[Herald Interview] Screening matters in crowdfunding: Crowdy

By Son Ji-hyoungPublished : Aug. 21, 2018 - 15:41

The Korea Herald is publishing a series of interviews on promising startups in the financial technology industry. This is the 21st installment. -- Ed.

In June, the South Korean mobile game software developer iPeoples reneged on a promise to give 10 percent returns to those investing through an equity crowdfunding platform.

The developer of the mobile game “Blue Marble M” was estimated to have crowdsourced 700 million won ($626,300) from some 770 investors by issuing bonds. It promised to repay principal and interest together six months from the investment and to guarantee principal.

The company, however, went back on its own pledge, citing a lack of cash. As the crowdfunding platform was not legally liable for the loss, investors were left high and dry, with no tangible protective measure.

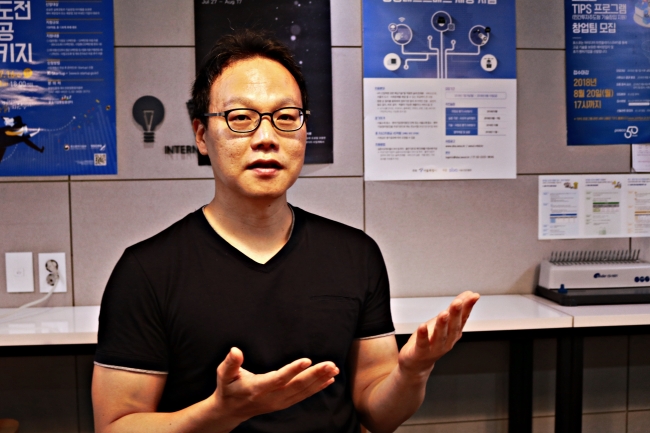

The case highlighted the importance of risk management and thorough screening in the crowdfunding platform business, Kim Ju-won, co-founder and managing partner of crowdfunding platform Crowdy, said in an interview with The Korea Herald.

Kim had earlier rejected iPeoples’ application for fundraising through Crowdy.

“The concept of crowdfunding is based on the collective intelligence of retail investors, but a platform should also be involved in keeping noneligible firms away from the act of fundraising on Crowdy,” the 43-year-old said.

In June, the South Korean mobile game software developer iPeoples reneged on a promise to give 10 percent returns to those investing through an equity crowdfunding platform.

The developer of the mobile game “Blue Marble M” was estimated to have crowdsourced 700 million won ($626,300) from some 770 investors by issuing bonds. It promised to repay principal and interest together six months from the investment and to guarantee principal.

The company, however, went back on its own pledge, citing a lack of cash. As the crowdfunding platform was not legally liable for the loss, investors were left high and dry, with no tangible protective measure.

The case highlighted the importance of risk management and thorough screening in the crowdfunding platform business, Kim Ju-won, co-founder and managing partner of crowdfunding platform Crowdy, said in an interview with The Korea Herald.

Kim had earlier rejected iPeoples’ application for fundraising through Crowdy.

“The concept of crowdfunding is based on the collective intelligence of retail investors, but a platform should also be involved in keeping noneligible firms away from the act of fundraising on Crowdy,” the 43-year-old said.

During the interview, Kim highlighted equity crowdfunding platforms’ role in allowing retail investors to be given opportunities for “value creation increasingly taking place in securities of privately-held companies,” which had been exclusive to institutional investors.

At the same time, Kim also stressed the responsibility of crowdfunding platforms to prevent retail investors from being exposed to “risk-bearing investment” and being left vulnerable.

“It does not matter whether our efforts (to sift out unfit fundraisers) fall short of drawing people’s attention,” he said. “We will continue to be uncompromising about our high standards in screening out fundraisers.”

Kim added he was in charge of evaluating fundraisers’ eligibility. Before co-founding Crowdy in 2015, Kim was a banker at Standard Chartered Bank Korea and Seoul units of Morgan Stanley, Lehman Brothers and Bank of America, among others.

“When assessing a company that taps Crowdy, we focus on what problem it has found and how it is solving it,” he said. “Some companies with decent technology prowess often fail to explain to us what problem they were trying to solve.”

At the same time, Kim also stressed the responsibility of crowdfunding platforms to prevent retail investors from being exposed to “risk-bearing investment” and being left vulnerable.

“It does not matter whether our efforts (to sift out unfit fundraisers) fall short of drawing people’s attention,” he said. “We will continue to be uncompromising about our high standards in screening out fundraisers.”

