[Kosdaq Star] Test-prep firm MegaStudyEdu surges on takeover deals

By Son Ji-hyoungPublished : Jan. 21, 2018 - 15:53

This is the 49th in a series of articles analyzing major companies traded on the tech-heavy Kosdaq market. -- Ed.

On South Korea‘s second-tier stock market, not only tech and bio companies are on the rise, but also one unique industry has been steadily growing: education services.

Reflecting the country’s high enthusiasm for education and aspirations for better jobs, education services companies have been gaining presence in the market dominated by tech companies. MegaStudyEdu, a test-prep service provider, is among them.

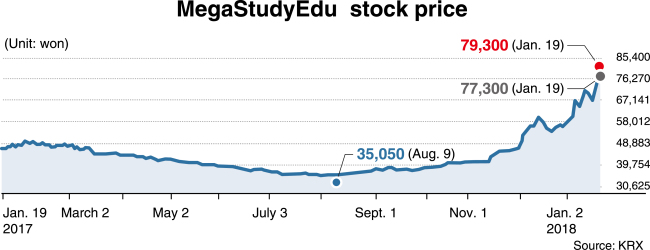

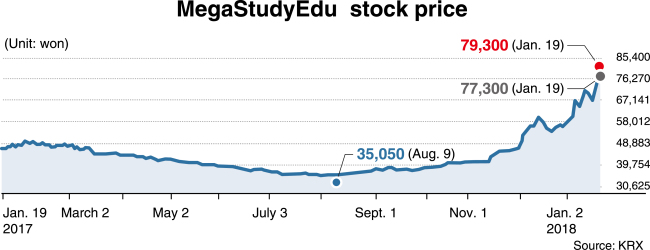

MegaStudyEdu, listed on the second-tier Kosdaq, saw its share price double in three months, closing at 77,300 won ($72.40) Friday, after hovering above 79,000 won that morning. The Friday closing price marked its highest since August 2015.

The performance of MegaStudyEdu had remained sluggish for years. MegaStudyEdu rarely saw light above 50,000 won for a year and a half until last month.

MegaStudyEdu on Jan. 2 announced that it had taken over Mega CST, devoted to the test-prep service for civil service officers.

The news drew anticipation for a “jump up” in the company’s performance, riding policy by the Moon Jae-in administration to hire more public servants. The government has aimed to create 174,000 jobs in the public sector during President Moon‘s tenure, with nearly 10,000 of them created during the second half of 2017 through a supplementary budget. The market for public servant aspirants has been growing with young Koreans flocking to prepare for civil servant exams, chasing the promise of stable income and employment status. Nearly 4 in 10 job seekers in May 2017 were preparing for tests to be public service officers, according to Statistics Korea.

This came after a takeover of Ibkimyoung, the nation’s leading test-prep provider for college transfer exam takers, in April 2017. Before the deal, MegaStudyEdu was devoted to test-prep services for elementary, middle and high school students.

Such acquisitions enabled MegaStudyEdu to cover most of the tiers of the markets through business penetration to test-prep markets for public servants and those transferring colleges, Hong Jong-mo, an analyst at Yuhwa Securities, wrote in a note to investors.

“MegaStudyEdu is ahead of the first year as an all-rounder in the private test-prep industry,” Hong wrote.

Hong cited figures including the enterprise value to earnings before interest, taxes, depreciation and amortization, which stood at 3.1 as of Tuesday, meaning the cost of acquiring an enterprise amounts to the net income for just over three years. Hong said the figure indicates MegaStudyEdu was “absolutely undervalued.”

The price soared 15.2 percent in three days after the report was released.

On South Korea‘s second-tier stock market, not only tech and bio companies are on the rise, but also one unique industry has been steadily growing: education services.

Reflecting the country’s high enthusiasm for education and aspirations for better jobs, education services companies have been gaining presence in the market dominated by tech companies. MegaStudyEdu, a test-prep service provider, is among them.

MegaStudyEdu, listed on the second-tier Kosdaq, saw its share price double in three months, closing at 77,300 won ($72.40) Friday, after hovering above 79,000 won that morning. The Friday closing price marked its highest since August 2015.

The performance of MegaStudyEdu had remained sluggish for years. MegaStudyEdu rarely saw light above 50,000 won for a year and a half until last month.

MegaStudyEdu on Jan. 2 announced that it had taken over Mega CST, devoted to the test-prep service for civil service officers.

The news drew anticipation for a “jump up” in the company’s performance, riding policy by the Moon Jae-in administration to hire more public servants. The government has aimed to create 174,000 jobs in the public sector during President Moon‘s tenure, with nearly 10,000 of them created during the second half of 2017 through a supplementary budget. The market for public servant aspirants has been growing with young Koreans flocking to prepare for civil servant exams, chasing the promise of stable income and employment status. Nearly 4 in 10 job seekers in May 2017 were preparing for tests to be public service officers, according to Statistics Korea.

This came after a takeover of Ibkimyoung, the nation’s leading test-prep provider for college transfer exam takers, in April 2017. Before the deal, MegaStudyEdu was devoted to test-prep services for elementary, middle and high school students.

Such acquisitions enabled MegaStudyEdu to cover most of the tiers of the markets through business penetration to test-prep markets for public servants and those transferring colleges, Hong Jong-mo, an analyst at Yuhwa Securities, wrote in a note to investors.

“MegaStudyEdu is ahead of the first year as an all-rounder in the private test-prep industry,” Hong wrote.

Hong cited figures including the enterprise value to earnings before interest, taxes, depreciation and amortization, which stood at 3.1 as of Tuesday, meaning the cost of acquiring an enterprise amounts to the net income for just over three years. Hong said the figure indicates MegaStudyEdu was “absolutely undervalued.”

The price soared 15.2 percent in three days after the report was released.

MegaStudyEdu for the first three quarters of 2017 posted a net income of 13 billion won and operating profit worth 16.4 billion won, up 60.2 percent and 52.1 percent on-year, respectively. Nearly three-fourths of the earnings stemmed from the test-prep market for high school students.

The Kosdaq-listed parent company MegaStudy holds 5.55 percent of MegaStudyEdu. Son Joo-eun, founder of the cram school MegaStudy and a test-prep industry guru in Korea, is the largest shareholder of MegaStudyEdu, owning 13.26 percent.

MegaStudyEdu was spun off from MegaStudy in April 2015 and relisted on the Kosdaq a month after. It is the 351st-largest firm on the Kosdaq, with its market cap at 179.2 billion won, as of Friday.

By Son Ji-hyoung

(consnow@heraldcorp.com)

The Kosdaq-listed parent company MegaStudy holds 5.55 percent of MegaStudyEdu. Son Joo-eun, founder of the cram school MegaStudy and a test-prep industry guru in Korea, is the largest shareholder of MegaStudyEdu, owning 13.26 percent.

MegaStudyEdu was spun off from MegaStudy in April 2015 and relisted on the Kosdaq a month after. It is the 351st-largest firm on the Kosdaq, with its market cap at 179.2 billion won, as of Friday.

By Son Ji-hyoung

(consnow@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)