Seoul shares nearly unchanged ahead of Fed's rate decision

By YonhapPublished : June 7, 2023 - 16:12

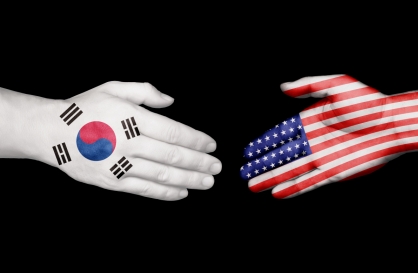

South Korean stocks closed nearly flat Wednesday as investors remained cautious ahead of big events next week. The local currency rose to a near two-month high against the US greenback.

The benchmark Korea Composite Stock Price Index rose 0.19 point, or 0.01 percent, to close at 2,615.60.

Trading volume was slim at 525.8 million shares worth 9.93 trillion won ($7.62 billion), with losers slightly outpacing gainers 439 to 422.

Institutions scooped up a net 348.97 billion won worth of local shares, while individuals dumped a net 294.5 billion won.

Analysts said investors are on their toes for US consumer prices for May and the Fed's rate decision, both slated for next week.

At the same time, a recent World Bank report forecast that the global economy will grow 2.1 percent in 2023, slowing down from 3.1 percent growth in 2022 due to lingering geopolitical situations and higher interest rates. But the bank raised its 2023 growth estimate by 0.4 percentage point from 1.7 percent.

Advanced economies, including the United States, Japan and Europe, are expected to expand only 0.7 percent this year, down from 2.6 percent in 2022.

"The Kospi started higher on the World Bank report but trimmed earlier gains on profit-taking," analyst Choi Yoon-ah from Shinhan Securities Co. said.

Large-cap shares finished mixed across the board.

Refineries and chemical makers were among the winners, as SK Innovation gained 3.41 percent to 206,500 won and LG Chem rose 3.18 percent to 746,000 won.

Leading pharmaceutical firms SK Biopharm and Samsung Bioscience climbed 0.27 percent and 0.13 percent to finish at 74,500 won and 786,000 won, respectively.

But tech shares went south as No. 1 chipmaker Samsung Electronics fell 0.98 percent to close at 71,000 won and its rival SK hynix retreated 0.64 percent to 108,000 won.

Top carmaker Hyundai Motor lost 2.29 percent to 196,400 won and its smaller affiliate Kia declined 4.87 percent to 82,000 won after news reports that the two companies have been sued by New York City for their failure to install anti-theft devices.

The local currency ended at 1,303.8 won against the US dollar, down 4.3 won from the previous session's close, marking the highest since April 14, when the won-dollar rate stood at 1,298.9 won. (Yonhap)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423171347)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)