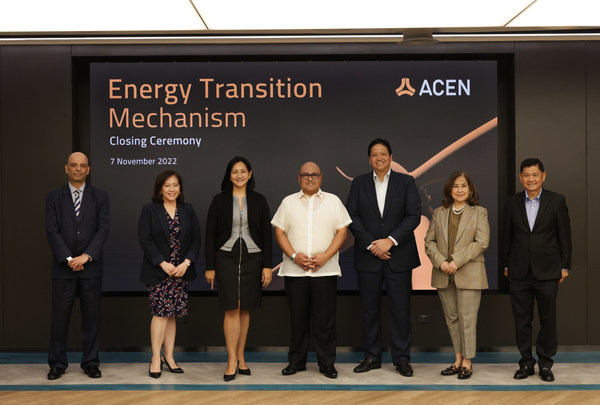

ACEN completes the world's first Energy Transition Mechanism (ETM) transaction for the 246-MW SLTEC coal plant

ByPublished : Nov. 8, 2022 - 09:40

- Full completion of the world's first market-based Energy Transition Mechanism (ETM) transaction, which will enable the early retirement of the 246-MW SLTEC coal plant and its transition to cleaner technology

- Entails full divestment of ACEN's equity stake in SLTEC, bringing the company closer to its commitment of 100% renewables generation by 2025

- ₱7.2 billion of proceeds received by ACEN for use in its renewable energy investments

MANILA, Philippines, Nov. 8, 2022 /PRNewswire/ -- ACEN (PSE:ACEN), the energy platform of the Ayala Group, disclosed today the full divestment of the South Luzon Thermal Energy Corporation (SLTEC) coal plant using the energy transition mechanism (ETM), the first ETM deal in the world. The landmark transaction will enable the early retirement of the 246-MW coal plant in Batangas, Philippines. As part of the ETM structure, the coal plant's operating life of up to 50 years will be cut in half, as ACEN commits to retire and transition the plant to a cleaner technology by 2040. This will help avoid or reduce up to 50 million metric tons of carbon emissions.

The ETM is a concept developed by the Asian Development Bank (ADB), which aims to leverage low-cost and long-term funding geared towards early coal retirement and the reinvestment of proceeds to enable renewable energy projects.

Ahmed Saeed, ADB vice president said, "We commend the Ayala Group and ACEN for the successful closing of this pioneering ETM transaction. We hope that this sets the tone for others to pursue the just transition of thermal plants to cleaner technologies."

The ETM for the SLTEC plant involved ₱13.7 billion in debt financing provided by the Bank of the Philippine Islands and Rizal Commercial Banking Corporation, as well as ₱3.7 billion in equity investments from the Philippine Government Service Insurance System (GSIS), The Insular Life Assurance Company, Ltd. (InLife), and ETM Philippines Holdings, Inc., for a total deal value of ₱17.4 billion. ACEN received ₱7.2 billion from the transaction for reinvestment in the company's renewable energy projects. The balance of proceeds was used for refinancing debt and transaction fees.

GSIS recently invested ₱2.2 billion in redeemable preferred shares issued by SLTEC. Wick Veloso, GSIS president and general manager said, "Our priority is to find ways to grow and sustain our funds to ensure that we are able to provide our over two million members and pensioners their benefits. We also fully support investments that prioritize optimal environmental, social, and governance (ESG) factors or outcomes consistent with our corporate social responsibility."

InLife anchored the equity placements with a ₱1-billion investment. Nina D. Aguas, InLife executive chairperson said, "To deliver a lifetime for good, for us at InLife, also means investing in cleaner air and environmental solutions for future generations. The proceeds of our investment will be used to develop renewable energy and eventually allow decommissioning of the coal plants. We join the call for the development of more renewable energy sources through this pioneering transition mechanism." She added that the ETM is a groundbreaking solution to a rising global concern.

Through this transaction, ACEN moves closer toward its commitment to 100% renewables generation by 2025, as well as its ambitious goal of reaching 20 GW of renewables capacity by 2030.

Cora Dizon, ACEN CFO and treasurer said, "Finding a win-win solution to balance the needs of multiple stakeholders amidst the goal of transitioning away from coal was admittedly challenging. Despite this, debt and equity investors still came together to support the financing of this pioneering energy transition deal, which has become a blueprint for other organizations to emulate."

Eric Francia, ACEN president and CEO said, "ACEN continues to blaze the trail for energy transition in the Asia Pacific. As the company has successfully divested its coal asset, ACEN commits to a just energy transition. We have established mechanisms to ensure that stakeholder interests, especially those of the people and communities of SLTEC, are effectively addressed."

AlphaPrimus Advisors and BPI Capital served as financial advisors to the transaction. CLSA Philippines was the lead arranger for the equity placements, while BPI Capital and RCBC Capital acted in the same capacity for the SLTEC debt financing.

About ACEN

ACEN is the listed energy platform of the Ayala Group. The company has ~4,000 MW of attributable capacity in the Philippines, Vietnam, Indonesia, India, and Australia, with a renewable share of 87%, which is among the highest in the region.

ACEN's aspiration is to be the largest listed renewables platform in Southeast Asia, with a goal of reaching 20 GW in renewables capacity by 2030. In 2021, ACEN announced its commitment to achieve Net Zero greenhouse gas emissions by 2050. This will involve the early retirement of its remaining coal plant by 2040 and transition the company's generation portfolio to 100% renewable energy by 2025.

For inquiries and more information, please contact:

For Investors and Analysts:

ACEN Investor Relations

Email: investorrelations@acenrenewables.com

DISCLAIMER: This disclosure may contain forward-looking statements that are subject to risk factors and opportunities that may affect ACEN's plans to complete the transaction/s that are the subject of this disclosure. Each forward-looking statement is made only as of the date of this disclosure. Outcomes of the subject transaction may differ materially from those expressed in the forward-looking statements included in this disclosure.

![[Graphic News] Number of coffee franchises in S. Korea rises 13%](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050817_0.gif&u=)

![[Robert J. Fouser] AI changes rationale for learning languages](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050811_0.jpg&u=)

![[Today’s K-pop] Stray Kids go gold in US with ‘Maniac’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050771_0.jpg&u=)

![[Eye Interview] 'If you live to 100, you might as well be happy,' says 88-year-old bestselling essayist](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/03/20240503050674_0.jpg&u=)