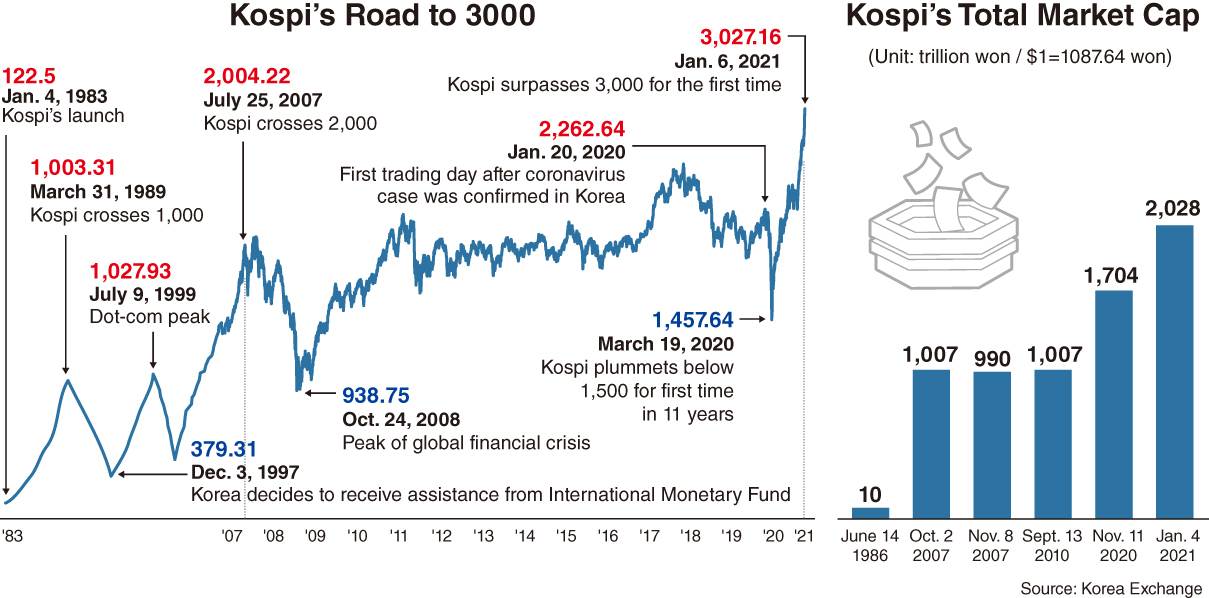

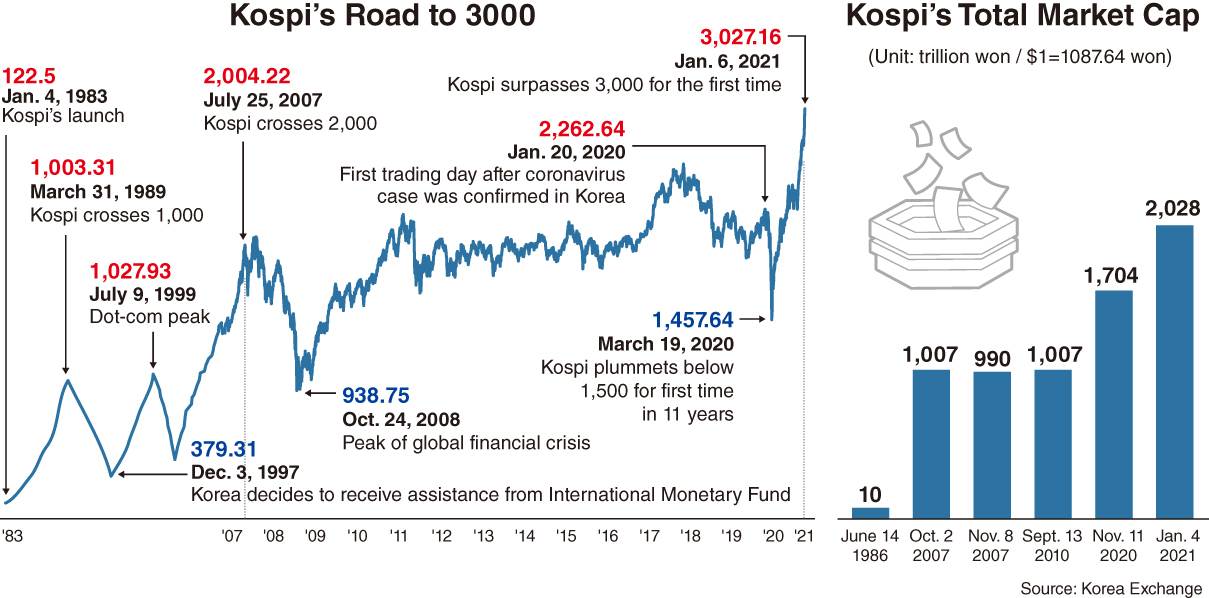

Buoyed by the increasing participation of small investors and their growing clout in South Korea’s stock market, the nation’s main bourse reached a historic high on Wednesday, surpassing 3,000 points for the first time in the stock market’s 38-year history.

