After a year of COVID-19, who are the market winners and losers?

IT, bio, online shopping take a leap forward amid market reshaping

By Bae HyunjungPublished : Dec. 30, 2020 - 17:03

Amid the worldwide crisis known as COVID-19, South Korea’s industries have faced mixed fates this year, with some riding on the effects of the pandemic, strict social distancing rules and accompanying market turbulence and others succumbing.

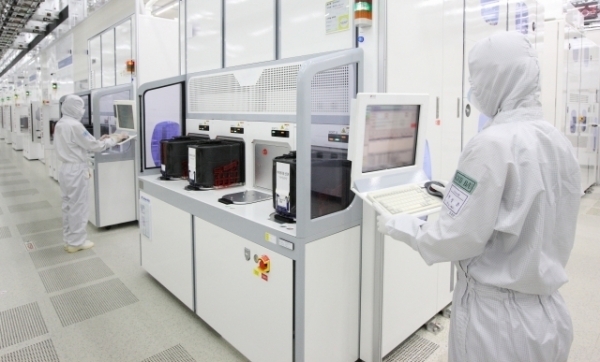

On momentum from the contactless consumer trend, the information technology sector has thrived, apparently ending years of sluggish semiconductor sales. The biotechnology industry has basked in the spotlight as companies raced to develop diagnostic kits, vaccines and treatments.

Transportation and travel-related sectors, in contrast, contracted drastically due to lockdowns and travel restrictions.

The year-end personnel appointments of key businesses reflected this wide gap between industries.

According to corporate tracker CEO Score, a total of 1,575 people from 18 key conglomerates were promoted to the C-suite this year, up 1.9 percent from a year earlier despite the COVID-19 fallout.

But the promotions were heavily concentrated in IT-based groups such as Samsung and LG, while retailers such as Lotte Group, Shinsegae Group and Hyundai Department Store Group slashed their executive promotion figures by double digits. SK Group and Hanwha Group, both involved in petroleum sales, also saw their executive pools dwindle.

“It has become more difficult than ever for companies to keep up with the fast-changing industrial ecosystem,” said the Hana Institute of Finance in its industry outlook report for 2021.

“The sectors that received a heavy blow from COVID-19, such as oil refining, shipping and retail, are likely to face fundamental restructuring sooner or later.”

Automakers, for instance, will be forced to speed up their ongoing transition to electric vehicles, the report said.

IT: The new contactless norm

The COVID-19 era has added peculiar twists to patterns of human interaction. Living through a global pandemic, people gradually became more accustomed to new methods of “gathering” via online video chats from the safety of their respective abodes.

By year-end, toasts were raised over screens as holiday festivities took place in separate homes.

Many elements clicked to enable this new norm, but at the core of it all were semiconductors, which are embedded in almost all electronics products on the market.

Just as DNA contains the genetic manuscript of a person, a semiconductor holds the operations manual of a machine. This is true of refrigerators, washing machines, air purifiers, vacuum cleaners, ovens, air conditioners, heaters, computers, laptops, mobile phones, TVs, game consoles and so on.

Buoyed by the stay-at-home trend and people’s increased desire to enjoy a comfortable indoor life, the semiconductor powerhouse Samsung Electronics reported its best-ever business performance in 2020.

The company marked a record quarterly revenue in third quarter at 66.9 trillion won ($64.24 billion) and an operating profit of 12.3 trillion won -- up 8 percent and 58.5 percent year-on-year.

Similarly, home appliance juggernaut LG Electronics filed a record cumulative third quarter operating profit of 2.5 trillion won.

The local finance industry predicts that LG Electronics will close the year with a record yearly revenue of 62.7 trillion won and an operating profit of 3.3 trillion won.

As for Naver and Kakao -- the two pillars holding up the Korean information technology business -- both firms are expected to come out strong through the pandemic on the back of increased online commerce and the subsequent need for online advertising and fintech.

Naver brought in record quarterly consolidated revenue of 2.59 trillion won in the third quarter, up 24.2 percent from the same quarter the year before.

It was its e-commerce unit, Naver Commerce, that stood out the most, expanding 40.9 percent on-year in sales as of end-September on the back of the newly launched interactive shopping channel Live.

Naver Webtoon also notched 31.8 percent growth on-year, as more people sought entertainment accessible from home.

Kakao also recorded its best-ever quarterly performance in the third quarter of over 1 trillion won, up 41 percent on-year, and saw its Kakao Pay and Kakao Mobility units mark 139 percent growth on-year.

Bio: Market booms on public health crisis

One sector whose fortunes were more directly tied to the ongoing pandemic was the biotech industry.

The worldwide calls for diagnostic tools, treatments and vaccines drew heated attention to biologics firms and caused great fluctuations in their stock market value.

