Tax agency launches probes into offshore tax evasion

By Jie Ye-eunPublished : March 24, 2021 - 14:24

South Korea’s tax agency said Wednesday that it has launched probes into 54 offshore tax evaders who enjoyed social benefits from the country without paying taxes here.

The National Tax Service discovered 14 individuals with dual nationality who enjoyed health and welfare benefits but concealed their properties and earnings overseas to elude taxation, the agency said.

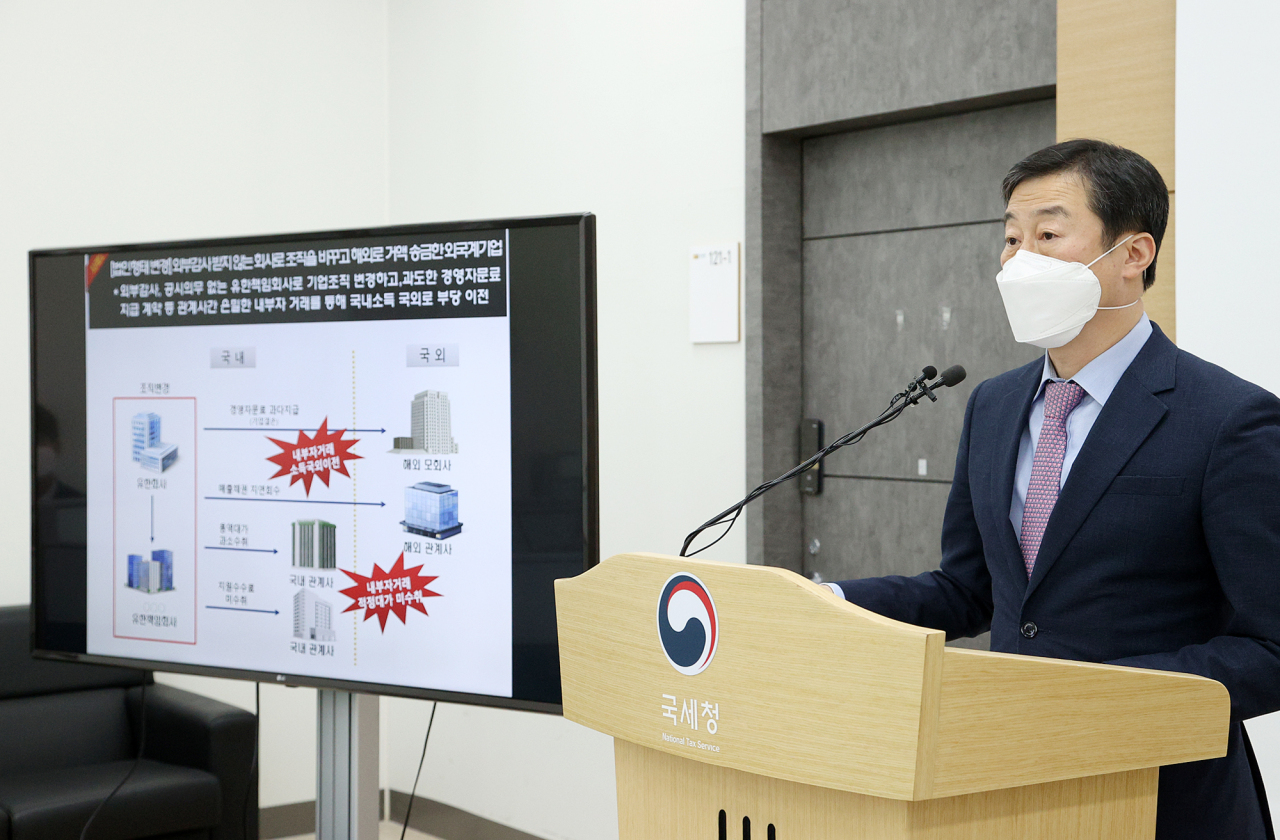

Six foreign-affiliated firms were also caught for changing the form of their businesses to limited liability companies to be exempted from external audits. They further transferred profits overseas through internal transactions, officials said.

In addition, the agency held 16 Koreans responsible for abusing their outstanding socioeconomic status and background to increase properties but pay less in taxes.

The office suggested an alleged case of a local clothing firm owner hiding assets by establishing a family trust abroad. The person appears to have transferred funds to other family members who live overseas to make considerable real estate investments there. Even after making transfer gains through real estate sales, the individual intentionally omitted related profits from the income report, the office claimed.

“Expectation for fair taxation and tax morality has been high recently. We promise to put all our efforts to realize even-handed tax administration and exercise tough measures on people who abuse privilege for tax dodging,” said Rho Jeong-seok, assistant commissioner for investigation at the National Tax Service, vowing to report their cases to prosecutors if necessary.

The latest probes marked the tax agency’s fourth investigation on offshore tax evasion since 2019. Previously they identified 318 offshore tax evaders and collected a total of some 1.16 trillion won ($1.02 billion) in taxes from them.

By Jie Ye-eun (yeeun@heraldcorp.com)

The National Tax Service discovered 14 individuals with dual nationality who enjoyed health and welfare benefits but concealed their properties and earnings overseas to elude taxation, the agency said.

Six foreign-affiliated firms were also caught for changing the form of their businesses to limited liability companies to be exempted from external audits. They further transferred profits overseas through internal transactions, officials said.

In addition, the agency held 16 Koreans responsible for abusing their outstanding socioeconomic status and background to increase properties but pay less in taxes.

The office suggested an alleged case of a local clothing firm owner hiding assets by establishing a family trust abroad. The person appears to have transferred funds to other family members who live overseas to make considerable real estate investments there. Even after making transfer gains through real estate sales, the individual intentionally omitted related profits from the income report, the office claimed.

“Expectation for fair taxation and tax morality has been high recently. We promise to put all our efforts to realize even-handed tax administration and exercise tough measures on people who abuse privilege for tax dodging,” said Rho Jeong-seok, assistant commissioner for investigation at the National Tax Service, vowing to report their cases to prosecutors if necessary.

The latest probes marked the tax agency’s fourth investigation on offshore tax evasion since 2019. Previously they identified 318 offshore tax evaders and collected a total of some 1.16 trillion won ($1.02 billion) in taxes from them.

By Jie Ye-eun (yeeun@heraldcorp.com)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)