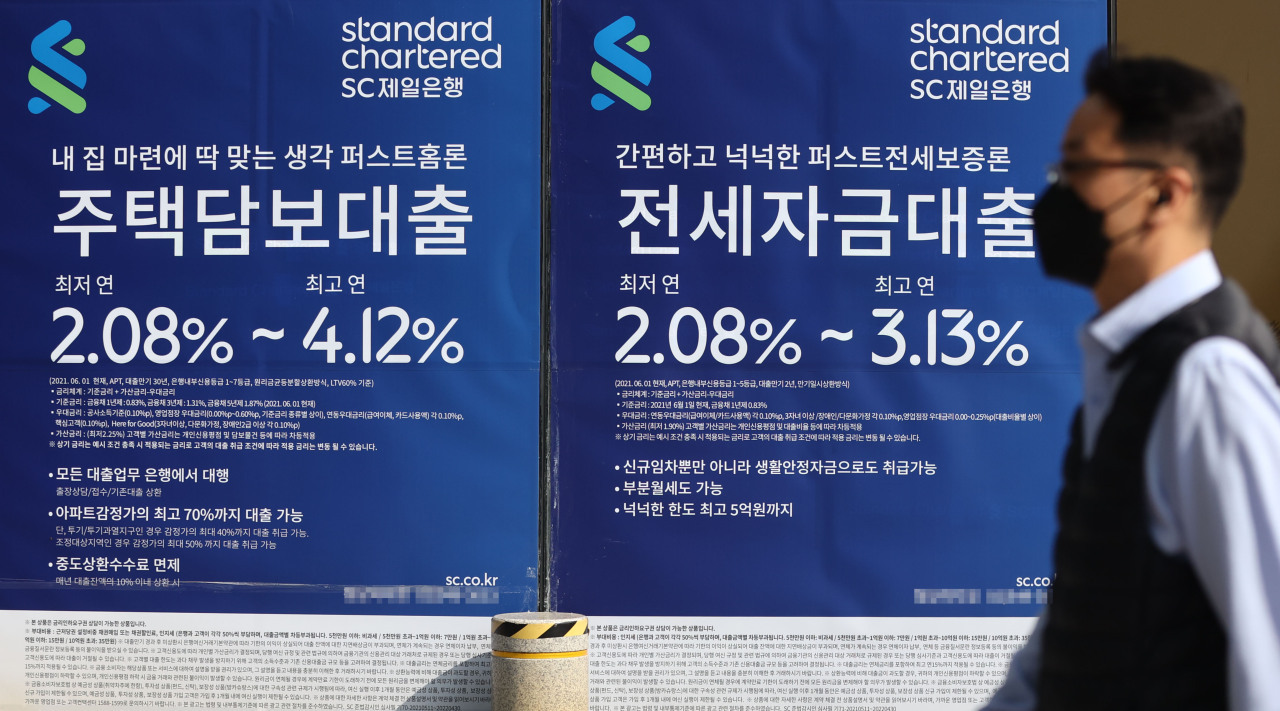

Banks' average interest rate on mortgage loans rose to the highest level in about three years, central bank data showed Friday, as the government has tightened lending rules to rein in soaring household debt.

According to the data by the Bank of Korea (BOK), banks' mortgage loan rate averaged 3.26 percent in October, up 0.25 percentage point from a month earlier.

This marked the highest since November 2018, when the corresponding rate was 3.28 percent.

Banks' unsecured loan rate also rose 0.47 percentage point to 4.62 percent last month, the highest since March 2019, when it was 4.63 percent.

Loan rates have been on the rise recently in line with the government's drive to put a lid on fast growing household debt and the central bank's rate hikes intended to tame inflation.

On Thursday, the BOK raised its policy rate by 0.25 percentage point to 1 percent, three months after it announced a quarter percentage point rate hike in August. (Yonhap)

According to the data by the Bank of Korea (BOK), banks' mortgage loan rate averaged 3.26 percent in October, up 0.25 percentage point from a month earlier.

This marked the highest since November 2018, when the corresponding rate was 3.28 percent.

Banks' unsecured loan rate also rose 0.47 percentage point to 4.62 percent last month, the highest since March 2019, when it was 4.63 percent.

Loan rates have been on the rise recently in line with the government's drive to put a lid on fast growing household debt and the central bank's rate hikes intended to tame inflation.

On Thursday, the BOK raised its policy rate by 0.25 percentage point to 1 percent, three months after it announced a quarter percentage point rate hike in August. (Yonhap)

![[Today’s K-pop] Treasure to publish magazine for debut anniversary](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/07/26/20240726050551_0.jpg&u=)