Kim added he was in charge of evaluating fundraisers’ eligibility. Before co-founding Crowdy in 2015, Kim was a banker at Standard Chartered Bank Korea and Seoul units of Morgan Stanley, Lehman Brothers and Bank of America, among others.

“When assessing a company that taps Crowdy, we focus on what problem it has found and how it is solving it,” he said. “Some companies with decent technology prowess often fail to explain to us what problem they were trying to solve.”

Problems that Kim found eligible, for example, include developing adequate pigments for a spray used for robot painting on building walls, and materials for marker pens using ink that sticks on a whiteboard surface and is removable without erasers.

Companies in the scale-up phase can also tap into the Crowdy platform for the sake of marketing, Kim added.

To invite more blue-chip companies to crowdfunding platforms, deregulation of the upper bar for equity crowdfunding set at 700 million won is critical, Kim said.

“Companies would not dare to do all the documentation to simply raise 700 million won,” he said, pinning hopes on financial authorities’ signals of deregulation in June to raise the upper bar to 1.5-2 billion won.

Companies in the scale-up phase can also tap into the Crowdy platform for the sake of marketing, Kim added.

To invite more blue-chip companies to crowdfunding platforms, deregulation of the upper bar for equity crowdfunding set at 700 million won is critical, Kim said.

“Companies would not dare to do all the documentation to simply raise 700 million won,” he said, pinning hopes on financial authorities’ signals of deregulation in June to raise the upper bar to 1.5-2 billion won.

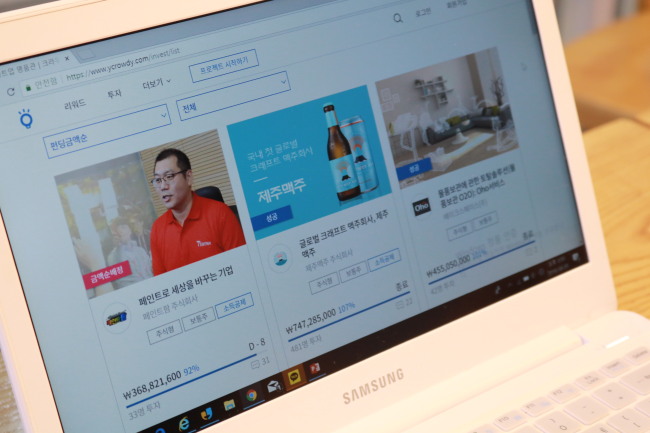

The crowdfunding platform has permitted investments from institutional investors like venture capitalists or private equities, as well as affluent individuals like angel investors, playing the role of a fundraiser marketplace.

In 2017, startups, small enterprises and business entities raised funds worth 3 billion won through equity crowdfunding on Crowdy, nearly one-fifth of the investment through Korean equity crowdfunding platforms. This also accounted for 92.5 percent of total crowdsourced funds on the Crowdy platform, where both equity crowdfunding and reward-based crowdfunding are available.

Of the total, 68 percent came from non-retail investors -- venture capitalists, asset managers, securities firms and angel investors, among others. As of August, the proportion of investments from such investors had soared to 83.9 percent.

Furthermore, the Crowdy platform could serve as a step to stock listing on markets operated by the Korea Exchange, including the KRX Startup Market or Korea New Exchange, which the market operator regards as a stepping stone to listing on the second-tier Kosdaq.

Crowdy has received a combined 2.7 billion won in investment from over 70 shareholders, and is currently seeking investment from venture capitalists, Kim said.

By Son Ji-hyoung

(consnow@heraldcorp.com)

In 2017, startups, small enterprises and business entities raised funds worth 3 billion won through equity crowdfunding on Crowdy, nearly one-fifth of the investment through Korean equity crowdfunding platforms. This also accounted for 92.5 percent of total crowdsourced funds on the Crowdy platform, where both equity crowdfunding and reward-based crowdfunding are available.

Of the total, 68 percent came from non-retail investors -- venture capitalists, asset managers, securities firms and angel investors, among others. As of August, the proportion of investments from such investors had soared to 83.9 percent.

Furthermore, the Crowdy platform could serve as a step to stock listing on markets operated by the Korea Exchange, including the KRX Startup Market or Korea New Exchange, which the market operator regards as a stepping stone to listing on the second-tier Kosdaq.

Crowdy has received a combined 2.7 billion won in investment from over 70 shareholders, and is currently seeking investment from venture capitalists, Kim said.

By Son Ji-hyoung

(consnow@heraldcorp.com)

![[Today’s K-pop] Treasure to publish magazine for debut anniversary](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/07/26/20240726050551_0.jpg&u=)