Articles by Im Eun-byel

Im Eun-byel

silverstar@heraldcorp.com-

Korea slams brake on budget growth

The Cabinet on Tuesday approved the 2024 budget proposal worth 656.9 trillion won ($497 billion), marking the lowest on-year growth in nearly two decades as the country suffers from sluggish tax revenue. The size of the second budget proposal drawn up by the Yoon Suk Yeol administration has increased by 2.8 percent from this year’s 638.7 trillion won, the smallest proposed increase since 2005. The budget for this year was 5.1 percent up on the previous year. “Due to the past administ

Economy Aug. 29, 2023

-

Inflation fears grow on high fuel costs

The on-year growth in consumer prices is likely to bounce back to the 3 percent range from this month due to the spike in international oil prices. While inflation in Korea has been easing off this year, the Finance Ministry expects it to climb back, reaching the 3 percent range before coming down again in October. Korea's on-year growth in consumer prices has been showing signs of slowing down this year. It came down to 4.8 percent in February from 5.2 percent in January, and stayed in the

Economy Aug. 27, 2023

-

BOK extends rate pause amid mounting US, China pressure

The Bank of Korea on Thursday kept its policy rate unchanged at 3.5 percent, maintaining it a fifth consecutive time amid growing China fears and a widened rate gap with the US. In a rate-setting meeting presided over by BOK Gov. Rhee Chang-yong, the six-member monetary policy board unanimously voted to maintain the current policy rate, which has stayed at 3.5 percent since February. “The board decided to hold the rate, projecting it would take significant time for the inflation rate, whic

Economy Aug. 24, 2023

-

BOK holds rate at 3.5% amid China fears

The Bank of Korea on Thursday kept its policy rate unchanged at 3.5 percent, holding it for the fifth consecutive time since February. Recent economic indicators show inflation could rebound within this year as the base effect from last year’s dip in international oil prices wears off. Oil prices have been on the rise recently, too, adding to the growing inflationary pressure on the Korean economy, which heavily dependent on energy imports. Chinese deflation and default risks from its real

Economy Aug. 24, 2023

-

Hanwha Life posts first accumulated profits in Vietnam

The Vietnamese arm of Hanwha Life Insurance posted its first accumulated profits since its launch 15 years ago. Marking the local unit’s 15th anniversary, the insurer held a ceremony in Ho Chi Minh City, Vietnam on Friday, where it unveiled its financial achievements. Since posting a net profit for the first time in 2016, the Vietnamese subsidiary has recorded profits for nearly five consecutive years between 2019 and 2023. As of the first half of this year, its accumulated profits reached

Companies Aug. 21, 2023

-

Korea’s economic recovery falters as China's deflation looms

The South Korean economy faces fresh risks from China, with no immediate breakthrough in sight to recover its faltering exports. Recent figures show worsened woes in Beijing, indicating the country’s economy could be on a path of decline. China has slipped into deflation, reporting a 0.3 percent drop in consumer prices in July on-year. It was the first time in 29 months for the figure to nosedive to a minus range. Further data showed its retail sales, industrial output and investment all

Economy Aug. 20, 2023

-

Listed firms’ earnings plunge in H1

In the first six months of 2023, the added operating profit of Kopsi-listed firms fell by more than half, as the economy struggles to deal with the impact of global geopolitical tensions and high interest rates, the Korea Exchange said Thursday. According to data provided by the Korea Exchange, the operating profit of 615 firms listed on Kospi stood at 53.1 trillion won ($39.6 billion) from January to June, 52.45 percent less than that of the same period from a year before. Data was not included

Market Aug. 18, 2023

-

Korean won slides amid strong US dollar, China fears

The Korean won declined below 1,340 won against the dollar during trading hours Wednesday, marking a new three-month low and reflecting increased volatility from the US’ stronger-than-expected economy and deflation worries in China, boosting the dollar's safe-haven appeal. The Korean won against the greenback opened at 1,340 won on Wednesday, 9.1 won higher than the previous trading day. Shortly after trading began, it fell back to 1,341 won, the weakest since the 1,343 won seen earli

Economy Aug. 16, 2023

-

SPAC listing market stable after rules eased: KRX

The Korea Exchange, the nation’s sole bourse operator, said Tuesday that the stock market for special purpose acquisition companies, or SPACs, remains stable after price fluctuations in the first months of eased regulations. A SPAC is a publicly traded shell corporation that is formed to raise capital through listings to acquire or merge with an existing company. Most SPACs make their debut at the public offering price of 2,000 won ($1.50) per share as mergers and acquisitions could be d

