South Korean firm Koramco REITs Management & Trust said Monday it plans to raise 106.6 billion won ($89.04 million) from retail investors for its market debut on the nation’s main bourse Kospi next month.

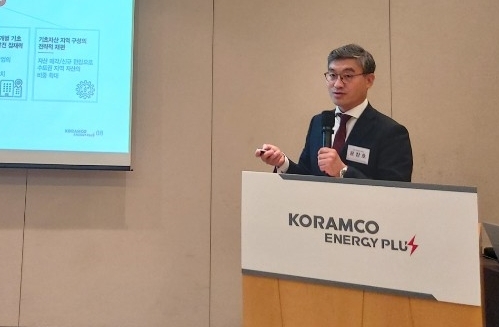

Koramco Energy Plus REIT is designed to directly invest in the 187 gas station sites, including the land, buildings, tanks and pipelines. Spanning an area 316,621 square meters, the land and buildings were valued at nearly 1.13 trillion won as of May 31 this year, Koramco REITs Managing Director Yun Jang-ho said in a press briefing.

“The REIT is packaged with Hyundai Oilbank’s gas stations that were acquired by SK Networks. It is the first REIT initial public offering for gas station sites in the Asian market,” Yun said. “With the superior leaseholders (Hyundai Oilbank and SK Networks) contracted for over 10 years, the REIT is expected to strike some 6.2 percent annual dividend yield for investors each year.”

Fast-food chains such as McDonald’s Korea and Burger King are also current leaseholders, but the REIT is expected to extend its assets by expanding business by operating a mobility retail platform. It is planning on attracting more superior leaseholders that have drive-thru and contactless services, according to Koramco.

Prior to the IPO, Koramco raised 241.5 billion won via pre-IPO proceeds. It plans to list the REIT’s 21.32 million new common shares, each priced at 5,000 won. The listing schedule will be determined after an IPO that is set to wrap up on Aug. 7. NH Investment & Securities will underwrite the deal.

“Gas station sites are high-valued assets overseas. Just like the US’ Getty Realty and Australia’s Viva Energy REIT, we’re hoping that investors and the market recognize our REIT’s (Koramco Energy Plus REIT) value. As Asia’s first (REIT IPO), we’ll reward our investors with a strong performance in the market.”

By Jie Ye-eun (yeeun@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)