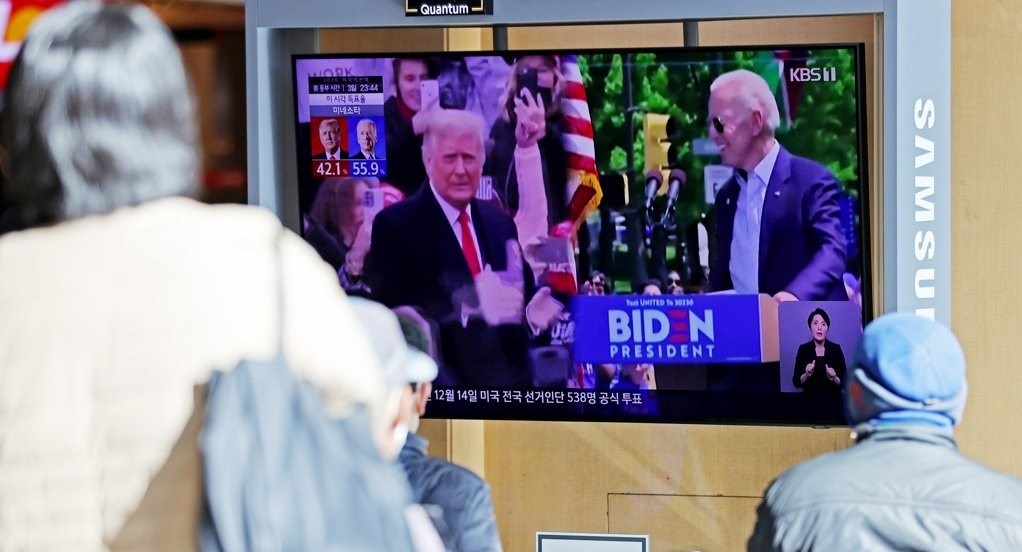

Local stocks up with US election still undecided

Divided US government is more boon than bane for stock market: analysts

By Kim Young-wonPublished : Nov. 5, 2020 - 16:15

The US stock market rally with the presidential election still up in the air gave a boost to the South Korean stock market Thursday, particularly for tech shares.

Extending gains that began earlier in the week, South Korea’s main bourse Kospi rose 2.4 percent, or 56.47 points, to close at 2,413.79 while the tech-heavy Kosdaq added 2.16 percent, or 17.83 points, to reach 844.8.

Electric battery makers and biotechnology firms saw their stocks jump on the day. Battery producer SK Innovation’s shares traded at a high of 143,500 won ($127), up 8.71 percent, in intraday trading, and closed at 138,000 won, up 4.55 percent. Drug manufacturer Samsung Biologics saw its shares hit a high of 785,000 won, up 7.09 percent, in the morning session, and ended at 781,000 won, up 6.55 percent.

“While there could be some volatility in the market due to the result of the presidential race, uncertainties about policy changes have been largely resolved in the long run,” said Seo Jung-hoon, an analyst at Samsung Securities.

The boost came from the Dow Jones Industrial Average growing 1.34 percent to 27,847.66 and the S&P 500 gaining 2.2 percent to 3,443.44. The tech-heavy Nasdaq soared 3.85 percent to 11,590.78.

Among top gainers were the FAANG tech stocks, including Facebook, up 8.32 percent, Amazon, up 6.32 percent, and Google parent Alphabet, up 6.09 percent.

Other analysts expected that the impact of the election on the stock market would not be as significant as previously predicted, as the US political landscape is likely to strike a balance of a Democratic presidency and Republican Senate.

“It seems that a Republican-led Senate will block the passage of regulation bills that are expected to be proposed by Biden and the Democrats (if the presidential candidate wins),” said Huh Jae-hwan, an analyst from Eugene Investment & Securities.

Some expected that a Biden presidency and a Republican Senate will be a boon for the US stock market as Biden tries, as he has pledged previously, to work with the Republican Senate to get something done. The implementation of radical tax plans or regulations could be delayed or blocked in such a scenario, according to market watchers.

By Kim Young-won (wone0102@heraldcorp.com)

![[KH Explains] Hyundai-backed Motional’s struggles deepen as Tesla eyes August robotaxi debut](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050605_0.jpg&u=20240516155018)