[News Focus] Will Kospi be alright when short sellers return in September?

By Kim Yon-sePublished : July 5, 2020 - 14:36

SEJONG -- An eye-catching issue in the nation’s economy is whether the growth of gross domestic product will bounce back in the second half of the year after touching a bottom in the first half.

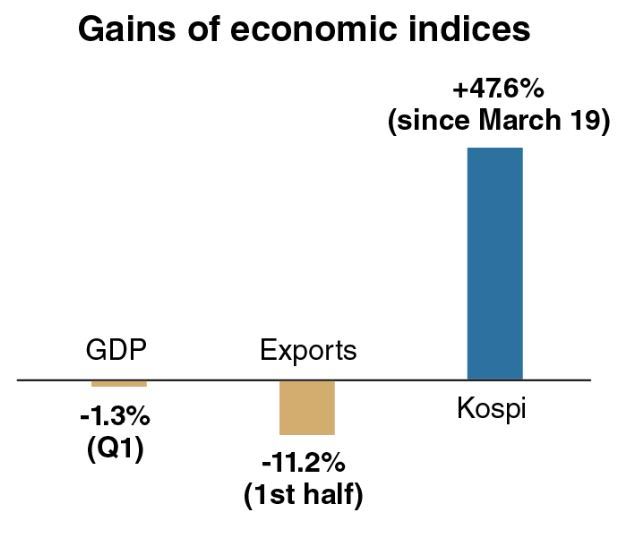

While GDP growth was minus 1.3 percent in the first quarter, compared to the previous quarter, there is a possibility that the coming figure for the second quarter (April-June) will also post negative growth or dip further.

Exports fell by 11.2 percent in the first half, on an on-year basis. For the employment sector, the number of de facto jobless, which includes those in the status of underemployed, in South Korea reached 4.36 million (or the extended jobless rate of 14.5 percent) as of May.

Despite a variety of worsened economic indices from COVID-19, there was an exceptional case: the local stock market, which has normalized at a high rate since late March.

The Kospi, which plunged to 1,457.64 points on March 19, recovered to the 2,000 mark in about two months to reach 2,029.78 on May 26. The nation’s first-tier stock index closed at 2,152.41 on July 3, up 47.6 percent compared to the mid-March figure.

But some market insiders say that the rapid recovery, despite the pandemic, is somewhat attributed to the financial authority’s issuance of a temporary ban on short selling for a six-month period starting from March 16.

Under the measure, local and foreign corporate institutions have been barred from engaging in short selling, under which they had been able to reap gains by dumping borrowed stocks and repurchasing them at far lower prices later, which is dubbed “short covering.”

Though individuals are also allowed to conduct the short selling skill, local and foreign institutions account for more than 98 percent of trading, worth 103 trillion won ($85.8 billion) as of 2019, due to the difficult process that is seen as daunting for small investors.

Shinhan Investment Corp. said in its report that the ban against short sellers has brought about “the effect of pulling up the equities index by about 9 percent.”

Online commenters are calling for the financial authority to extend the ban period in consideration of the sagging economic indices and lingering uncertainty involving few signs of termination of the still spreading novel coronavirus at home and abroad.

On the other hand, more and more people on the stock bulletin boards share the view that small investors need to dispose of most of their stocks before the temporary six-month ban is lifted in mid-September.

“Even if the authority decided to extend the ban period from the scheduled September, it might be an eased ban only for some portion of the stocks, not for the entirety of stocks like the initial ban,” a commenter predicted.

Small investors have continued to express their discontent with a systematic practice on the local stock market in which foreign and domestic institutions take huge gains via the short selling skill.

From the trading skill, a large portion of retail investors in particular had to suffer huge losses despite financial soundness and decent earnings performance of their holding listed company stocks. Short sellers have frequently targeted stocks whose proportion of individual stakes sharply climbed.

Some rule perpetrators were found to have conducted “naked” short selling, under which investors sell stocks without borrowing. The practice is illegal in Korea’s capital market.

The long-standing anger among the estimated 6 million local retail investors lies in that the financial authority has taken a lukewarm position amid growing voices to abolish short sales. They say the practice prevents a level playing field between institutions and small investors.

By Kim Yon-se (kys@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)