Pandemic pushes major banks to offer early retirement

By Choi Jae-heePublished : Dec. 2, 2020 - 16:47

South Korea’s major banks have been asking employees to accept early retirement to cut costs amid the prolonged coronavirus pandemic, industry sources said Wednesday.

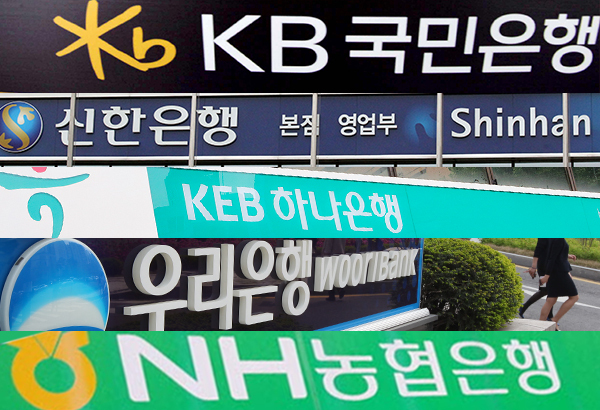

More than 1,700 employees at the nation’s five major commercial banks here -- Woori, Hana, Shinhan, KB Kookmin, NH NongHyup -- were offered early retirement between the end of December last year and early this year, industry data showed. To cope with financial setbacks stemming from the pandemic, local banks are likely to continue to cut back workforce, the sources explained.

NH NongHyup has accepted voluntary retirement applications from all employees aged 40 and above or senior employees aged 56 and above. The senior employees would receive 28-months worth of salary in advance.

NH NongHyup’s industry peer KB Kookmin Bank -- where some 460 senior employees left the company in January in exchange for severance pay -- is slated to launch its early retirement program for those aged over 56.

Advanced salary would be offered depending on years of service, along with scholarships for their children. The program also includes re-employment aid, amounting to a maximum of 28 million won ($25,414).

Shinhan has received applications from employees who have been in the workforce more than 15 years. This includes those aged 60 and above with senior management roles and rank-and-file staffs over the age of 56. The bank’s retirement payment amounted up to 36-months worth of salary.

Meanwhile, Hana Bank saw a total of 63 senior employees leave in exchange for retirement benefits, which included up to 31-months worth of severance pay.

At Woori Bank, some 300 employees who turned 55 or 56 late last year or this year applied for early retirement programs. The bank provided either 30 months- or 36 months-worth of advanced salary, depending on the age.

On top of COVID-19 risks, the lenders have been downsizing due to the swift digitalization of the industry which led to a shuttering of bank branches and offices across the country for contactless services like mobile banking.

According to data from the Financial Supervisory Service, the number of offline banks fell to 3,659 in this September from 3,784 in December last year. Considering that some 50 branches were closed between December 2018 and 2019, the pace of decrease sharply picked up over a year.

By Choi Jae-hee (cjh@heraldcorp.com)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)