winning 18 drill ship orders and two FPSO orders between January and September.

Their reliance on offshore plant orders has been increasing. In the case of Hyundai Heavy Industries, the world’s top shipbuilder, offshore plant orders reached $24.1 billion, which accounts for 77.5 percent of the company’s total orders for this year up to the end of November.

Hyundai Heavy has transformed itself into the largest offshore plant builder based on its on-ground shipbuilding construction method. Since the beginning of its involvement in the sector in the 1990s, the company said its offshore and engineering unit has completed 3 million tons of offshore facilities and 510 kilometers of subsea pipeline in 49 projects.

Samsung Heavy showed the same trend. The company won $7.8 billion worth orders in offshore plants in the same period, which is 86 percent of the $9 billion in total orders. Samsung Heavy, in particular, takes market leadership in drill-ship building. The company won 31 drill ships orders out of the total 51 demanded globally over the past 10 years.

The nation’s top three shipbuilders’ shift to offshore plants was reflected in their annual year-end executive promotion and personnel reorganization announcements.

Investments and tasks ahead

The goals that Hyundai Heavy Industries set in its annual executive promotion on Dec. 1 were to downsize the number of executives and to strengthen its offshore plant and engineering unit.

Samsung Heavy Industries named vice president Park Dae-young as the new CEO. Park has more than 20 years’ experience in the offshore plant business.

Industry watchers said DSME will follow suit in the upcoming year-end executive promotion announcement.

Shipbuilding companies have also spurred the expansion of investment in offshore plant module production, design and engineering.

In November, Hyundai Heavy established an offshore plant in Onsan, South Gyeongsang Province, to produce large-sized offshore-plant modules. Its production capacity is over 50,000 tons a year.

Samsung Heavy formed a partnership with AMEC, a U.K.-based offshore-plant engineering company, in October this year to improve its offshore plant design capacity.

There are still a few critical tasks to overcome ahead of the nation’s shipbuilders to establish their offshore businesses as cash generating.

“Despite the growth potential of offshore plants, the nation’s shipbuilders heavily depend on overseas partners in such areas as plant design and supply of materials. Offshore plants will remain as a low-margin business unless the shipbuilders improve those weak points,” an industry source said.

By Seo Jee-yeon (jyseo@heraldcorp.com)

-

Articles by Korea Herald

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050484_0.jpg&u=20240501151646)

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)

![[KH Explains] Will alternative trading platform shake up Korean stock market?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050557_0.jpg&u=20240501161906)

![[Today’s K-pop] Stray Kids go gold in US with ‘Maniac’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/02/20240502050771_0.jpg&u=)