The benchmark Kospi was launched by the nation’s sole bourse operator Korea Exchange on Jan. 4, 1983, three years after the base value of 100 was decided. It kicked off trading at 122.5 points with 328 listed firms on the market, while investors’ trading volume marked about 59 trillion won ($54.5 billion).

Crossing 200 points in April 1986, Kospi’s combined market capitalization exceeded 10 trillion won for the first time. The index headed upward to 500 points the following year and surpassed 1,000 points in March 1989, as Korea started taking its position as a manufacturing hub of Asia. It took about nine years for the index to reach 1,000 points from its base value.

At that time, Samsung Electronics’ market valuation stood at No. 7, followed by LG Electronics, Hyundai Engineering & Construction and SK. Steelmaker Posco was the most valuable firm in terms of the market size. The top-tier banks then, such as Hanil Bank, Cheil Bank and Seoul Trust Bank, were also among the large caps.

To boost local stocks, the government partially opened the market to foreigners from Jan. 3, 1992, restricting their acquisition of domestic shares to 20 percent. Buoyed by foreign investors’ purchases worth nearly 6.9 billion won, 512 out of 766 listed stocks spiked to the 6.7 percent daily permissible limit on the day. Instead of large-cap stocks in sectors such as electronics, banking and construction, they tended to purchase blue chip stocks with low price-earnings ratios at the time.

Backed by the inflow of foreign investments, local stocks continued rallying for some years, but the Kospi crashed down to 379.31 in December 1997 when the country was hit by the Asian financial crisis. Foreigners continued dumping a massive amount of their shares, as the index nose-dived to a low of 280 points in June the following year.

At the height of the dot-com boom in 1999, the main bourse again skyrocketed to the 1,000-point level, but retreated to the 500-point level when the bubble popped a year later. It took 18 years and three months for the index to move up from 1,000-point level to the 2,000-point mark in July 2007.

The Kospi constituents’ combined market valuation also reached 1,007 trillion won in October 2007. The result came as the country’s increased exports were driven by rising demand in China and the economic expansion of the nation. Along the way, Samsung Electronics became the main bourse’s market bellwether, pushing Posco to the No. 2 spot.

After recovering to the 2,000-point mark in 2010, the index was on a roller-coaster ride, moving between 1,800 and 2,200 points until it crossed the 2,500 mark in October 2017, in the wake of a global semiconductor market boom.

Surpassing the psychological threshold of 3,000 points was a bumpy road for the Kospi, as it took 13 years and five months after it first touched 2,000 in 2007. The benchmark was long not able to escape the “Boxpi” trend, referring to when the stock market fluctuates within a narrow band.

The index had to face another major critical event last year as the whole world suffered from the unprecedented COVID-19 pandemic. On Jan. 20, the day after confirming the first domestic case of COVID-19 infection, the Kospi closed at 2,262.64 points.

But as the number of confirmed cases rapidly increased locally and globally, the index hit its 2020 rock bottom of 1,457.64 in March. The bourse operator also activated two circuit breakers in the same month. Both foreign and institutional investors offloaded massive amounts of shares to secure cash and turn eyes to low-risk assets.

Unlike the past trend, small domestic investors dubbed “ant warriors” became the most active stock traders, scooping up undervalued shares. They eyed stock jackpots and purchased a net 47.5 trillion won solely from the Kospi market last year. After a roller-coaster ride, the market ended its final trading session of the year at 2,873.47 points. With the faster-than-expected recovery, Kospi logged the best performance among Group of 20 peers in the same year.

Previously, both market watchers and investors were optimistic about the index continuing its bullish trend to 3,000 points this year. On the back of retail investors’ buying spree, it was realized in just three trading sessions after the market opened this year on Monday. Kospi reached as high as 3,027.16 in early Wednesday trade. The total market cap rose to some 2,059.74 trillion won.

Amid the ongoing COVID-19 pandemic, investors’ interest has also shifted lately. Blue chip Samsung Electronics remained Kospi’s largest cap stock, while its market valuation accounted for nearly 25 percent of the combined Kospi-listed constituents of 1,965.71 trillion won.