Seegene, a local firm specializing in molecular diagnostics, announced that its aggregate revenue until mid-December topped 1 trillion won on the back of strong demand for COVID-19 test kits and diagnostic machines. That is nearly 10 times more than the 122 billion won it reported for all of 2019.

Biosimilar company Celltrion and its affiliates also gained momentum.

During the pandemic, demand for Celltrion’s self-injectable autoimmune disease treatment Remsima SC was prescribed more in Europe, for patients who could no longer make regular visits to the hospital due to the spread of COVID-19.

Celltrion Healthcare, which oversees sales of Celltrion biosimilars, posted 127.7 billion won operating profit for the third quarter -- an astounding 500 percent on-year spurt. In cumulative figures the company brought in more than 1.2 trillion won by the third quarter, surpassing its revenue for all of 2019.

Celltrion on Tuesday filed for a conditional use permit from the Korean drug authorities for a COVID-19 antibody treatment, becoming the first Korean company to do so.

Samsung Biologics posted 56.5 billion won in operating profit in the third quarter, up 139 percent from a year earlier. The Samsung affiliate had hit a rocky patch last year, weighed upon by the watchdog Financial Supervisory Service’s extensive investigation into alleged accounting fraud.

Autos: Looking ahead to higher hurdles in 2021

As for the automotive industry, Korean automakers put up a good defense this year, making up for a decline in international trade with increased sales in the domestic market.

According to the Korea Automobile Manufacturers Association, Korea moved up two notches in the global ranks for car production -- beating India and Mexico and finishing at No. 5 after China, the US, Japan and Germany.

While global demand dwindled amid the pandemic, the five Korean carmakers -- Hyundai Motor, Kia Motors, SsangYong Motor, Renault Samsung Motors and GM Korea -- witnessed combined sales of over 1.47 million vehicles in the domestic market from January to November, KAMA’s data showed.

While overseas sales contracted, domestic sales expanded 6.2 percent on-year, accounting for 49 percent of total sales, up from 39 percent last year, according to KAMA.

Local sales have benefited from a tax break the government granted to vitalize the automotive industry, with the special consumption tax cut by up to 70 percent in the first half of this year. The tax cut stood at 30 percent in the second half of the year.

Also, automakers are speeding up their electric vehicle development timelines in step with increased demand for eco-friendly transportation.

But the main factor that continues to place a strain on the country’s automotive industry is the unceasing tension between labor and management.

SsangYong Motor, which has India’s Mahindra & Mahindra as its largest shareholder, filed for court receivership this month after failing to pay back debts of about 165 billion won to its creditor banks.

GM Korea and Kia Motors have also reeled under yearslong strikes as they failed to resolve differences with their respective labor unions on wage deals.

With the global economy projected to recover next year and the operation of production plants normalized, experts say Korean automakers should gear up for heightened competition.

“This year, the government and the industry took action against the COVID-19 crisis fast enough to minimize the damage,” said Jeong Marn-ki, the head of KAMA.

“But for next year, the automotive industry’s current structure of high cost, low efficiency, strict state regulations, and the conflict between the company management and the labor can aggravate a company’s productivity,” he said.

Steel: Indicators of waning manufacturing

The steel industry experienced a tougher year in 2020 as the pandemic took its toll.

The country’s largest steelmaker, Posco, recorded its very first operating loss in the second quarter this year as demand dwindled while the price of iron ore peaked.

While the company returned to profitability in the following quarter, its revenue decreased 15 percent and operating profit was down 60.5 percent when compared with the third quarter of 2019.

According to the Korea Iron and Steel Association, the total crude steel production of Korean companies was 49.6 million tons from the first to the third quarter this year. This places the 2020 output below the 70-million-ton mark for the first time in four years.

Domestic sales declined by about 8 percent, according to the association’s data, from last year’s 53.2 million tons to about 48 million tons this year.

Steel exports are expected to dip below 30 million tons for the first time in seven years.

After this year’s slump, the Korean steel sector is expected to improve to a certain extent, on the back of stronger demand for steel and higher prices in the global market.

“The problem is that such market recovery will be led by emerging economies, which will act in favor of Chinese and Japanese steelmakers that have been expanding overseas manufacturing facilities in India and Southeast Asia,” said an industry official.

Korean steelmakers, on the other hand, have kept their plants here all the while, with only a limited range of refineries and outlets overseas, the official pointed out.

Aviation: Striving for survival

The sector that took the hardest blow from the pandemic was the aviation industry, with air traffic dramatically reduced amid strict border controls.

Though many major airlines lost profit and announced mass layoffs, both Korean Air and Asiana Airlines posted earnings surprises during the third quarter thanks to their strong cargo business -- 7.6 billion won and 5.8 billion won, respectively. Korean Air’s move to acquire longtime rival Asiana, which is troubled with debt, was also hailed as good news for employment in the industry.

Both Korean air carriers are also gearing up to take the lead in vaccine transportation next year, with special low-temperature containers and exclusive delivery chains.

