Articles by Im Eun-byel

Im Eun-byel

silverstar@heraldcorp.com-

Commercial real estate market slump to persist until 2024: Mastern

The global commercial real estate market, hit by high interest rates and a decline in office space demand, is likely to be in a prolonged slowdown until next year, a real investment firm based in Seoul said through a report issued on Monday. While Korean investment firms are suffering from losses in their investments in office properties overseas, Mastern Investment Management said the slump in the market will continue as major economies, including the US Federal Reserve, are yet to drop their a

Industry Aug. 14, 2023

-

Frozen Iranian funds released

Iranian funds worth an estimated $6 billion, frozen in bank accounts in Korea, have been released, following the US and Iran's tentative agreement to engage in a prisoner swap in exchange for Tehran's access to the blocked funds. All of Iran’s frozen funds in Korea have been unblocked, Central Bank of Iran Gov. Mohammad Reza Farzin said through a post written in Persian on social platform X on Saturday. The central bank chief wrote that $7 billion in Iranian assets in Korea have

Economy Aug. 13, 2023

-

Korea to unveil medical care plans for pets in Oct.

The South Korean government plans to propose new policies to improve its medical care system for pets amid a growing pet population in the country. The number of households with dogs or cats in Korea came to 6.02 million last year, rising sharply by 65.4 percent from 3.64 million in 2012, according to the Ministry of Agriculture, Food and Rural Affairs' report at an intergovernmental meeting held Wednesday. According to the ministry, local households spend an average of 60,000 won ($45) p

Industry Aug. 9, 2023

-

Trade, overseas dividends bring current account surplus expansion

#Current account surplus for first 6 months shrink 90% compared to a year ago South Korea logged a current account surplus for two consecutive months in June due to a trade surplus and increased dividends from overseas, central bank data showed Tuesday. The country's current account gained $5.87 billion in June, following the $1.93 billion surplus from a month earlier, according to preliminary data from the Bank of Korea. Prime Minister Han Duck-soo assessed that Korea was showing a sound p

Economy Aug. 8, 2023

-

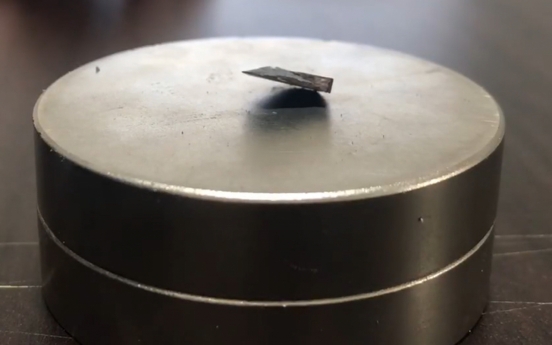

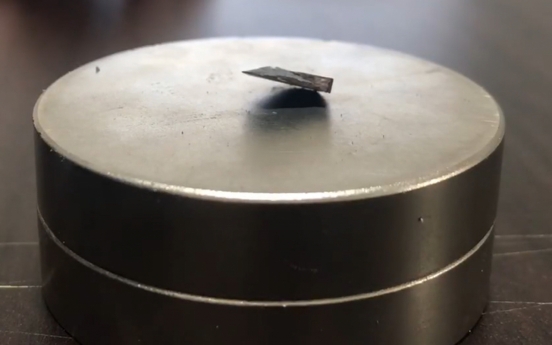

Superconductor-themed stocks rally on hope for breakthrough finding

Stock prices of superconductor-themed shares rebounded Monday, backed by a retail investor frenzy with high hopes on the potential game-changing room temperature superconductor technology. Shares of superconductor industry related firms continued to enjoy a rally from last week after a research team including the Quantum Energy Research Centre said it discovered a room-temperature superconductor called LK-99 on July 22. Related stocks experienced a slight dip on Friday, when skeptical responses

Market Aug. 7, 2023

-

[KH Explains] Inheritance tax reform postponed amid criticism over 'silver spoon'

Major changes in the inheritance tax, one of President Yoon Suk Yeol's key campaign promises, have been postponed until next year's general election, as the reform could intensify criticism over tax cuts for the wealthy. On July 27, the government unveiled the tax code revision plan to be submitted to the National Assembly. Providing a tax reduction on the inheritance of family business for large conglomerates was not included in the proposal, as the government has been cautious on

Market Aug. 3, 2023

![[KH Explains] Inheritance tax reform postponed amid criticism over 'silver spoon'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/08/03/20230803000577_0.jpg&u=)

-

Consumer inflation falls to 25-month low

BOK predicts inflation to rebound from August, coming in at 3 percent by year-end Korea's consumer prices showed slowed growth, rising by 2.3 percent in July on-year, mainly due to the decline in international oil prices and base effect from last year, data showed Wednesday. According to Statistics Korea, consumer price growth, a key gauge of inflation, stood last month at 2.3 percent more than a year earlier. It is the lowest increase in 25 months since June 2021. Inflation has been showin

