SK Innovation’s valuation rises ahead of new sulfur cap

Local oil refiner to complete construction of Vaccum Residue Desulfurization Unit in Ulsan by July 2020

By Kim Bo-gyungPublished : July 8, 2018 - 15:42

SK Innovation, South Korea’s leading oil refiner, has bolstered its value and profit model with a desulfurization project underway in Ulsan and its ultra-low sulfur production business in Singapore, before stricter environmental regulations by the International Maritime Organization go into effect in 2020, industry experts said Sunday.

The International Maritime Organization passed a regulation in 2016 to limit the amount of sulfur in ship fuel to 0.5 percent starting January 2020 from the current 3.5 percent.

The cap aims to reduce sulfur oxide emissions, which cause acid rain.

The International Maritime Organization passed a regulation in 2016 to limit the amount of sulfur in ship fuel to 0.5 percent starting January 2020 from the current 3.5 percent.

The cap aims to reduce sulfur oxide emissions, which cause acid rain.

Bracing for the new limit and demand for low sulfur fuel oil, SK Innovation has invested roughly 1 trillion won ($896.8 million) to build a Vaccum Residue Desulfurization Unit in Ulsan to reproduce heavy fuel to low sulfur fuel, according to the company.

The desulfurization project is to be completed in July 2020, giving SK Innovation a competitive edge to produce 38,000 barrels of low sulfur fuel per day, the largest among Korean oil refiners.

“Due to the new unit we will be able to react more flexibly to changes in the future low sulfur oil market, which is widely expected to see an increase in price due to a global supply shortage,” said SK Innovation.

Following the oil refiner’s investment in the desulfurization project, leading global investment banking, securities and investment management firm Goldman Sachs adjusted its investment advice on SK Innovation to buy from sell, and raised the target price to 250,000 won from 165,000 won, according to its report released on May 30.

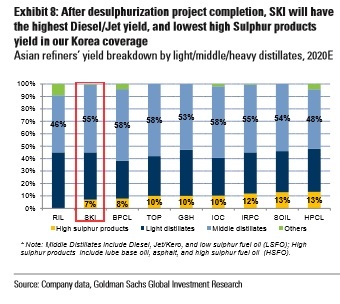

“We believe SK Innovation has a positive leverage from IMO 2020 due to its higher middle distillate and lower high sulfur product yield versus Asian peers and higher mix of heavy-sour crude in its feedstock intake,” according to report by Goldman Sachs.

Addressing concerns raised over SK Innovation possibly facing weakened profitability due to the reduced margin of high sulfur fuel, the company said it would sell more low sulfur oil made in Singapore.

SK Innovation’s trading subsidiary SK Trading International has been reproducing low sulfur fuel oil containing 0.1 percent sulfur since 2015 using an oil tanker there, the company said.

The volume of Singapore’s ultra-low sulfur fuel market is projected to grow some 30 percent on-year to 190,000 metric tons this year from 140,000 tons.

In response to market expansion, SK Trading International said it would double sales of ultra-low sulfur fuel to 100,000 tons this year compared to last year‘s 54,000 tons.

Ultra-low sulfur fuel oil contains 0.001 percent or less sulfur.

Singapore has the highest demand for ultra-low sulfur oil in Asia, and SK Trading International and Singapore-based energy firm Sentek Marine are the two suppliers there.

“There needs to be sufficient space to install a scrubber in ships, and I am doubtful companies can get a return on investment on ships that have been operating for more than 10 years. Ultimately, most ships will end up using low sulfur fuel,” said Lee Dae-jin, a researcher of global market data provider IHS Markit.

By Kim Bo-gyung (lisakim425@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)