[Market Close-up] S. Korean stock market recovers faster than its global peers

In 12 weeks, Kospi surges nearly 40%, but rising Sino-US conflict is burden: analysts

By Jie Ye-eunPublished : May 27, 2020 - 16:53

Buttressed by the buying spree of retail investors and expansion of liquidity, South Korea’s stock market recovered to the psychologically important 2,000-point mark, rebounding faster than other major stock markets around the world.

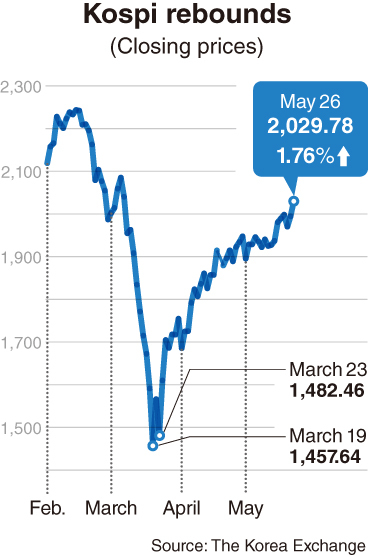

According to the Korea Exchange, the Kospi reached 2,029.78 points at Tuesday’s close, 12 weeks after last posting above the 2,000-mark on March 6, when it closed at 2,040.22. The index plunged to a yearly low of 1,457.64 on March 19, but rose sharply by nearly 40 percent.

The local market’s recovery was faster than during the 2008 global financial crisis -- when the index plummeted to 938.75 on Oct. 24, then rebounded to 1,297.85 on April 6 the following year.

Hit by the recent pandemic, stock markets in other major nations also tumbled.

But their recovery was slower than the Kospi. The US’ Dow Jones Industrial Average rose 31.6 percent from its bottom-line as of Friday (local time). Japan’s Nikkei 225 and Taiwan’s Taiex rose 28.2 percent and 26.7 percent, respectively, as of Tuesday.

Market watchers attributed the fast recovery to retail investors’ massive, steady buying. Individual investors net purchased about 16.28 trillion won ($13.18 billion) worth of local shares from March 9 to Tuesday. While foreign and institutional investors net sold 18.54 trillion won and 597 billion won, respectively, reflecting the power of individual investors in defending the market from a further drop.

Fiscal expansion around the globe also increased liquidity in the market. In addition, extensive regulations in the real estate sector in Korea and uncertainty rising over other investment sectors have led local retail investors to seek profits from stock investments instead of alternatives, said Oh Hyun-seok, research head at Samsung Securities.

“Retail investors have returned to the local stock market with money that they previously invested in real estate, banking and cryptocurrencies, and this pattern of cash inflow from other investment sectors to the stock market is likely to continue for a while,” he said.

Offshore investors have been continuing their selling spree, but the size of foreign stock-selling has been decreasing, according to Lee Kyung-min, an analyst at Daishin Securities. Their interest in Korean stocks is changing too, as they have been buying considerable shares in information technology, bio-pharmaceutical and health care sectors.

“If you look at the local market by sector, foreign investors have recently injected their funds in the software, rechargeable battery, semiconductor and bio sectors. Due to the movement, some firms related to the sectors have been newly listed in the top 10 ranking in terms of market capitalization.”

While retail investors are likely to buy local shares with their deposits for stock investment, it is premature to say that the main bourse has settled around the 2,000-mark, according to the two experts.

To secure the 2,000-point level, the global financial markets have to stabilize, Lee said. At the same time, the escalating political tensions between the US and China over imposing the national security law in Hong Kong may be another variable for the stock market, he added.

“Since the emerging markets’ equity funds suffered outflows for weeks, it has become a burden for foreign investors. Even if they find Korea as an attractive investment market, they probably need to sell local shares to secure their funds,” Oh of Samsung said.

By Jie Ye-eun (yeeun@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)