Economy Aug. 15, 2023

-

Lotte chairman highest-paid chaebol leader in H1

Lotte Group Chairman Shin Dong-bin was the highest-paid business leader in Korea for the first half of this year, regulatory filings posted Monday by major firms in Korea showed. Shin received total compensation of 11.2 billion won ($8.37 million) from the retail giant's six affiliates in the January-June period, up from 10.2 billion won tallied a year earlier. He maintained the highest-paid business leader title for a second consecutive year. The wage reflects Shin's management perf

Companies Aug. 15, 2023

-

Commercial real estate market slump to persist until 2024: Mastern

The global commercial real estate market, hit by high interest rates and a decline in office space demand, is likely to be in a prolonged slowdown until next year, a real investment firm based in Seoul said through a report issued on Monday. While Korean investment firms are suffering from losses in their investments in office properties overseas, Mastern Investment Management said the slump in the market will continue as major economies, including the US Federal Reserve, are yet to drop their a

Industry Aug. 14, 2023

-

Frozen Iranian funds released

Iranian funds worth an estimated $6 billion, frozen in bank accounts in Korea, have been released, following the US and Iran's tentative agreement to engage in a prisoner swap in exchange for Tehran's access to the blocked funds. All of Iran’s frozen funds in Korea have been unblocked, Central Bank of Iran Gov. Mohammad Reza Farzin said through a post written in Persian on social platform X on Saturday. The central bank chief wrote that $7 billion in Iranian assets in Korea have

Economy Aug. 13, 2023

-

Korea to unveil medical care plans for pets in Oct.

The South Korean government plans to propose new policies to improve its medical care system for pets amid a growing pet population in the country. The number of households with dogs or cats in Korea came to 6.02 million last year, rising sharply by 65.4 percent from 3.64 million in 2012, according to the Ministry of Agriculture, Food and Rural Affairs' report at an intergovernmental meeting held Wednesday. According to the ministry, local households spend an average of 60,000 won ($45) p

Industry Aug. 9, 2023

-

Trade, overseas dividends bring current account surplus expansion

#Current account surplus for first 6 months shrink 90% compared to a year ago South Korea logged a current account surplus for two consecutive months in June due to a trade surplus and increased dividends from overseas, central bank data showed Tuesday. The country's current account gained $5.87 billion in June, following the $1.93 billion surplus from a month earlier, according to preliminary data from the Bank of Korea. Prime Minister Han Duck-soo assessed that Korea was showing a sound p

Economy Aug. 8, 2023

-

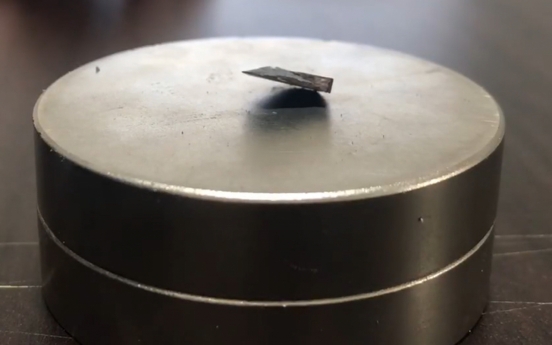

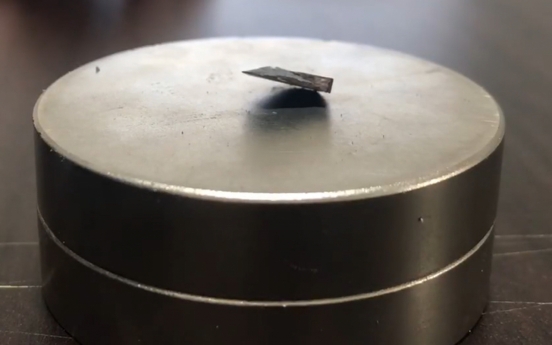

Superconductor-themed stocks rally on hope for breakthrough finding

Stock prices of superconductor-themed shares rebounded Monday, backed by a retail investor frenzy with high hopes on the potential game-changing room temperature superconductor technology. Shares of superconductor industry related firms continued to enjoy a rally from last week after a research team including the Quantum Energy Research Centre said it discovered a room-temperature superconductor called LK-99 on July 22. Related stocks experienced a slight dip on Friday, when skeptical responses

Market Aug. 7, 2023

Most Popular

-

1

Qoo10 liquidity crisis sparks massive complaints, fears of wider damage

-

2

Yoon urges municipalities to embrace foreigners

-

3

What is happening at Hybe?

-

4

S. Korea to consent to Japan's Sado mines gaining World Heritage status: official

-

5

Korea unveils tax reform bill to spur economy

-

6

Actor’s excessive airport security sparks probe into human rights violations

-

7

Man who let his father die due to financial difficulties to be released on parole

-

8

Actor Yoo Ah-in accused of sexual attack

-

9

S. Korea, China shifting from tensions to cooperation: Seoul

-

10

LG Electronics achieves record earnings in Q2