South Korea rolled out plans Wednesday to curb speculation on cryptocurrencies, including trade bans for minors and ways to impose taxes on investment returns, in its resolve to tame the country’s bitcoin craze without completely shutting it off.

Banks in Korea that provide virtual bank accounts for cryptocurrency trades will have to verify the identification of account holders when creating new ones and prohibit minors from opening accounts, according to the plan.

The regulators will also bar financial institutions from investing in or obtaining cryptocurrencies.

The authorities will also review ways to oblige cryptocurrency exchange operators to verify users’ real names, strengthen storage security of encryption keys and disclose purchase price and order volumes.

Imposing taxes on returns from the investment will also be “discussed in-depth,” while harsher punitive actions will be taken against cryptocurrency-related scams, the government added.

Banks in Korea that provide virtual bank accounts for cryptocurrency trades will have to verify the identification of account holders when creating new ones and prohibit minors from opening accounts, according to the plan.

The regulators will also bar financial institutions from investing in or obtaining cryptocurrencies.

The authorities will also review ways to oblige cryptocurrency exchange operators to verify users’ real names, strengthen storage security of encryption keys and disclose purchase price and order volumes.

Imposing taxes on returns from the investment will also be “discussed in-depth,” while harsher punitive actions will be taken against cryptocurrency-related scams, the government added.

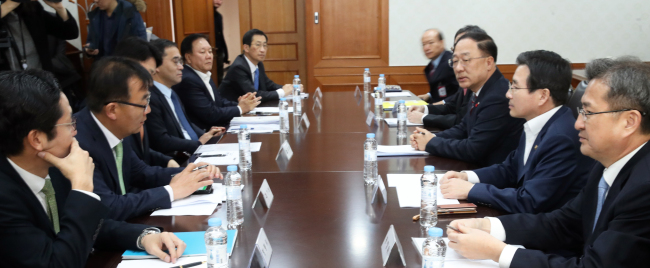

Such issues were discussed in a closed-door emergency meeting Wednesday in Seoul presided over by Hong Nam-ki, minister of the Office for Government Policy coordination, organized by a pangovernmental task force.

The meeting was joined by relevant government representatives, including Vice Minister of Justice Lee Keum-ro, Vice Chairman of the Financial Services Commission Kim Yong-beom, Vice Minister of Science, ICT and Future Planning Kim Yong-soo and Bank of Korea Senior Deputy Gov. Yoon Myun-shik.

Cryptocurrency exchanges expressed relief from the news that the regulation was not seen as an all-out ban on the industry.

Had the ban been implemented, the government would have “put the cryptocurrency industry in the dark,” making it harder to control cryptocurrency coin buyers, a source who declined to be identified told The Korea Herald.

Some investors, meanwhile, also viewed the latest measures as a way of fostering the industry by protecting “constructive investors” and warding off “indecent ones.”

The meeting was joined by relevant government representatives, including Vice Minister of Justice Lee Keum-ro, Vice Chairman of the Financial Services Commission Kim Yong-beom, Vice Minister of Science, ICT and Future Planning Kim Yong-soo and Bank of Korea Senior Deputy Gov. Yoon Myun-shik.

Cryptocurrency exchanges expressed relief from the news that the regulation was not seen as an all-out ban on the industry.

Had the ban been implemented, the government would have “put the cryptocurrency industry in the dark,” making it harder to control cryptocurrency coin buyers, a source who declined to be identified told The Korea Herald.

Some investors, meanwhile, also viewed the latest measures as a way of fostering the industry by protecting “constructive investors” and warding off “indecent ones.”

The measures came in the wake of bitcoin price volatility, as well as cryptocurrency-related crimes.

The de facto key cryptocurrency bitcoin traded at 18.6 million won ($17,000) at around 5:30 p.m. Wednesday, down 25 percent from an intraday high on Dec. 7, when it hit 24.7 million won, according to coin price tracker Coinass. Bitcoin trade volume in Korea shrank one-fourth on Tuesday, compared to Sunday.

Bitcoin traded at below 1 million won in January, but since surpassing 10 million won on Nov. 26, the bitcoin price has suffered severe ups and downs.

Since late November, Korea has looked to impose regulations on trading cryptocurrencies in the nation’s exchanges -- including Bithumb, Coinone and Korbit -- through state-sponsored bills.

The de facto key cryptocurrency bitcoin traded at 18.6 million won ($17,000) at around 5:30 p.m. Wednesday, down 25 percent from an intraday high on Dec. 7, when it hit 24.7 million won, according to coin price tracker Coinass. Bitcoin trade volume in Korea shrank one-fourth on Tuesday, compared to Sunday.

Bitcoin traded at below 1 million won in January, but since surpassing 10 million won on Nov. 26, the bitcoin price has suffered severe ups and downs.

Since late November, Korea has looked to impose regulations on trading cryptocurrencies in the nation’s exchanges -- including Bithumb, Coinone and Korbit -- through state-sponsored bills.

In line with the move, top policymakers have voiced objections against the industry as a whole.

In a Cabinet meeting on Nov. 28 Prime Minister Lee Nak-yon urged the government to take stringent measures, which would otherwise “plague the nation with severe disturbance.” He pointed to the cryptocurrency transaction volume that surpassed that of the second-tier stock market Kosdaq.

On Monday, FSC Chairman Choi Jong-ku, Korea‘s top financial regulator, said in a luncheon with the press that cryptocurrency exchange business nurtures “zero utility to the national economy.”

Lawmakers have set a bill in motion in July to license cryptocurrency exchanges here to bring them within legal boundaries, but fell short of passing it.

By Son Ji-hyoung (consnow@heraldcorp.com)

In a Cabinet meeting on Nov. 28 Prime Minister Lee Nak-yon urged the government to take stringent measures, which would otherwise “plague the nation with severe disturbance.” He pointed to the cryptocurrency transaction volume that surpassed that of the second-tier stock market Kosdaq.

On Monday, FSC Chairman Choi Jong-ku, Korea‘s top financial regulator, said in a luncheon with the press that cryptocurrency exchange business nurtures “zero utility to the national economy.”

Lawmakers have set a bill in motion in July to license cryptocurrency exchanges here to bring them within legal boundaries, but fell short of passing it.

By Son Ji-hyoung (consnow@heraldcorp.com)

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)