Foreign exchange reserves...rebound on less intervention

By Korea HeraldPublished : Nov. 2, 2011 - 16:02

The central bank’s stockpile of foreign exchange reserves rebounded in October, indicating it poured in less money to tame currency volatilities amid deepening sovereign debt crisis in Europe.

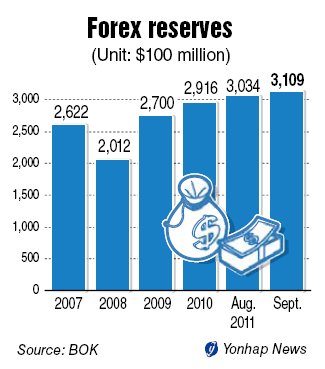

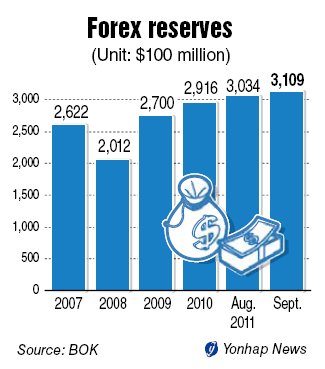

Data released by the Bank of Korea Wednesday said its foreign exchange reserves posted the largest monthly gain in six months to $310.98 billion in October on higher returns from investments. The bank said the increase of $7.6 billion from September is also attributed to the weakening of the U.S. dollar, which raised the conversion value of BOK’s non-dollar assets.

“A softer U.S. dollar boosted the conversion value of the euro and the pound last month. Investment profit also rose as the reserves are on the rising trend,” said Shin Jae-hyuk, an economist at the BOK.

The rebound is a reverse of the fall in September when the reserves shrank by $8.81 billion, the most since mid-2008. Dealers attributed the sharp decline of September to the central bank’s intervention into the currency market as the won rattled down 9.5 percent against the greenback on Europe’s debt shocks. Multiple currency traders suspects BOK to have spent around $9 billion to $13 billion to slow the won’s depreciation, eating into the foreign exchange reserves.

“The figure for October is up not only because there were higher returns from investments in non-dollar currencies such as the euro and the yen, but also because authorities spent less money as currency market recovered slowly,” a trader said.

Foreign exchange reserves, currently eighth largest in the world, hit a record high of $312.19 billion in August after exceeding the $300 billion mark for the first time in April. BOK says its investments are paying off, especially in euro, which appreciated 3.4 percent against the dollar across October.

About 90 percent, or $280.12 billion of the total reserves is securities. Deposits take up about $23.69 billion and $3.58 billion is the country’s special-drawing rights at the International Monetary Fund.

Bank of Korea in October expanded currency swap agreement with China and Japan, boosting its total foreign exchange reserves to around $450 billion. It means that Korea now has more than enough external reserves to repay all of its $398 billion of outstanding debt.

By Cynthia J. Kim (cynthiak@heraldcorp.com)

Data released by the Bank of Korea Wednesday said its foreign exchange reserves posted the largest monthly gain in six months to $310.98 billion in October on higher returns from investments. The bank said the increase of $7.6 billion from September is also attributed to the weakening of the U.S. dollar, which raised the conversion value of BOK’s non-dollar assets.

“A softer U.S. dollar boosted the conversion value of the euro and the pound last month. Investment profit also rose as the reserves are on the rising trend,” said Shin Jae-hyuk, an economist at the BOK.

The rebound is a reverse of the fall in September when the reserves shrank by $8.81 billion, the most since mid-2008. Dealers attributed the sharp decline of September to the central bank’s intervention into the currency market as the won rattled down 9.5 percent against the greenback on Europe’s debt shocks. Multiple currency traders suspects BOK to have spent around $9 billion to $13 billion to slow the won’s depreciation, eating into the foreign exchange reserves.

“The figure for October is up not only because there were higher returns from investments in non-dollar currencies such as the euro and the yen, but also because authorities spent less money as currency market recovered slowly,” a trader said.

Foreign exchange reserves, currently eighth largest in the world, hit a record high of $312.19 billion in August after exceeding the $300 billion mark for the first time in April. BOK says its investments are paying off, especially in euro, which appreciated 3.4 percent against the dollar across October.

About 90 percent, or $280.12 billion of the total reserves is securities. Deposits take up about $23.69 billion and $3.58 billion is the country’s special-drawing rights at the International Monetary Fund.

Bank of Korea in October expanded currency swap agreement with China and Japan, boosting its total foreign exchange reserves to around $450 billion. It means that Korea now has more than enough external reserves to repay all of its $398 billion of outstanding debt.

By Cynthia J. Kim (cynthiak@heraldcorp.com)

-

Articles by Korea Herald

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)