Recently, Asiana delivered the Sputnik V vaccine to Russia via Flight 795, a cargo flight that departed from Incheon on Wednesday. The product was developed in Russia and manufactured by a Korean biopharma contractor.

In contrast to the market champions, however, low-cost carriers such as Jin Air, Jeju Air and Air Busan suffered major operating losses of 49.2 billion won, 70.1 billion won and 42.4 billion won, respectively.

Their dilemma is the lack of an alternative business portfolio, growing competition on short domestic routes and insufficient budgets.

As for Eastar Jet, which shut down its operations in July after its thwarted merger with Jeju Air, it is reportedly in the final stages of talks with a local company.

Even the “no landing” international flights, which gained the spotlight as a new and unique travel experience, are thinning out. Asiana recently announced that it will cancel all such flights this month due to the resurgence of COVID-19 here.

Oil refiners were inevitably affected by the sluggish state of aviation, as well as by a sharp drop in oil prices.

The four major Korean oil refineries -- SK Innovation, S-Oil, GS Caltex and Hyundai Oilbank -- posted a combined loss of 4.8 trillion won during the January-September period, with the figure projected to surpass 5 trillion won at the end of this year.

Retail: Online shopping, food delivery, comfy clothes

The COVID-19 quarantine rules drastically widened the gap between in-person and online shopping this year.

While online retail sales enjoyed a 17 percent year-on-year jump in November, in-store sales dropped by 2.4 percent, according to data from the Ministry of Trade, Industry and Energy. Overall retail sales were up 6.3 percent during the same month, due in part to an increase in food and home appliance sales.

As restaurants and cafes took a hit from strict social distancing measures, food delivery apps emerged as the biggest winners this year in retail as more people than ever ordered food from home to beat the pandemic blues.

Even food businesses that previously had not provided takeaway registered on one or several of the delivery apps -- Baemin, Yogiyo, Baedaltong and the newer Coupang Eats.

In August, the combined transactions made on the country’s four major food delivery apps amounted to 1.2 trillion won, a monthly record.

Reflecting soaring demand, No. 1 player Baemin went down for hours on Christmas Eve as a result of the “overwhelming volume of orders.” The outage on the major platform created havoc among restaurant operators and delivery workers on the busy holiday night.

The indoor life trend reflected in the food delivery business also affected the fashion industry.

As more people worked from home and spent time indoors, commuting clothes and streetwear gave way to super-casual “one-mile wear.”

According to the Korea Federation of Textile Industries, the 72 listed companies that deal with fashion textiles saw their accumulated operating profit slip 38.4 percent on-year in the third quarter this year. Of them, 27 moved into deficit.

Meanwhile, Shinsegae-affiliated lifestyle brand Jaju is enjoying a nearly 300 percent jump in pajama sales during the fourth quarter compared with earlier this year.

Also, the group’s fashion affiliate Shinsegae International successfully launched “10 Month,” a new seasonless apparel brand that focuses on basic items.

“The brand name suggests that these quality basic items may be worn throughout the year, during the 10 months excluding the peak winter and summer time,” said an official.

“It first started as an in-house task force but recently (spun) off as an independent team as it grew popular among consumers.”

Service: Most suffer, some benefit from distancing

While the overall service sector reeled under a lack of visitors and sporadic mandatory shutdowns, some specific areas have thrived, according to the Hana Institute of Finance report.

Psychiatrists and other mental health professionals saw an increased number of patients this year, reflecting the number of people suffering from stress or depression due to the pandemic and its consequences.

Plastic surgeons and dermatologists also saw more business as more people chose to undergo cosmetic procedures while working from home.

But ear, nose and throat clinics and pediatric clinics, which are usually crowded in winter, saw fewer patients as people feared infection. Also, seasonal diseases such as colds decreased this year as children stayed at home and people were diligent about hand-washing and sanitizing, the report said.

While most private educational institutions suffered decreased sales, driving schools grew exceptionally popular due to the strong preference for personal cars instead of public transport.

Besides these few exceptions, however, most service providers continued to struggle against the prolonged market fallout.

According to the Korea Economic Research Institute, the business sentiment index for January tallied from 600 companies in December stood at 91.7, down 7.2 points from a month earlier.

The on-month decline was the most conspicuous in the nonmanufacturing sector, which marked a double-digit slip.

“While the manufacturing industries see some hope in the vaccine development and distribution, the service industries are growing more pessimistic over the economic recovery outlook due to the third epidemic wave,” said an official with KERI.

“The wide gap between industries is likely to persist or even intensify as the COVID-19 crisis and its aftermath continue into next year.”

By Bae Hyun-jung, Jo He-rim, Lim Jeong-yeo and Yim Hyun-su

(tellme@heraldcorp.com) (kaylalim@heraldcorp.com)(herim@heraldcorp.com) (hyunsu@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)