Samsung widens gap with rivals on NAND flash memory

By Kim Young-wonPublished : July 12, 2016 - 11:14

[THE INVESTOR] Tech giant Samsung Electronics saw its NAND flash memory sales hit an all-time high in the January-March period, according to a market report.

The Korean company earned US$2.62 billion in revenue in the first quarter, up 3.1 percent from the fourth quarter last year, according to a recent report released by IHS, a market research firm.

The Korean company earned US$2.62 billion in revenue in the first quarter, up 3.1 percent from the fourth quarter last year, according to a recent report released by IHS, a market research firm.

Its market share in the global NAND flash memory sector came in at 42.6 percent, up 0.6 percentage point from the fourth quarter while Japanese chipmaker Toshiba, the second largest NAND flash memory manufacturer, caught up fast with its market share having increased four percentage point to 28 percent during the same period.

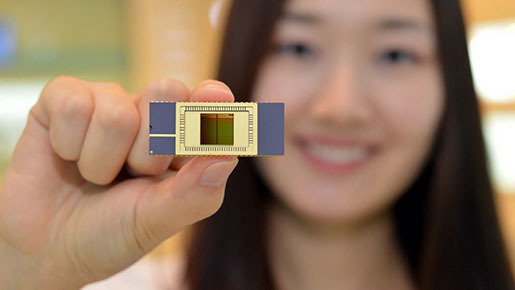

Having ruled the world’s NAND flash memory chip market since 2002, the Korean tech giant was the first company worldwide to mass-produce 3-D NAND flash memory in 2013.

The 3-D NAND memory which stacks layers of cells for the sake of space efficiency inside the chip is increasingly replacing the conventional planar chip, being widely used in solid-state drive storage devices for laptops and servers.

Samsung currently produces a NAND flash memory chip with 48 layers.

Aiming to outrun the Korean rival, the Japanese firm recently announced that it will join hands with Western Digital, a US chipmaker, to invest around 1.5 trillion Japanese yen (US$14.60 billion) for manufacturing facilities for 3-D memory chips.

Other chip companies that have recently joined the fray include XMC of China, which plans to invest 27 trillion won to build NAND flash memory chip plants.

Global chipmakers Intel, Micron and IBM are also ratcheting up their efforts to develop advanced types of memory chips much faster than the current NAND memory, which some market experts said would pose a threat to the Korean NAND flash memory maker.

By Kim Young-won (wone0102@heraldcorp.com)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)