Biopharma firms such as Celltrion and Samsung Biologics became the market’s leading stocks and internet platforms Naver and Kakao drew huge attention. Battery makers LG Chem and Samsung SDI also stood as new solid stocks backed by high expectations of the electric vehicle market’s growth.

By Jie Ye-eun (yeeun@heraldcorp.com)

The benchmark Kospi was launched by the nation’s sole bourse operator Korea Exchange on Jan. 4, 1983, three years after the base value of 100 was decided. It kicked off trading at 122.5 points with 328 listed firms on the market, while investors’ trading volume marked about 59 trillion won ($54.5 billion).

Crossing 200 points in April 1986, Kospi’s combined market capitalization exceeded 10 trillion won for the first time. The index headed upward to 500 points the following year and surpassed 1,000 points in March 1989, as Korea started taking its position as a manufacturing hub of Asia. It took about nine years for the index to reach 1,000 points from its base value.

At that time, Samsung Electronics’ market valuation stood at No. 7, followed by LG Electronics, Hyundai Engineering & Construction and SK. Steelmaker Posco was the most valuable firm in terms of the market size. The top-tier banks then, such as Hanil Bank, Cheil Bank and Seoul Trust Bank, were also among the large caps.

To boost local stocks, the government partially opened the market to foreigners from Jan. 3, 1992, restricting their acquisition of domestic shares to 20 percent. Buoyed by foreign investors’ purchases worth nearly 6.9 billion won, 512 out of 766 listed stocks spiked to the 6.7 percent daily permissible limit on the day. Instead of large-cap stocks in sectors such as electronics, banking and construction, they tended to purchase blue chip stocks with low price-earnings ratios at the time.

Backed by the inflow of foreign investments, local stocks continued rallying for some years, but the Kospi crashed down to 379.31 in December 1997 when the country was hit by the Asian financial crisis. Foreigners continued dumping a massive amount of their shares, as the index nose-dived to a low of 280 points in June the following year.

At the height of the dot-com boom in 1999, the main bourse again skyrocketed to the 1,000-point level, but retreated to the 500-point level when the bubble popped a year later. It took 18 years and three months for the index to move up from 1,000-point level to the 2,000-point mark in July 2007.

The Kospi constituents’ combined market valuation also reached 1,007 trillion won in October 2007. The result came as the country’s increased exports were driven by rising demand in China and the economic expansion of the nation. Along the way, Samsung Electronics became the main bourse’s market bellwether, pushing Posco to the No. 2 spot.

After recovering to the 2,000-point mark in 2010, the index was on a roller-coaster ride, moving between 1,800 and 2,200 points until it crossed the 2,500 mark in October 2017, in the wake of a global semiconductor market boom.

Surpassing the psychological threshold of 3,000 points was a bumpy road for the Kospi, as it took 13 years and five months after it first touched 2,000 in 2007. The benchmark was long not able to escape the “Boxpi” trend, referring to when the stock market fluctuates within a narrow band.

The index had to face another major critical event last year as the whole world suffered from the unprecedented COVID-19 pandemic. On Jan. 20, the day after confirming the first domestic case of COVID-19 infection, the Kospi closed at 2,262.64 points.

But as the number of confirmed cases rapidly increased locally and globally, the index hit its 2020 rock bottom of 1,457.64 in March. The bourse operator also activated two circuit breakers in the same month. Both foreign and institutional investors offloaded massive amounts of shares to secure cash and turn eyes to low-risk assets.

Unlike the past trend, small domestic investors dubbed “ant warriors” became the most active stock traders, scooping up undervalued shares. They eyed stock jackpots and purchased a net 47.5 trillion won solely from the Kospi market last year. After a roller-coaster ride, the market ended its final trading session of the year at 2,873.47 points. With the faster-than-expected recovery, Kospi logged the best performance among Group of 20 peers in the same year.

Previously, both market watchers and investors were optimistic about the index continuing its bullish trend to 3,000 points this year. On the back of retail investors’ buying spree, it was realized in just three trading sessions after the market opened this year on Monday. Kospi reached as high as 3,027.16 in early Wednesday trade. The total market cap rose to some 2,059.74 trillion won.

Amid the ongoing COVID-19 pandemic, investors’ interest has also shifted lately. Blue chip Samsung Electronics remained Kospi’s largest cap stock, while its market valuation accounted for nearly 25 percent of the combined Kospi-listed constituents of 1,965.71 trillion won.

Biopharma firms such as Celltrion and Samsung Biologics became the market’s leading stocks and internet platforms Naver and Kakao drew huge attention. Battery makers LG Chem and Samsung SDI also stood as new solid stocks backed by high expectations of the electric vehicle market’s growth.

By Jie Ye-eun (yeeun@heraldcorp.com)

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)