[News Focus] Shareholders meeting culture in Korea needs reforms

By Jung Min-kyungPublished : April 1, 2019 - 14:48

Every spring, investors flock to annual shareholders meetings eager to gain a better insight into their companies and their plans for the year.

But many South Korean firms have been receiving flak for the opaque nature of such meetings. Critics say the absent CEOs, run-of-the-mill presentations and even snubbing of shareholders at many meetings shows a lack of willingness to communicate.

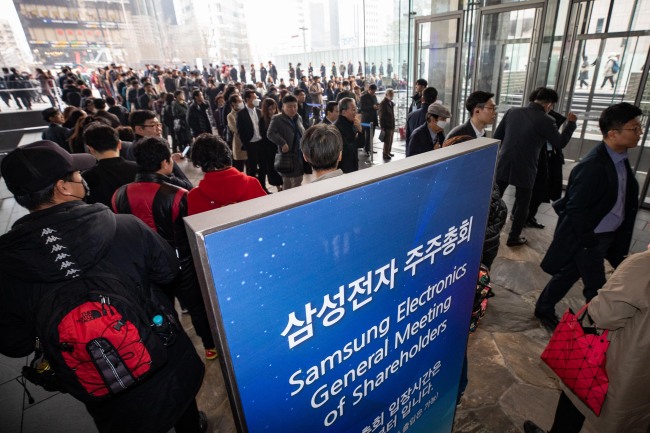

On March 20, over 1,000 investors rushed to attend Samsung Electronics’ 50th shareholders meeting at its headquarters in Seocho, southern Seoul -- the first since it decided on a 50:1 stock split last May.

But the investors soon found that they had to fight to get one of the 800 seats the tech firm had prepared for the meeting. Many were irked as they waited outside in line for more than an hour, to attend an event which the de facto leader of the company, Vice Chairman Lee Jae-yong, did not attend.

Moreover, throughout the meeting, shareholders were asked to “clap their hands,” to confirm key agenda -- including appointment of board members -- which many shareholders disapproved of. If a company does not have any specific policy regarding the voting process in an annual general meeting, then they are legally allowed to apply some method of confirmation that shows intent of support, such as clapping.

One investor called for proper voting for such important agendas, but Samsung dodged direct answers, merely saying that the chairman had legal authority to make such decisions.

The tech firm eventually issued an apology on its website later in the day saying it was sorry for the lack of seats, but included no explanation on the absence of a formal voting system or whether it has plans to make such meetings more investor-friendly in the future.

Samsung is not alone, shareholders meetings at other firms across industries here were also not much different.

KT, one of the nation’s big three mobile carriers, held its annual general meeting on Friday, where sounds of applause clashed with the shouts of its labor union members and civic groups calling for Chairman Hwang Chang-kyu to step down.

The meeting descended into chaos, as about 20 union members continued to shout from the back of the venue, criticizing Hwang, who has been recently accused of bribery and agreeing to hire people in return for favors from their relatives.

On the other hand, it is also an open secret that not some participating shareholders have a disruptive interest at heart. Small shareholders known as “juchonggun,” or shareholder swindlers, voice objections to company decisions not for business reasons, but because they hope the company will pay them off to buy their silence.

Such shenanigans on behalf of the companies and the juchonggun, have led to calls for ways to improve the shareholders meetings here.

In 2007, a 17-year-old stakeholder sparked media attention as he attended a shareholders meeting of Hyundai Motor.

Brazenly raising his hand and shouting, “objection,” the boy named Lee Hyun-wook asked then Vice Chairman Kim Dong-jin, “Toyota is moving to expand its lobbying expenses in the US. What are your plans to deal with such aggressive moves?” The board members were uncomfortable and looked nervous.

The boy -- who reportedly held 75 Hyundai Motor shares at the time -- commented later that he felt the entire meeting seemed like a “prearranged performance” and demanded that the company stop mobilizing its own employees to fill the seats. He also said he wishes to become a CEO who is different from those who have inherited the family business and do not bother to turn up at shareholders meetings.

Twelve years later, not much has changed and there have hardly been any improvements.

An increasing number of local firms are adopting electronic voting systems at shareholders meetings. According to data released by the Fair Trade Commission last week, 86 out of 248 Kospi and Kosdaq-listed firms have adopted the system at their shareholders meetings.

Among them were major firms such as Hyundai Motor, SK Group, Posco, and Hanwha. Samsung, for its part, decided against the adoption of the system again this year, after mulling it for nearly a decade.

There have also been increasing efforts by major groups to become more approachable to investors.

SK Telecom, the nation’s biggest mobile carrier, led shareholders through an exclusive tour of a special exhibition of its latest 5G network services and information and communications technologies called “T.um” on the first floor of its headquarters in central Seoul, prior to its annual general meeting Tuesday.

“We invited about 30 shareholders who had expressed their willingness to participate in the tour,” Kim Dong-young, a spokesperson for SKT told The Korea Herald.

The firm expressed its interest in turning the shareholders meeting into a “party,” seemingly benchmarking the annual meeting of US-based multinational conglomerate Berkshire Hathaway. Its CEO Warren Buffett is known to participate in the meetings actively.

“It’s simply about building more personal relationships with the investors,” Kim explained.

FTC head Kim Sang-jo told reporters earlier this month that many major listed firms and affiliates of top companies have displayed a positive change in their governance structure through their shareholders meeting agendas, but noted that “overall Samsung could have been more active.”

Amid heightening concerns, experts project the National Pension Service’s proactive exercise of the stewardship code to act as a catalyst in not only reinforcing investors’ voice but also changing Korea’s culture of shareholders meeting.

“The focus used to be about companies making announcements on their progress and plans -- now it’s about the decisions the investors (namely NPS) will make,” Yang Joon-mo, an economics professor at Yonsei University told The Korea Herald.

Though the stewardship code may boost shareholders rights and transparency in corporate management, Yang warned that with “great power comes great responsibility.”

“Concerns exist that the NPS’ intervention may not lead to shareholders resolving corporate issues in a positive manner, but rather the collapse of corporate governance without any resolutions,” he noted.

By Jung Min-kyung (mkjung@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)