Brokerages' oil price errors could worsen investor losses

By Jie Ye-eunPublished : April 21, 2020 - 16:00

South Korean investors could face losses regarding their hedge on oil futures as local brokerages did not reflect plunging oil prices in their forecasts, according to market watchers Tuesday.

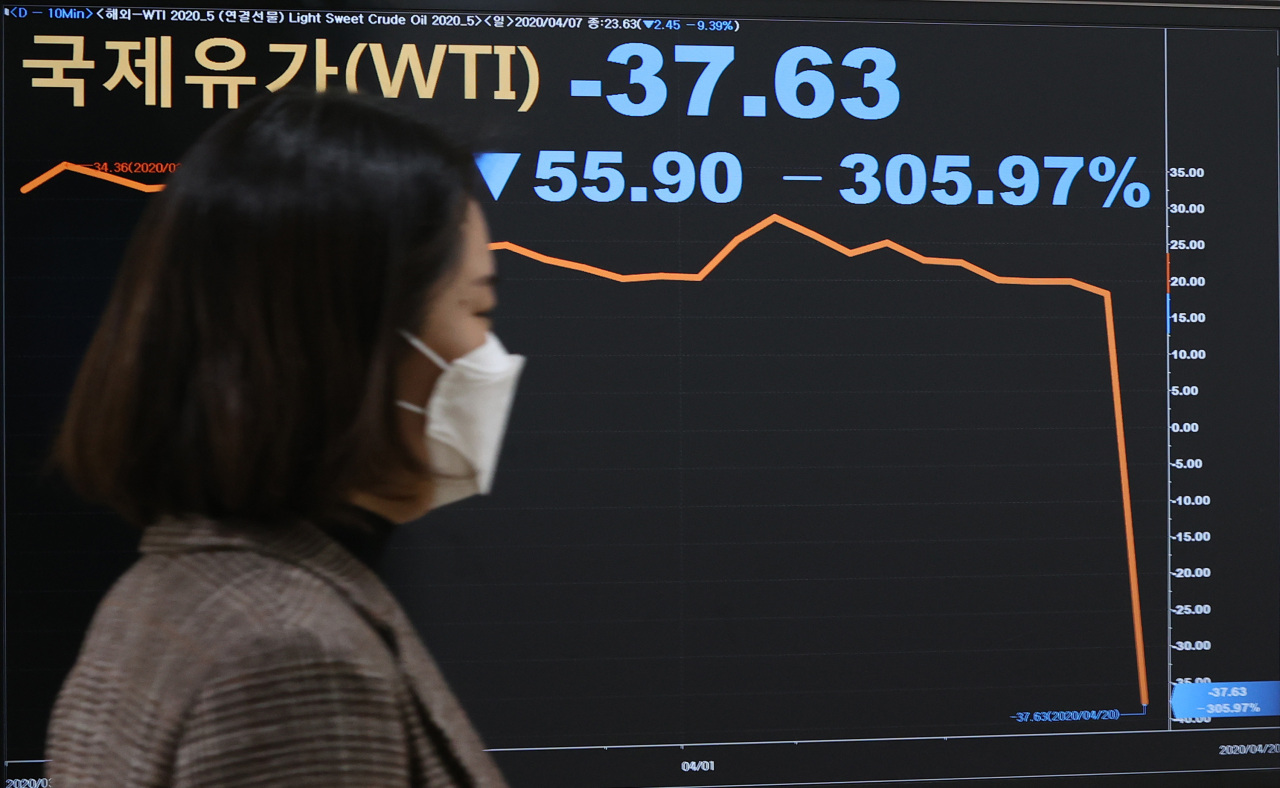

A futures contract for US West Texas Intermediate crude for May delivery closed at negative $37.63 per barrel at the end of Monday trading in the US -- plunging $55.90 from the previous session’s close. The sudden collapse has put some securities firms into chaos.

Kiwoom Securities suffered a technical glitch during the trading hours, as it was unable to place orders on time for sales of E-mini Crude Oil futures.

“Seeing the price reaching a minus figure around 3:10 a.m., I was trying to put a selling order via HTS, but was rejected. The trading system couldn’t recognize my request and I had to just sit and watch my asset undergoing a dramatic fall,” a source said, requesting anonymity.

Another source claimed that he could not place a covering when the oil futures fell into negative territory, which resulted him a bigger trading loss than expected.

The problem was due to a malfunction in its trading system, the brokerage said, adding that it would review the errors and compensate investors for losses.

“Most of local securities firms probably didn’t develop their trading systems to recognize negative bids for oil futures in advance. Who could have expected oil prices to plunge this far. Not just investors, but we (brokerages) are shocked too,” an industry insider said.

Korea Investment & Securities’ HTS also unrecognized negative bids overnight. Due to the malfunction, some investors were unable to place trading orders.

“The system malfunctioned for one to two hours. After we realized the problem, we corrected it as soon as possible. We believe that investors were not impacted,” a KIS official said.

Other brokerages’ HTS such as Hana Financial Investment, Kyobo Securities and Daishin Securities also did not recognize investors’ minus bids, however, they enforced liquidation before midnight of the futures’ expiration, which could have helped investors prevent losses.

By Jie Ye-eun (yeeun@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)