SK Biopharmaceuticals issues record-breaking IPO

2020 to be remembered as a turning point for Korean biopharma industry

By Lim Jeong-yeoPublished : June 24, 2020 - 17:54

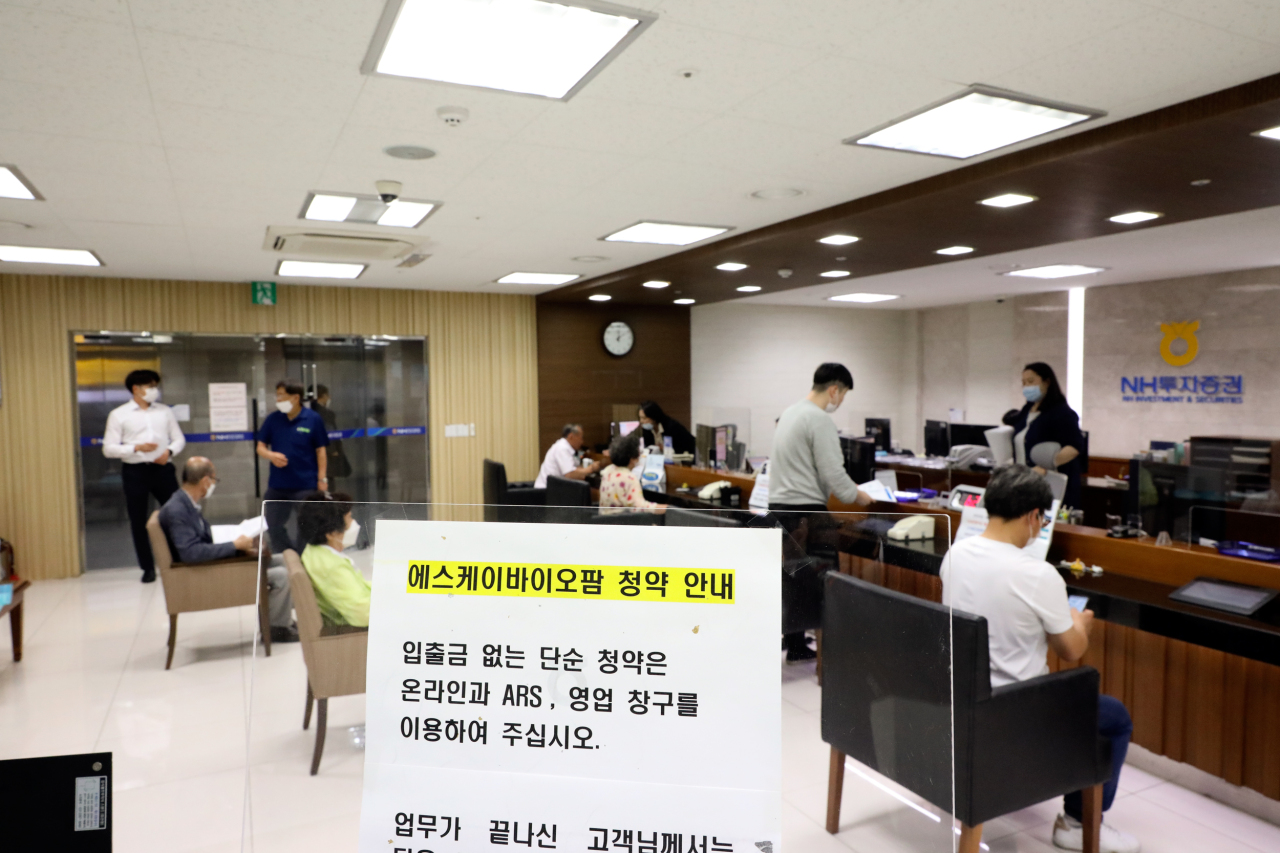

Investors were highly enthusiastic about the initial public offering of SK Biopharmaceuticals in the two-day retail tranche that wrapped up Wednesday, as it was oversubscribed 323 times with deposit payments amounting to 30.98 trillion won ($25.8 billion).

The deposit payments -- 50 percent of the offering price -- reached 19.5 trillion won by noon and then zoomed up, according lead underwriter NH Investment & Securities.

The drugmaker specializes in developing novel medicines for central nervous system disorders.

The figure was the highest since Cheil Industries’ IPO in 2014 that garnered 30.06 trillion won in deposit payments.

The heated response from retail investors came following news that the SK Biopharmaceuticals’ offering price was fixed at 49,000 won per share, the top end of its indicative price range, during the institutional tranche that was 835.66 times oversubscribed.

The retail investors’ tranche marked the end of SK Biopharmaceuticals IPO to raise 959.3 billion won through 19,578,310 common shares.

Underwriting the blockbuster flotation were NH Investment & Securities, Citigroup Global Markets Korea Securities, Korea Investment & Securities, Morgan Stanley, Hana Financial Investment and SK Securities.

SK Biopharmaceuticals will make its debut on July 2 on the main bourse Kospi.

The company said it will use the proceeds for commercialization of its cenobamate product in the US, and for development of other pipelines it has.

The competition for the SK Biopharmaceuticals shares was intense as individual investors took out loans -- as high as 100 million won -- in order to have proof of means for IPO subscription before they are traded and rise in value.

SK Holdings will hold 75 percent stake in SK Biopharmaceuticals after the IPO.

SK Biopharmaceuticals shares are deemed to pose less risk than the stocks of other biologics firms that are poised to issue IPOs because the company already has commercialized products.

SK Biopharmaceuticals produces solriamfetol, a drug for obstructive sleep apnea, which launched in the US market through the US company Jazz Pharmaceuticals.