Economy Aug. 2, 2023

-

Deep contraction in imports leads to trade surplus in July

Korea narrowly avoided a trade deficit in July as falling prices of energy and raw materials pulled imports down faster than exports. Outbound shipments fell 16.5 percent on-year to $50.33 billion last month, while inbound shipments fell 25.4 percent to $48.7 billion, according to the data compiled by the Ministry of Trade, Industry and Energy and Korea Customs Service released Tuesday. Accordingly, Korea logged a trade surplus of $1.63 billion in July, marking a $500 million increase from a mon

Economy Aug. 1, 2023

-

[KH Explains] Commercial real estate crash punishes investors

Korean investment firms are at the risk of painful losses in their commercial real estate investments with high interest rates and a shift to teleworking. With major economies tightening monetary policies, and the post-pandemic trend of working from home pushing up office vacancy rates, commercial office buildings -- once perceived as a reliable investment -- have become a liability. Igis Asset Management’s 370 billion won ($290 million) investment in the Trianon office building in Frankfu

Market July 31, 2023

![[KH Explains] Commercial real estate crash punishes investors](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/07/31/20230731000588_0.jpg&u=20230731175358)

-

Battery stocks’ volatility leaves investors reeling

The fluctuating stock prices of firms in the secondary battery sector sent the local stock market on a rollercoaster ride over the last week. Battery materials stocks achieved gains on Friday afternoon after suffering losses in the morning, raising alarms for retail investors who belatedly joined in on a buying spree for EcoPro and Posco shares. Shares of EcoPro closed at 1.10 million won ($863.85) on Friday. It spiked to a record high of 1.53 million won during trading hours on Wednesday, bu

Market July 30, 2023

-

Mastern America, BuildBlock join hands to expand presence in US commercial development market

Mastern America, the US arm of Mastern Investment Management, said Wednesday it has joined hands with real estate platform operator BuildBlock to expand its presence in the US commercial development market. The two firms recently signed a memorandum of understanding to bolster their ties and cooperate on diverse investment projects. BuildBlock is a real estate platform operating in major cities and regions in the US, including Silicon Valley, Los Angeles, Hawaii, New York and Texas. The plat

Market July 26, 2023

-

End of IPO drought?

Expectation for end of interest hikes and IPO market reform to boost slowed listing activities The initial public offering pipeline for the second half of the year appears to be strong, with high-profile companies, including a fabless chip startup and a battery material maker, pushing for their listings on the Korean stock market to raise equity capital amid relaxed IPO rules. The IPO market here remained sluggish in the first half of the year due to deteriorating investor sentiment on the

Market July 26, 2023

-

Korea’s economy grows 0.6% in Q2

South Korea’s economy has managed to avoid negative growth by expanding 0.6 percent in the April-June period from the previous quarter, the Bank of Korea said Tuesday, chiefly due to imports that fell even more sharply than the country‘s weak exports. According to preliminary data from the BOK, the country’s gross domestic product, a key measure of economic growth which refers to the value of all goods and services created, showed a 0.6 percent on-quarter increase. The growth

Economy July 25, 2023

-

[KH explains] Investors bullish on Posco stocks

Shares of firms under Korean steel giant Posco Group are skyrocketing, hitting new highs as the group is expected to excel amid high prospects for the battery industry, Posco Holdings, the holding firm and leading stock of Posco Group, closed at 551,000 won ($428) Friday, more than double its closing price of 272,000 won on Jan. 2. Posco Future M, the group's battery material maker, is also under the spotlight. Its shares closed at 495,000 won on the day, marking a significant increase from

Economy July 23, 2023

![[KH explains] Investors bullish on Posco stocks](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/07/23/20230723000197_0.jpg&u=)

-

EcoPro highly likely to make MSCI index in August: analysts

South Korean battery materials company EcoPro, the red-hot stock in the nation’s secondary tech-laden Kosdaq, is highly likely to be included in the MSCI Korea Index in August, Samsung Securities wrote in a recent report published Friday. EcoPro is a holdings firm with units EcoPro BM and EcoPro HN under its wings. Running high on the recent electric vehicle boom, the cathode materials maker saw its shares soar to a record high of 1.14 million ($890.28) Wednesday, almost a 10-fold jump fro

Market July 21, 2023

Most Popular

-

1

[Exclusive] Korean military set to ban iPhones over 'security' concerns

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

-

2

Korean, Romanian leaders discuss defense tech, nuclear energy

-

3

S. Korea calls on Japan to confront history amid Yasukuni Shrine visit

-

4

Yoon’s jailed mother-in-law excluded from latest parole list

-

5

Hybe and Min Hee-jin, CEO of Hybe sublabel Ador, lock horns

-

6

[Pressure points] Leggings in public: Fashion statement or social faux pas?

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)

-

7

Korea’s homegrown nanosatellite successfully launches into space

-

8

[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

-

9

Nicaragua shuts down Seoul embassy

-

10

Rocket engine expert, ex-NASA exec to lead Korea's new space agency

![[KH Explains] Inheritance tax reform postponed amid criticism over 'silver spoon'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/08/03/20230803000577_0.jpg&u=)

![[KH Explains] Commercial real estate crash punishes investors](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/07/31/20230731000588_0.jpg&u=20230731175358)

![[KH explains] Investors bullish on Posco stocks](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2023/07/23/20230723000197_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)