Securities firms fined for failing to identify Samsung chairman assets

By Son Ji-hyoungPublished : April 12, 2018 - 16:22

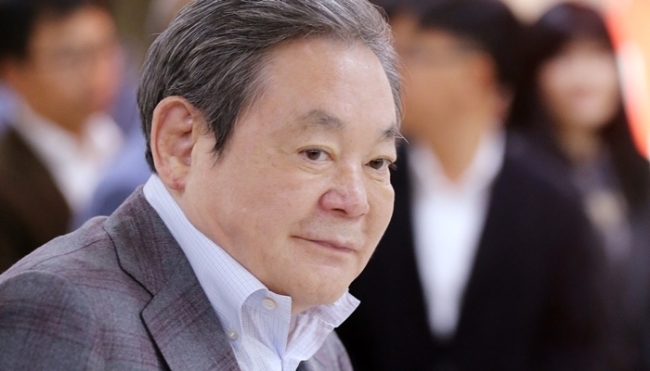

South Korea‘s four securities firms have been slapped with a combined 3.4 billion won ($3.2 million) in fines for their failure to identify and verify assets owned by bedridden Samsung Electronics Chairman Lee Kun-hee under false-name accounts, watchdogs said Thursday.

The amount of the fine equals 55 percent of face value of Lee’s financial assets under the accounts not owned by the chairman, which came to 6.2 billion won as of August 1993.

The amount of the fine equals 55 percent of face value of Lee’s financial assets under the accounts not owned by the chairman, which came to 6.2 billion won as of August 1993.

The four companies -- Mirae Asset Daewoo, Samsung Securities, Shinhan Financial Investment and Korea Investment & Securities -- were accused of failing to meet know-your-customer obligations in regards to dealing with Lee‘s financial assets.

In Korea, the KYC obligation applies to all financial companies under the Act on Real Name Financial Transactions and Confidentiality. The obligation came into effect in the form of an emergency presidential order by late Kim Young-sam in 1993, in a bid to prevent irregularities in financial transactions such as money laundering and tax evasion. The presidential order turned into an act in 1997.

The law stipulates that the financial firms are obliged to identify and verify any asset, not owned under a real name before the presidential order in 1993.

Depending on the volume of the asset each company holds, Shinhan Financial Investment, Korea Investment & Securities, Mirae Asset Daewoo and Samsung Securities are fined 1.5 billion won, 1.2 billion won, 385 million won and 350 million won respectively.

Lee’s asset in 1993 was scattered in 27 accounts created in the four securities firms. Over 40 percent of the assets were placed in 13 accounts from Shinhan Financial Investment, the Financial Supervisory Service found in a probe that took place from Feb. 19 to March 9.

The announcement on Thursday by the Financial Services Commission, also an overseer of the FSS, came partly in response to growing calls for tougher scrutiny on Lee’s tax evasion allegation.

Along with the announcement, the FSC notified Lee of his obligation to bring the assets under accounts owned by the chairman.

By Son Ji-hyoung

(consnow@heraldcorp.com)

In Korea, the KYC obligation applies to all financial companies under the Act on Real Name Financial Transactions and Confidentiality. The obligation came into effect in the form of an emergency presidential order by late Kim Young-sam in 1993, in a bid to prevent irregularities in financial transactions such as money laundering and tax evasion. The presidential order turned into an act in 1997.

The law stipulates that the financial firms are obliged to identify and verify any asset, not owned under a real name before the presidential order in 1993.

Depending on the volume of the asset each company holds, Shinhan Financial Investment, Korea Investment & Securities, Mirae Asset Daewoo and Samsung Securities are fined 1.5 billion won, 1.2 billion won, 385 million won and 350 million won respectively.

Lee’s asset in 1993 was scattered in 27 accounts created in the four securities firms. Over 40 percent of the assets were placed in 13 accounts from Shinhan Financial Investment, the Financial Supervisory Service found in a probe that took place from Feb. 19 to March 9.

The announcement on Thursday by the Financial Services Commission, also an overseer of the FSS, came partly in response to growing calls for tougher scrutiny on Lee’s tax evasion allegation.

Along with the announcement, the FSC notified Lee of his obligation to bring the assets under accounts owned by the chairman.

By Son Ji-hyoung

(consnow@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)