Jazz bought the pipeline’s license in the early stage of development and carried out the subsequent, larger stage clinical trials, after which it gained approval from the US Food and Drug Administration and released the drug in the US market under the brand name Sunosi.

Jazz has the rights to commercialize solriamfetol globally, outside of the 12 Asian countries where SK Biopharmaceuticals maintains the rights.

SK Biopharmaceuticals also has cenobamate, a drug for partial-onset epileptic seizures in adults, which launched in the US under the brand name Xcopri. SK Biopharmaceuticals has independently discovered, researched and developed the drug, and is marketing and distributing the drug on its own in order to maximize the business value of the drug.

In Europe, cenobamate will be commercialized by Swiss company Arvelle Therapeutics if it is approved by the EMA.

SK Biopharmaceuticals’ other pipelines in development encompass carisbamate, relenopride, SKL13865, SKL20540, SKL-PSY and SKL24741.

Carisbamate, a drug for Lennox-Gastaut syndrome, or early childhood epilepsy, is currently undergoing phase 1/2 clinical trial.

As for the rest, other than relenopride, which is for a rare disorder of the central nervous system and in clinical trial phase 2, the pipelines are in clinical phase 1 trials for attention deficit disorder, schizophrenia, bipolar disorder and epilepsy.

Investors are advised to take in to consideration that it has taken SK Biopharmaceuticals 15 years to carry out the developments and commercialization of cenobamate, the company said in its red herring prospectus.

Drugs pertaining to central nervous system disorders are notoriously difficult to develop, something that investors should keep in mind, it noted.

Precisely because the CNS drugs are tough to crack, the market there is largely void. It remains a challenge for many pharma firms to produce a drug that shows efficacy, without causing detrimental harm in patients.

SK Biopharmaceuticals urged investors to know that a possible sales setback of cenobamate, a desertion of key marketing personnel, or intense competition in the future, are some of the factors that may affect its long-term business.

By Lim Jeong-yeo (kaylalim@heraldcorp.com)

The deposit payments -- 50 percent of the offering price -- reached 19.5 trillion won by noon and then zoomed up, according lead underwriter NH Investment & Securities.

The drugmaker specializes in developing novel medicines for central nervous system disorders.

The figure was the highest since Cheil Industries’ IPO in 2014 that garnered 30.06 trillion won in deposit payments.

The heated response from retail investors came following news that the SK Biopharmaceuticals’ offering price was fixed at 49,000 won per share, the top end of its indicative price range, during the institutional tranche that was 835.66 times oversubscribed.

The retail investors’ tranche marked the end of SK Biopharmaceuticals IPO to raise 959.3 billion won through 19,578,310 common shares.

Underwriting the blockbuster flotation were NH Investment & Securities, Citigroup Global Markets Korea Securities, Korea Investment & Securities, Morgan Stanley, Hana Financial Investment and SK Securities.

SK Biopharmaceuticals will make its debut on July 2 on the main bourse Kospi.

The company said it will use the proceeds for commercialization of its cenobamate product in the US, and for development of other pipelines it has.

The competition for the SK Biopharmaceuticals shares was intense as individual investors took out loans -- as high as 100 million won -- in order to have proof of means for IPO subscription before they are traded and rise in value.

SK Holdings will hold 75 percent stake in SK Biopharmaceuticals after the IPO.

SK Biopharmaceuticals shares are deemed to pose less risk than the stocks of other biologics firms that are poised to issue IPOs because the company already has commercialized products.

SK Biopharmaceuticals produces solriamfetol, a drug for obstructive sleep apnea, which launched in the US market through the US company Jazz Pharmaceuticals.

Jazz bought the pipeline’s license in the early stage of development and carried out the subsequent, larger stage clinical trials, after which it gained approval from the US Food and Drug Administration and released the drug in the US market under the brand name Sunosi.

Jazz has the rights to commercialize solriamfetol globally, outside of the 12 Asian countries where SK Biopharmaceuticals maintains the rights.

SK Biopharmaceuticals also has cenobamate, a drug for partial-onset epileptic seizures in adults, which launched in the US under the brand name Xcopri. SK Biopharmaceuticals has independently discovered, researched and developed the drug, and is marketing and distributing the drug on its own in order to maximize the business value of the drug.

In Europe, cenobamate will be commercialized by Swiss company Arvelle Therapeutics if it is approved by the EMA.

SK Biopharmaceuticals’ other pipelines in development encompass carisbamate, relenopride, SKL13865, SKL20540, SKL-PSY and SKL24741.

Carisbamate, a drug for Lennox-Gastaut syndrome, or early childhood epilepsy, is currently undergoing phase 1/2 clinical trial.

As for the rest, other than relenopride, which is for a rare disorder of the central nervous system and in clinical trial phase 2, the pipelines are in clinical phase 1 trials for attention deficit disorder, schizophrenia, bipolar disorder and epilepsy.

Investors are advised to take in to consideration that it has taken SK Biopharmaceuticals 15 years to carry out the developments and commercialization of cenobamate, the company said in its red herring prospectus.

Drugs pertaining to central nervous system disorders are notoriously difficult to develop, something that investors should keep in mind, it noted.

Precisely because the CNS drugs are tough to crack, the market there is largely void. It remains a challenge for many pharma firms to produce a drug that shows efficacy, without causing detrimental harm in patients.

SK Biopharmaceuticals urged investors to know that a possible sales setback of cenobamate, a desertion of key marketing personnel, or intense competition in the future, are some of the factors that may affect its long-term business.

By Lim Jeong-yeo (kaylalim@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)