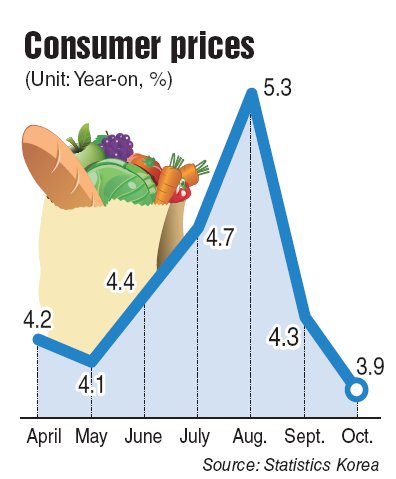

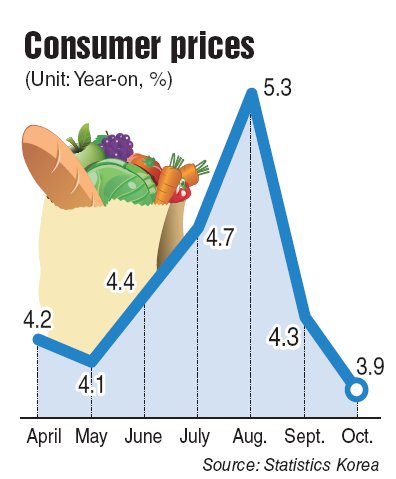

South Korea’s consumer prices grew at a slower pace in October than a month earlier, falling below the 4 percent mark for the first time this year, a report showed Tuesday.

According to the report by Statistics Korea, the country’s consumer price index rose 3.9 percent last month from a year earlier, slowing from the 4.3 percent on-year gain in September.

The October figure marked the first time this year that the index has fallen below the government’s annual inflation target of 4 percent for 2011. Prices also shrank 0.2 percent from a month earlier.

Core inflation, which excludes volatile oil and food costs, grew 3.7 percent from a year earlier, which was the slowest price hike in four months, the report showed. In September, prices rose 3.9 percent.

Prices of fresh foods drove the declining pace of inflation.

The fresh food price index fell 14 percent from a year earlier, with vegetable prices plunging 33.6 percent, the report showed.

The service sector price hikes also remained subdued. Home rental prices rose 4.9 percent, while personal and public service prices gained 3.2 percent and 1.1 percent on-year last month.

Factory goods still saw relatively faster price hikes amid rising energy costs. Gasoline and diesel prices jumped 16.3 percent and 17.8 percent, while the prices of gold rings surged 29.1 percent over the same period, the report showed.

The overall slowing price growth comes as welcoming news for the government, which has been struggling to tame the nation’s seemingly runaway inflation, driven by higher energy, food and other commodity prices.

The latest price data might also affect the future policy direction of the nation’s central bank, which is in charge of keeping tabs on inflation by adjusting borrowing costs, analysts said.

Last month, the Bank of Korea held steady the key interest rate for the fourth straight month at 3.25 percent on worries that a rate hike could dampen the nation’s economic growth faced with heightened external risks such as the eurozone fiscal debt problems. The rate will be reviewed again on Nov. 11.

(Yonhap News)

According to the report by Statistics Korea, the country’s consumer price index rose 3.9 percent last month from a year earlier, slowing from the 4.3 percent on-year gain in September.

The October figure marked the first time this year that the index has fallen below the government’s annual inflation target of 4 percent for 2011. Prices also shrank 0.2 percent from a month earlier.

Core inflation, which excludes volatile oil and food costs, grew 3.7 percent from a year earlier, which was the slowest price hike in four months, the report showed. In September, prices rose 3.9 percent.

Prices of fresh foods drove the declining pace of inflation.

The fresh food price index fell 14 percent from a year earlier, with vegetable prices plunging 33.6 percent, the report showed.

The service sector price hikes also remained subdued. Home rental prices rose 4.9 percent, while personal and public service prices gained 3.2 percent and 1.1 percent on-year last month.

Factory goods still saw relatively faster price hikes amid rising energy costs. Gasoline and diesel prices jumped 16.3 percent and 17.8 percent, while the prices of gold rings surged 29.1 percent over the same period, the report showed.

The overall slowing price growth comes as welcoming news for the government, which has been struggling to tame the nation’s seemingly runaway inflation, driven by higher energy, food and other commodity prices.

The latest price data might also affect the future policy direction of the nation’s central bank, which is in charge of keeping tabs on inflation by adjusting borrowing costs, analysts said.

Last month, the Bank of Korea held steady the key interest rate for the fourth straight month at 3.25 percent on worries that a rate hike could dampen the nation’s economic growth faced with heightened external risks such as the eurozone fiscal debt problems. The rate will be reviewed again on Nov. 11.

(Yonhap News)

-

Articles by Korea Herald

![[Today’s K-pop] BTS pop-up event to come to Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050734_0.jpg&u=)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)