Korea’s leading firms beat Japanese peers in market cap

By Korea HeraldPublished : Aug. 14, 2012 - 19:46

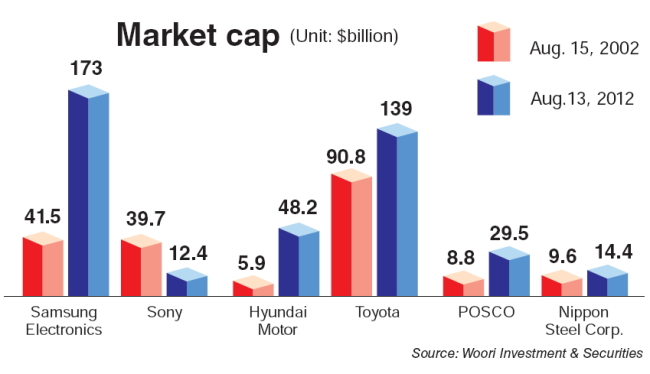

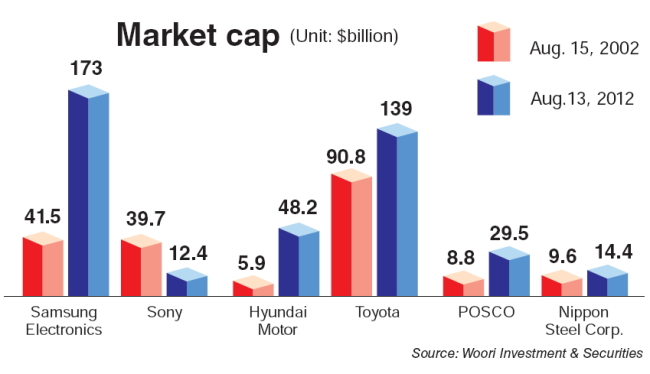

Korea’s leading companies in six major export industries now have greater aggregate market values compared to their Japanese peers, as they have grown faster and attracted more investment.

Based on last Friday’s closing prices, market capitalizations of the top Korean manufacturers of semiconductors, displays, steel products, ships, oil refiners and builders were greater than that of their Japanese rivals, Shinhan Investment Corp. said Tuesday.

In late 2009, Korean companies in only three of the trades ― semiconductors, construction and steel ― beat the Japanese in the aggregate value of listed stocks, which is widely perceived to reflect a firm’s current earnings and growth potential.

In semiconductors, the market cap of Samsung Electronics amounted to 198.56 trillion won ($175.9 billion), compared to Toshiba’s 16.59 trillion won.

The market cap of LG Display surged from 8.77 trillion won late last year to 9.3 trillion won this year, outpacing Sharp whose market cap plummeted from 11.25 trillion won to 3.35 trillion won in the same period.

In oil refining, SK Innovation (15.53 trillion won) narrowly beat JX Holdings (15.07 trillion won).

POSCO is way ahead of Nippon Steel Corp. and Hyundai Heavy Industries has kept its lead for three years since it overtook Mitsubishi Heavy Industries.

The market caps of Korea’s leading companies in cars, chemicals, Internet, games, media and advertising, tires, food and pharmaceuticals, on the other hand, still fall behind those of the Japanese.

The gaps are narrowing, however.

The aggregate market values of Toyota and Honda dropped compared to late 2009, but those of Hyundai and Kia doubled and quadrupled in the same period, respectively.

“The changes in market caps of Korean and Japanese companies indicate the outlooks for the overall national economy,” said Chung Ho-sung, a senior analyst at Samsung Economic Research Institute.

“The prospects for Japanese firms are gloomy while Korean businesses are growing fast, but this can change anytime.”

By Kim So-hyun (sophie@heraldcorp.com)

Based on last Friday’s closing prices, market capitalizations of the top Korean manufacturers of semiconductors, displays, steel products, ships, oil refiners and builders were greater than that of their Japanese rivals, Shinhan Investment Corp. said Tuesday.

In late 2009, Korean companies in only three of the trades ― semiconductors, construction and steel ― beat the Japanese in the aggregate value of listed stocks, which is widely perceived to reflect a firm’s current earnings and growth potential.

In semiconductors, the market cap of Samsung Electronics amounted to 198.56 trillion won ($175.9 billion), compared to Toshiba’s 16.59 trillion won.

The market cap of LG Display surged from 8.77 trillion won late last year to 9.3 trillion won this year, outpacing Sharp whose market cap plummeted from 11.25 trillion won to 3.35 trillion won in the same period.

In oil refining, SK Innovation (15.53 trillion won) narrowly beat JX Holdings (15.07 trillion won).

POSCO is way ahead of Nippon Steel Corp. and Hyundai Heavy Industries has kept its lead for three years since it overtook Mitsubishi Heavy Industries.

The market caps of Korea’s leading companies in cars, chemicals, Internet, games, media and advertising, tires, food and pharmaceuticals, on the other hand, still fall behind those of the Japanese.

The gaps are narrowing, however.

The aggregate market values of Toyota and Honda dropped compared to late 2009, but those of Hyundai and Kia doubled and quadrupled in the same period, respectively.

“The changes in market caps of Korean and Japanese companies indicate the outlooks for the overall national economy,” said Chung Ho-sung, a senior analyst at Samsung Economic Research Institute.

“The prospects for Japanese firms are gloomy while Korean businesses are growing fast, but this can change anytime.”

By Kim So-hyun (sophie@heraldcorp.com)

-

Articles by Korea Herald