Korea to check banks’ FX trading

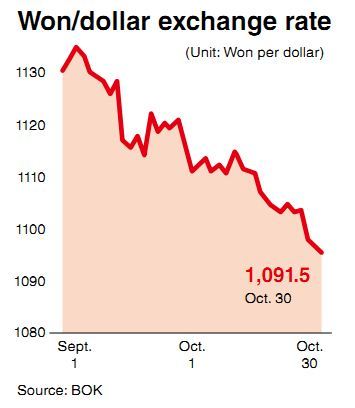

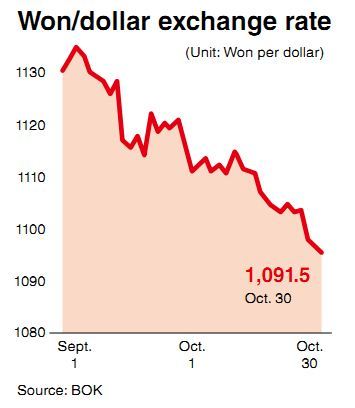

Authorities plan to probe forward exchange positions in light of strong won

By Korea HeraldPublished : Oct. 30, 2012 - 20:19

Financial authorities are set to launch a special investigation into whether banks kept forward foreign exchange positions under a government-set ceiling, which is aimed at reining in banks’ short-term borrowing.

Forward exchange is a type of foreign exchange transaction whereby a contract is made to exchange one currency for another at a fixed date in the future at a specified exchange rate. By buying or selling forward exchange, businesses protect themselves against a decrease in the value of a currency they plan to sell at a future date.

Forward exchange position indicates the difference between a bank’s forward exchange assets and liabilities. It can be over-bought (long), over-sold (short) or square, meaning a bank’s FX assets equal its FX debts.

The Korean government limits FX derivatives position at 40 percent of capital for domestic banks, and at 200 percent of in-country capital for branches of foreign banks.

The envisioned scrutiny comes as banks’ forward exchange positions have greatly increased in size recently.

If the size of a bank’s forward exchange position increases, it could lead to a rise in foreign loans, becoming a risk to the macro-prudence of the banking sector.

The Bank of Korea and the Financial Supervisory Service plan to look into the details and forms of forward exchange transactions, as well as a new type of foreign exchange-related derivative.

Based on the findings of the probe, the financial authorities will consider raising the ceilings on banks’ forward exchange positions.

The joint FX investigation is the third after the government’s inspections in October-November of 2010, and April-May of last year.

Checking on bank’s forward exchange positions was the purpose of the two previous inquiries, but during the second probe, authorities also zeroed in on banks’ purchases of “kimchi bonds,” or non-won-denominated bonds issued in the Korean market. After the second probe, the authorities lowered the bank’s forward exchange position to 40 percent, down from 50 percent, effective from June. The ceiling on that of foreign banks was reduced to 200 percent, down from 250 percent.

“We will decide after the investigation whether to toughen the restrictions on forward exchange positions. Nothing has been decided as of yet,” said a foreign exchange authority.

Industry sources believe the ceiling is likely to be lowered again this time. Technically, under current rules, it can be pushed down to as low as 25 percent of capital for domestic banks and 125 percent for branches of foreign banks.

The government is reluctant to introduce a Tobin tax, or a tax on all spot conversions of one currency into another, because of its huge ramifications and risks.

If the Korean won strengthens beyond controllable levels, financial authorities could also consider raising the rate of bank levy on non-depository foreign exchange liabilities.

Considering that the won-dollar exchange rate recently fell when foreign capital outflow from Korea was only marginal, authorities attribute the won’s sharp gain to prompt selling of the greenback by exporters and delayed money exchange by importers.

Financial authorities expect the foreign exchange market to turn the corner this week when demand for money exchange from exports and imports is the highest.

The government also plans to suggest studying and discussing the spillover and countermeasures to the recent quantitative easing by advanced countries at the G20 financial ministers and central bankers’ meeting that starts on Nov. 4.

By Kim So-hyun (sophie@heraldcorp.com)

Forward exchange is a type of foreign exchange transaction whereby a contract is made to exchange one currency for another at a fixed date in the future at a specified exchange rate. By buying or selling forward exchange, businesses protect themselves against a decrease in the value of a currency they plan to sell at a future date.

Forward exchange position indicates the difference between a bank’s forward exchange assets and liabilities. It can be over-bought (long), over-sold (short) or square, meaning a bank’s FX assets equal its FX debts.

The Korean government limits FX derivatives position at 40 percent of capital for domestic banks, and at 200 percent of in-country capital for branches of foreign banks.

The envisioned scrutiny comes as banks’ forward exchange positions have greatly increased in size recently.

If the size of a bank’s forward exchange position increases, it could lead to a rise in foreign loans, becoming a risk to the macro-prudence of the banking sector.

The Bank of Korea and the Financial Supervisory Service plan to look into the details and forms of forward exchange transactions, as well as a new type of foreign exchange-related derivative.

Based on the findings of the probe, the financial authorities will consider raising the ceilings on banks’ forward exchange positions.

The joint FX investigation is the third after the government’s inspections in October-November of 2010, and April-May of last year.

Checking on bank’s forward exchange positions was the purpose of the two previous inquiries, but during the second probe, authorities also zeroed in on banks’ purchases of “kimchi bonds,” or non-won-denominated bonds issued in the Korean market. After the second probe, the authorities lowered the bank’s forward exchange position to 40 percent, down from 50 percent, effective from June. The ceiling on that of foreign banks was reduced to 200 percent, down from 250 percent.

“We will decide after the investigation whether to toughen the restrictions on forward exchange positions. Nothing has been decided as of yet,” said a foreign exchange authority.

Industry sources believe the ceiling is likely to be lowered again this time. Technically, under current rules, it can be pushed down to as low as 25 percent of capital for domestic banks and 125 percent for branches of foreign banks.

The government is reluctant to introduce a Tobin tax, or a tax on all spot conversions of one currency into another, because of its huge ramifications and risks.

If the Korean won strengthens beyond controllable levels, financial authorities could also consider raising the rate of bank levy on non-depository foreign exchange liabilities.

Considering that the won-dollar exchange rate recently fell when foreign capital outflow from Korea was only marginal, authorities attribute the won’s sharp gain to prompt selling of the greenback by exporters and delayed money exchange by importers.

Financial authorities expect the foreign exchange market to turn the corner this week when demand for money exchange from exports and imports is the highest.

The government also plans to suggest studying and discussing the spillover and countermeasures to the recent quantitative easing by advanced countries at the G20 financial ministers and central bankers’ meeting that starts on Nov. 4.

By Kim So-hyun (sophie@heraldcorp.com)

-

Articles by Korea Herald